Is a car a liability or an asset? Your perspective and management of its value will determine your response. Although a car can provide convenience and even be a need in today's fast-paced world, its financial consequences are sometimes misinterpreted. Effective asset management for both individuals and companies depends on an awareness of the actual character of car value.

This becomes especially crucial when you realise that a car is a depreciating asset—its value decreases with time, affecting its general value and financial planning. Understanding how this works will enable you to decide how best to buy, keep, and finally sell your car.

What Makes a Vehicle an Asset?

An asset is defined as something with economic value that can generate future benefits. Vehicles can qualify as assets, but their classification depends on their use and how they contribute to value—whether personal or business-related.

Personal Vehicles: Utility Over Profit

For personal use, a vehicle is primarily valued for its practicality—enabling mobility, saving time, and improving accessibility. However, from a financial perspective, personal vehicles are often liabilities. They incur regular expenses, such as fuel, insurance, and maintenance, while their value consistently declines. In this case, their economic benefit is indirect, tied to convenience rather than generating income.

Business Vehicles: Functional Assets

Business vehicles, on the other hand, often meet the criteria of true assets. Delivery vans, company cars, and service vehicles are integral to operations, directly supporting revenue-generating activities. Their value lies not just in their initial cost but in their ability to enhance efficiency, expand service areas, or improve customer reach. However, to maximise their economic contribution and minimise depreciation, many businesses implement a vehicle management system. Such systems monitor vehicle performance, usage, and maintenance, ensuring their worth is preserved for as long as possible.

Vehicles, whether personal or business-related, hold potential as assets. Their classification hinges on their purpose and the level of management applied to sustain or enhance their value.

Cars as Depreciating Assets

Cars are a classic example of depreciating assets, meaning their value decreases over time due to factors like wear and tear, market conditions, and obsolescence. Depreciating assets contrast with appreciating assets (such as real estate), which tend to gain value over time.

To give you a broader picture, here's more examples of depreciating assets:

- Vehicles: Cars, trucks, and vans lose value over time, with new vehicles depreciating by as much as 20% in their first year alone.

- Electronics: Smartphones, laptops, and televisions quickly lose worth as newer models are introduced.

- Office Equipment: Items like printers, desks, and chairs wear out and become outdated.

- Machinery and Tools: Industrial equipment and tools degrade with use and advancing technology.

- Furniture: Whether for homes or offices, furniture depreciates due to wear and changing trends.

Why Cars Lose Value

Several factors drive a car's depreciation:

- Immediate Value Drop: New cars lose around 20% of their value within the first year.

- Mileage: The more a car is driven, the more its resale value declines.

- Wear and Tear: Physical damage, ageing parts, and diminished performance further reduce worth.

- Market Trends: Consumer preferences and new model releases make older vehicles less desirable.

For instance, a car purchased for £30,000 might only be worth £12,000 after five years, even with regular maintenance.

Financial Implications of Depreciation

Recognising that a car is a depreciating asset is essential for both personal and business financial planning. For individuals, depreciation means that cars should be seen as a necessity rather than an investment. For businesses, where vehicles are part of operations, unmanaged depreciation can eat into profits and reduce asset value on balance sheets.

