What Fixed Assets Should I Track?

Did you know that 30% of businesses face operational delays due to poor asset tracking? Fixed assets are the backbone of your business, and tracking them properly can be the game-changer your operations need.

A business’ fixed assets are its most important components after its workforce. Given their significance, tracking fixed assets and their management must be properly organised so you have an adequate analysis of all such assets that play a role in the business’ income.

Physical objects as large as the building you work into the furniture and devices employees use, all are considered fixed assets. Apart from having an ever-ready and complete database with an analysis of all fixed assets, tracking fixed assets allows you to:

- Make fixed asset management a breeze

- Keep fixed assets in their best condition

- Organise the storage of all fixed asset data

- Make well-informed asset-related decisions

- Identify and deal with ghost assets

This is not an exhaustive list of all the benefits fixed asset tracking has to offer. But if you want to uncover its full potential, you must do it right. This post is all about how to track fixed assets the right way.

What Fixed Assets Should I Track?

To get things started on the right foot, we need to determine which assets go on the fixed asset register and which don’t. You don’t want to be logging the wrong assets on the wrong asset register only to have everything jumbled up in the end.

For an asset to qualify as a fixed asset, it must be something that cannot be readily converted into cash. It should be a physical object that you’ve purchased and intend to use for more than a year. Additionally, the asset must also play a direct role in the business proceedings of your company.

That being said, let’s go through some examples.

- Buildings: All facilities that your company uses

- Property: The cost to purchase land and for land improvements

- Hardware: Computers, laptops, servers, tablets

- IT Software: Any software that you have purchased outright, and not leased or paid as a service

- Furniture: Tables, chairs, filing cabinets.

- Machinery: Machines used for production (for factories especially)

- Equipment: Any other office or field equipment

- Vehicles: Company-owned cars, trucks, bicycles, and other vehicles

What Fixed Asset Information Should You Track?