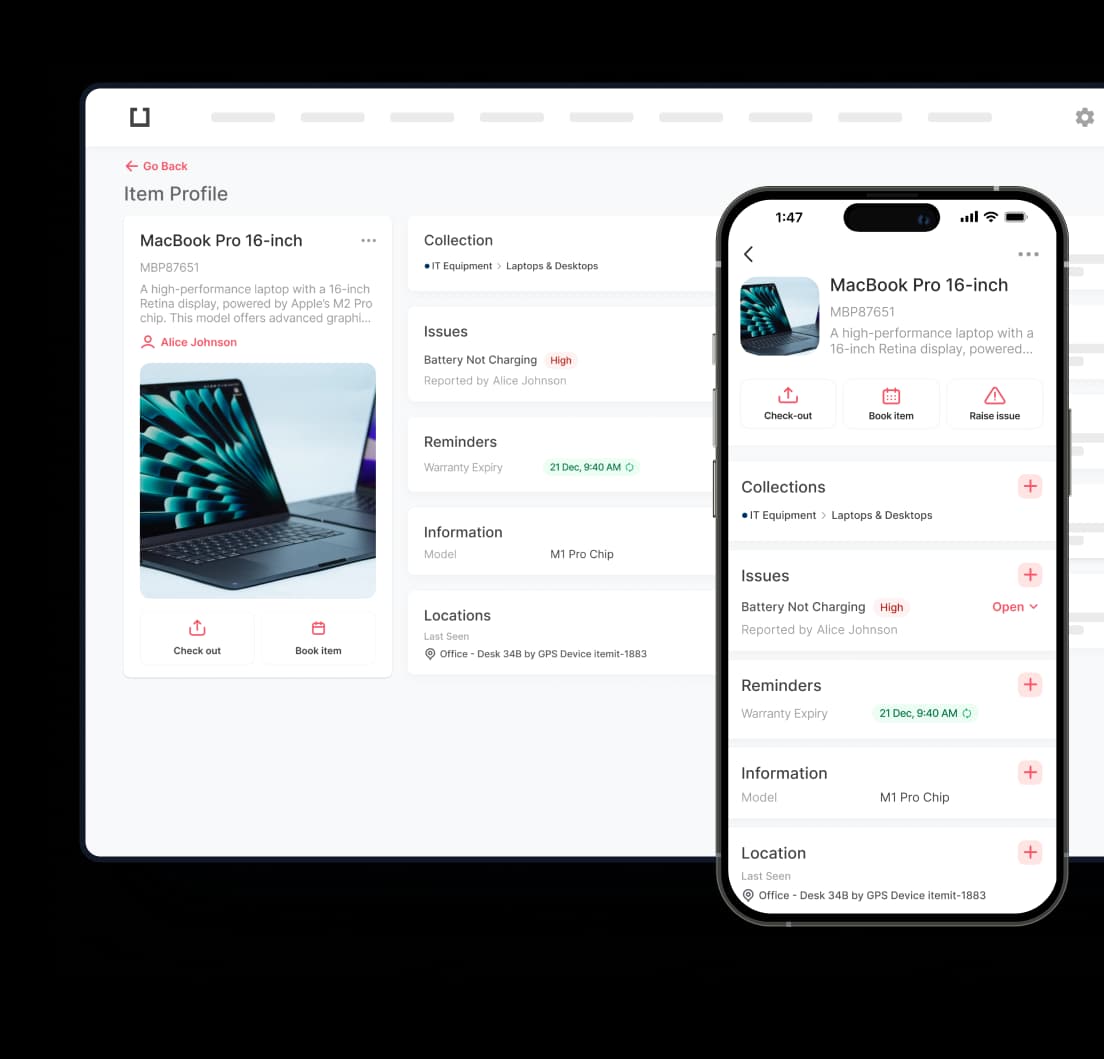

Using Technology to Track and Manage Depreciation

With tools like asset tracking software, businesses and even individuals can track cars to monitor their value over time. Tracking mileage, repair history, and market data will help you to clearly understand when it makes financial sense to replace or sell a car. Effective tracking also guarantees that vehicles are kept in the best condition, slowing down the depreciation process and extending value as much as possible.

Although depreciation is unavoidable, you can control its effects and ensure that your vehicles run more economically for your financial objectives by means of strategic observation and proactive actions.

When Does a Car Become a Liability?

Although most people consider cars assets, there are plenty of circumstances in which they become liabilities. When the expenses and responsibilities of owning or operating a car exceed its financial or practical worth, a liability results.

How a Car Becomes a Liability

- Debt from Financing: Taking out a loan to buy a car immediately results in debt. Although the car loses value over time, the loan repayment is fixed. Thus, should the car's value drop below the loan balance, you may find yourself "upside down." This situation strains finances, particularly if the loan terms extend beyond the car's useful life.

- Expensive Maintenance: Some cars, especially more expensive or older models, have high maintenance costs. Wear-related costs, routine repairs, and part replacements can rapidly mount up and eat into savings or income.