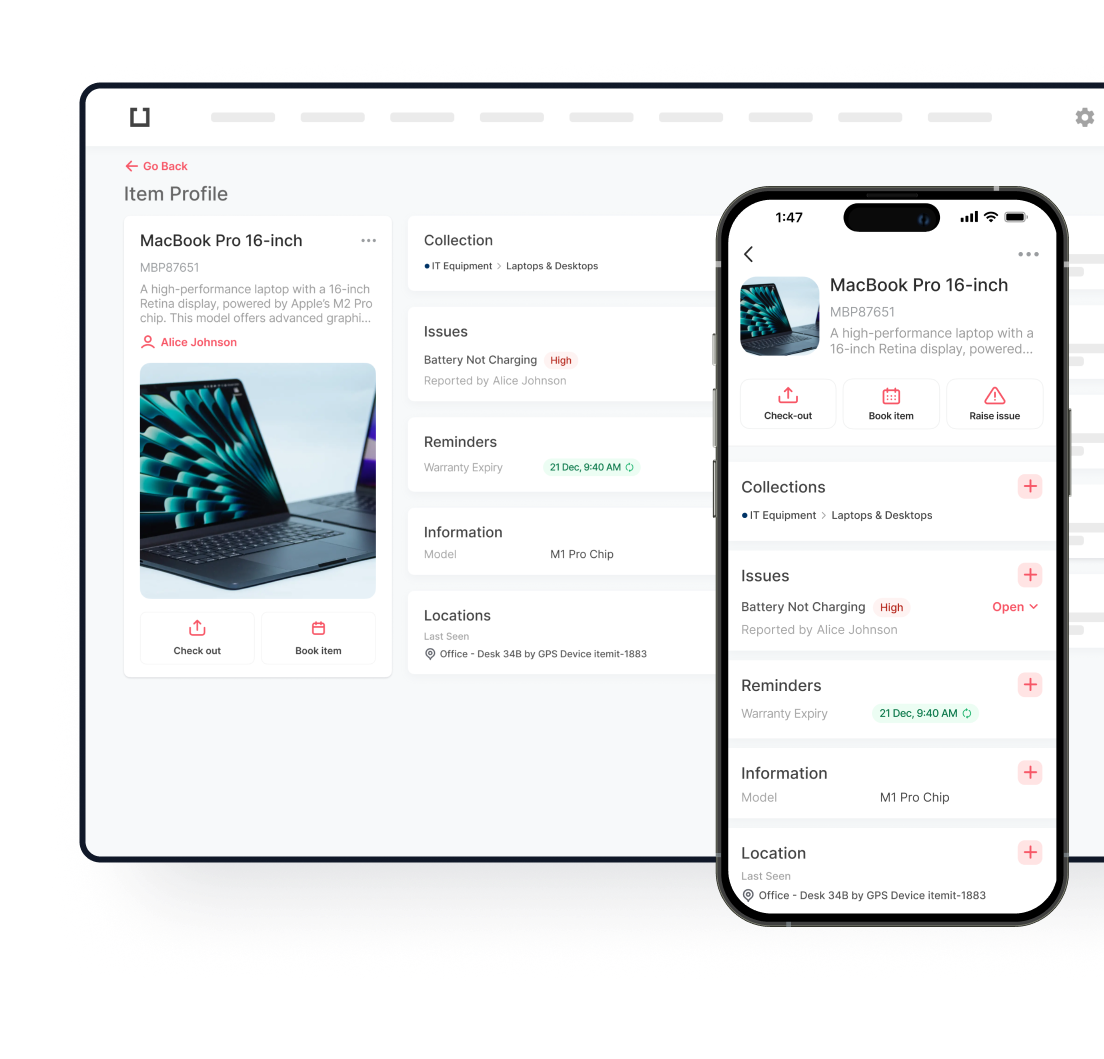

Once you’ve determined the assets that’ll go on the fixed asset register, you need to know what things you need to track about them. Although the itemit app will let you enter all the relevant details in the right places after you register an asset, you still need to know this in order to understand fixed asset tracking better.

The most important aspect of tracking your assets is to ensure that the data is up-to-date. This is because the database should always have the correct information about where an asset is located, in whose custody it is and its last maintenance date. Apart from the most basic details, here is a checklist for what you may wish to track for an efficient fixed asset tracking system.

- Vendor: The company you purchased the assets from

- Purchase Cost

- Effective Lifetime

- Serial Number: important for warranty information

- Warranty Expiration Date

A Few Words About Depreciation

Taking depreciation into account is a crucial part of your finances. For example, if your company purchases a laptop for $2,000 and expects to use it for five years, depreciation allows you to spread that cost over its useful life rather than accounting for it all at once. By the end of five years, the laptop might only be worth $200, so $1,800 would be recorded as depreciation over that period.

This is crucial for financial reporting, as it helps reflect the true value of assets on your balance sheet. Additionally, depreciation can be deducted as a business expense, reducing taxable income and helping save on taxes. Fixed asset tracking enables you to track assets over time and monitor depreciation effectively. This helps you keep accurate financial records for better financial decisions and to achieve efficient tax filing.

Keep in Mind Not to Mix up Fixed Asset Tracking and Inventory Management

Your business’ inventory is the consumables and stock your company owns. On the other hand, assets are the things you use day-to-day. It’s very common for users to mix up the two types of assets and start tracking things that belong in the inventory with the fixed asset register.

Inventory management and the process of tracking fixed assets are two different disciplines. If you’re making the mistake of using the same method to track both, you will inevitably face challenges.

The fixed asset register is used to track data on the asset level. So that you know who has an asset, where it is, and if it’s well maintained. On the other hand, inventory management is used to track a group of assets without much detail. So, instead of exact asset data, the inventory shows you bulk asset data in terms of e.g. quantities of each item type.

Challenges in Fixed Asset Tracking (and How to Overcome Them)

Tracking fixed assets is critical for efficient operations, but it’s not without its challenges. Many businesses struggle with outdated systems, manual processes, or even a lack of proper tracking altogether. Here are some common challenges and how they can be overcome:

1. Difficulty Keeping Asset Records Updated

Without a centralised system, it’s easy for asset records to become outdated or inaccurate. This can lead to mismanagement, missed maintenance schedules, and even compliance issues.

Solution: Implement automated asset tracking software like itemit. With real-time updates, changes to an asset’s status, location, or condition are immediately recorded, reducing human error.

2. Misplacement or Loss of Assets

Losing assets, especially high-value ones, can lead to significant financial losses. This often occurs when businesses rely on manual logs or spreadsheets.

Solution: Use asset tags with unique identifiers such as QR codes or RFID tags. Paired with a mobile app like itemit, you can track the location of each asset in real-time and minimise the risk of loss.

3. Inefficient Maintenance Scheduling

Proper maintenance is critical for prolonging an asset’s lifecycle, but many businesses struggle to keep up with schedules, leading to downtime or unexpected repairs.

Solution: Leverage a system that automates maintenance reminders. With itemit, you can set custom alerts for upcoming service dates, ensuring no asset falls through the cracks.

4. Mixing Fixed Assets with Inventory

A common mistake is tracking inventory and fixed assets the same way. This creates confusion and makes audits and financial reporting more complicated.

Solution: Use separate systems for inventory management and fixed asset tracking. Dedicated fixed asset registers, like those in itemit, track detailed information about individual assets, while inventory systems focus on stock levels and quantities.

5. Lack of Integration Across Departments

When asset tracking is siloed in one department, other teams may not have the information they need. This can disrupt workflows and lead to inefficiencies.

Solution: Adopt a cloud-based tracking system that allows all departments to access up-to-date asset data from any location, fostering better collaboration.

Using Asset Tags

Assets tags are the best thing that’s happened to the fixed asset management process. With asset tags, you can allocate a unique identity to each of your fixed assets. This automates asset tracking and eliminates the need for manual data entry.

The most essential asset details such as its location, status and custody are automatically updated whenever the itemit app scans the asset tag. Not only that, using asset tags enables you to carry out accurate asset audits, real-time asset tracking and management and reduce administrative costs.

Best Practices for Using Asset Tags

- Choose the Right Tag for the Job: Consider the environment and type of asset. For instance, use durable tags for outdoor assets and QR codes for office equipment.

- Place Tags Strategically: Ensure tags are placed in visible but protected areas to prevent wear and tear. For example, avoid placing tags on frequently touched surfaces like laptop keyboards.

- Standardise Tagging Across Your Business: Develop clear guidelines for where and how tags are placed to maintain consistency. This ensures employees can easily locate and scan tags.

- Ensure Tags are Scannable: Regularly check tags for damage or fading. If a tag becomes illegible, replace it promptly to avoid disruption in asset tracking.

- Integrate Tags with Software: Tags are most effective when paired with a tracking system like itemit. The software allows you to scan tags and instantly retrieve or update asset details such as location, custodian, or maintenance status.

- Train Your Team: Provide employees with training on how to use asset tags and scanning tools. This minimises user errors and ensures smooth operations.

- Audit Regularly: Schedule periodic audits to ensure all tags are in place and assets are accurately tracked in the system.

Why Choose a Dedicated Software for Asset Tracking?

Managing fixed assets with spreadsheets or manual methods might work initially, but as your business grows, these tools often lead to inefficiencies and errors. On the other hand, itemit, provides real-time updates, ensuring your asset data is always accurate and accessible. For instance, when equipment is moved or updated, the system reflects these changes instantly, eliminating guesswork and improving visibility.

Automation is another significant benefit. Fixed asset software streamlines repetitive tasks such as scheduling maintenance, tracking depreciation, and conducting audits. Automated reminders prevent missed maintenance or warranty deadlines, keeping assets in top condition while saving time and money.

A dedicated system also enhances accountability by enabling detailed tracking of where assets are and who’s using them, reducing the risk of loss or misplacement. Plus, with advanced reporting tools, you gain valuable insights into asset performance to make informed decisions about upgrades or replacements.

Unlike static spreadsheets, fixed asset tracking software is scalable and integrates with other tools like accounting systems, making it ideal for growing businesses. With itemit, you can save time, reduce costs, and streamline operations—all while ensuring your assets are managed efficiently and effectively.

The Smarter Way to Track Your Business Assets

Fixed asset tracking is something all businesses should do. Having a trustworthy way of comprehending the assets you have, where they are and being able to manage maintenance and depreciation is essential for a business’s success.

Your company should track the assets simply because they are helping your business operate, generate revenue and grow. This involves keeping the fixed asset register up-to-date with all the right information. This will save you and your company loads of time and money.

To find out more about how itemit’s fixed asset register software can help your business, you can contact the team at team@itemit.com. You can also fill in the form below to start your very own 14-day free trial.

Try itemit

Choose a better way to track

your assets.

Start your free 14-day trial now!

Latest posts

itemit Blog

Tips, guides, industry best practices, and news.

What is equipment booking software and do I need it?

What is equipment booking software? Should you use it if you’re hiring out or sharing equipment? How can itemit help you book equipment?

The Impact Of IoT On Asset Tracking And Management

How does IoT revolutionise asset tracking and management? Discover the latest in IoT asset tracking and its transformative impact—read the article now!

IT Inventory Management: A Short Guide

What is IT inventory management and how can it make your working life easier? Read this short guide now to discover what it is and why you need it!