- Operating Costs: Beyond upkeep, costs such as insurance, gas, registration, and parking can be rather significant. Even if the car does not yield appreciable financial or practical advantages, these continuous expenses can make it a financial burden.

- Underutilised Vehicles: A car that spends more time in the garage than on the road can become a liability. It offers a minimal return on investment and keeps declining in value even if it is not used, incurring expenses.

Financial Implications of Car Liabilities

When a car is financed or incurs significant costs, it can negatively impact your financial records. For businesses, these liabilities reduce profitability, while for individuals, they limit disposable income. For example, a car purchased on credit becomes a monthly expense, which can be exacerbated by unforeseen repair bills or rising fuel prices.

Cars, while essential for many, can shift into liabilities when their associated debts or expenses outweigh their value. Recognising these risks and managing costs effectively is key to preventing a car from draining your financial resources.

Tracking and Valuating Vehicle Assets

When a car is financed or incurs significant costs, it can negatively impact your financial records. For businesses, these liabilities reduce profitability, while for individuals, they limit disposable income. For example, a car purchased on credit becomes a monthly expense, which can be exacerbated by unforeseen repair bills or rising fuel prices.

Cars, while essential for many, can shift into liabilities when their associated debts or expenses outweigh their value. Recognising these risks and managing costs effectively is key to preventing a car from draining your financial resources.

Whether in personal or business environments, effective management of vehicle assets depends on asset tracking systems. These systems use technology to offer real-time insights on vehicle use, maintenance, and depreciation. This degree of control guarantees that cars stay useful assets rather than turning into liabilities.

Key Benefits of Tracking Tools:

- Monitoring Usage: Tracking systems can log mileage, driving patterns, and usage frequency. This data helps in understanding wear and tear and planning for replacements or upgrades.

- Digital Maintenance Logs: Tools that store maintenance records ensure timely servicing and reduce the risk of breakdowns. A well-maintained vehicle depreciates slower, preserving its value longer.

- GPS Tracking: GPS-enabled solutions offer location tracking, route optimisation, and theft prevention, making them indispensable for businesses managing fleets.

- Valuation Reports: Advanced tracking tools provide real-time valuation data, giving you a clear picture of a vehicle’s current worth and depreciation rate. This helps in deciding when to sell or trade in a car.

For businesses managing fleets or multiple vehicles, fixed asset tracking software offers a scalable and reliable solution. It combines the features above with additional capabilities like integration with accounting systems, custom reporting, and compliance tracking. This ensures that all vehicles are not only tracked but also managed effectively to maximise their financial contribution.

Asset tracking systems change the way vehicle assets are maintained, simplifying difficult procedures and lowering the financial risks related to depreciation.

Benefits of Accurate Vehicle Valuation

Accurate assessment of vehicle assets is crucial for both personal and business financial management. Knowing the exact value of a car or fleet of vehicles helps one make wise decisions, better plan, and maximize efficiency.

For Businesses: Financial Clarity and Operational Efficiency

- Better Financial Planning: Accurate vehicle valuation allows businesses to allocate budgets effectively. Understanding the current worth of vehicles ensures that funds are set aside for replacements, upgrades, or maintenance at the right time.

- Improved Tax Reporting: Depreciation calculations and asset valuations are essential for tax filings. Precise records of vehicle value ensure compliance with tax regulations and help businesses take advantage of allowable deductions.

- Optimised Fleet Management: Accurate valuations, combined with systems like garage inventory tracking, enable businesses to monitor all vehicles in one place. This ensures efficient use of resources, helping identify underperforming vehicles and plan for replacements proactively.

For Personal Assets: Smarter Decisions and Long-Term Savings

Accurate vehicle valuation is equally important for personal car owners. Knowing your car’s worth helps when selling, trading in, or planning for future purchases. For example:

- Avoid Overpaying or Undervaluing: A precise valuation prevents selling a car for less than it’s worth or overpaying for a replacement.

- Informed Insurance Coverage: Knowing the exact value of your car helps secure appropriate insurance coverage, avoiding underinsurance or excessive premiums.

- Improved Budgeting: Accurate valuation aids in financial planning, allowing you to factor in depreciation and maintenance costs effectively.