Business owners everywhere! Do you want to know what assets you have and where they are? Do you want to know who has what and why? Do you want to keep better track of things? Take back control and ditch those annoying spreadsheets!

With itemit you can save time and money by creating a fixed asset register.

What Are Your Fixed Assets?

Your fixed assets are a selection of assets that make your company money.

They can be anything from your trucks to your buildings, they can be office equipment, machinery, even land.

It’s important to maintain your assets and monitor them properly as their value will decrease over time. Sooner or later, when your fixed assets have depreciated past a certain value, they’ll cost more money to maintain than they’ll make you.

Keeping track and using asset management software will therefore help with your financial accounting.

You can find which are your fixed assets from your balance sheet. Under your assets section, there should be a section name: “property, plant and equipment.” Most of your fixed assets will be under here.

Have you ever wondered what your figures are or how they are derived? With the use of just spreadsheets if an auditor comes in, would you instantly know the totals? Would you be able to show how each asset adds up to those totals?

If not you may be in trouble. Instead of breaking compliance laws it might turn into a scramble to prove you have the assets you’ve listed. With asset management, this doesn’t have to be an issue.

These are tangible assets, which means that they are real, you can touch them, and their value deteriorates with usage or increases with time, depending on the asset itself.

You will also see intangible assets under the asset section in your balance sheet, however. This is your logo, your slogan, patents, copyrights. Things that you can’t “use” but still make you money.

A good idea is to think if you’re going to be using it for more than a year or not. If you are, it’s probably a fixed asset. Either way, with the right asset management software, your intangible assets can still be tracked.

What Is A Fixed Asset Register?

A fixed asset register can help your business flourish, as it’ll help you keep track of everything you need to run your business.

Most people still currently use spreadsheets for this, but with the right asset management app, things can be a lot easier. Spreadsheets create issues and difficulties and never work how you want them to. Ditch them. Make life easier.

A fixed asset register is what you want to use to keep track of your fixed assets. Effectively it’s asset inventory management. You know exactly what you have and where it is, but you can also add in more information.

With this information, you have a perfect asset management system. You can track your assets as they depreciate in value, but you’ll also know exactly what you have, what make, what warranty, etc.

This way, the second an asset stops making you money, it’s possible to simply replace it and maintain a steady profit. With asset tracking software, you’ll no longer risk these potential issues.

If an asset isn’t on the books, it’s probably because the value has depreciated to 0. This means the asset has no accounting value.

Listing Your Fixed Assets

First of all you need to actually list out your fixed assets. With the right asset register software this becomes simple. Even for both intangible assets and tangible ones, the right asset management app can add information about both.

So, knowing that your fixed assets can be anything you intend to keep for a while and that helps you make money, how do you list them?

Tag them! Use asset tags on all of your assets, then you’ll know instantly what’s been recorded to your asset register. You can use RFID or QR tags, but once everything has been scanned with a physical audit or walkaround, it’ll all be in the right place.

What Information To Add

This is the important part. You’ve scanned in all of your fixed assets and know exactly what you have and where it is.

Now what? What do you need to know?

There’s a lot of information you can add. Some helpful for tax purposes, some helpful for tracking, some helpful for finances. Itemit attributes are configurable and so you can add any information that you need.

First of all you’ll want to add a description of the product. You can add a picture on itemit, as well as adding in the colour, model, and year of manufacture. This’ll help similar assets stay distinguished.

itemit also adds a unique serial number for your items to help you track your assets closely as well.

The next things you can add is purchase information, including the date of purchase, the price, insurance coverage and warranty information. This will not only help with tax purposes but also with tracking your finances.

When the asset is placed in service, this can be added as well as how long the asset is expected to survive. If there is a salvage value, this should be added here too.

Finally, an appropriate depreciation method could be added, just so there is absolute clarity with how your fixed assets are getting managed.

Choosing A Depreciation Method

How you choose a depreciation period depends on the asset itself.

However, it’ll usually relate to tax and the usefulness of the product.

First of all you need to calculate how long the asset will be useful for. To do this you can use the percentage calculated between the cost of the asset and its usefulness at the end of various time periods.

You can look at similar fixed assets and see how long they survived for.

You can even contact the manufacturer to ask how long the product will last.

If there is built in obsolescence into the asset, it will also be possible in this way to see when the asset will cease to be useful.

After this, the method itself should be discussed with tax authorities to see if it is allowable. How the cost declines will either be linear or accelerated across the usefulness of the asset, however.

itemit also has depreciation built in, so you’ll be able to track your assets this way.

Why itemit?

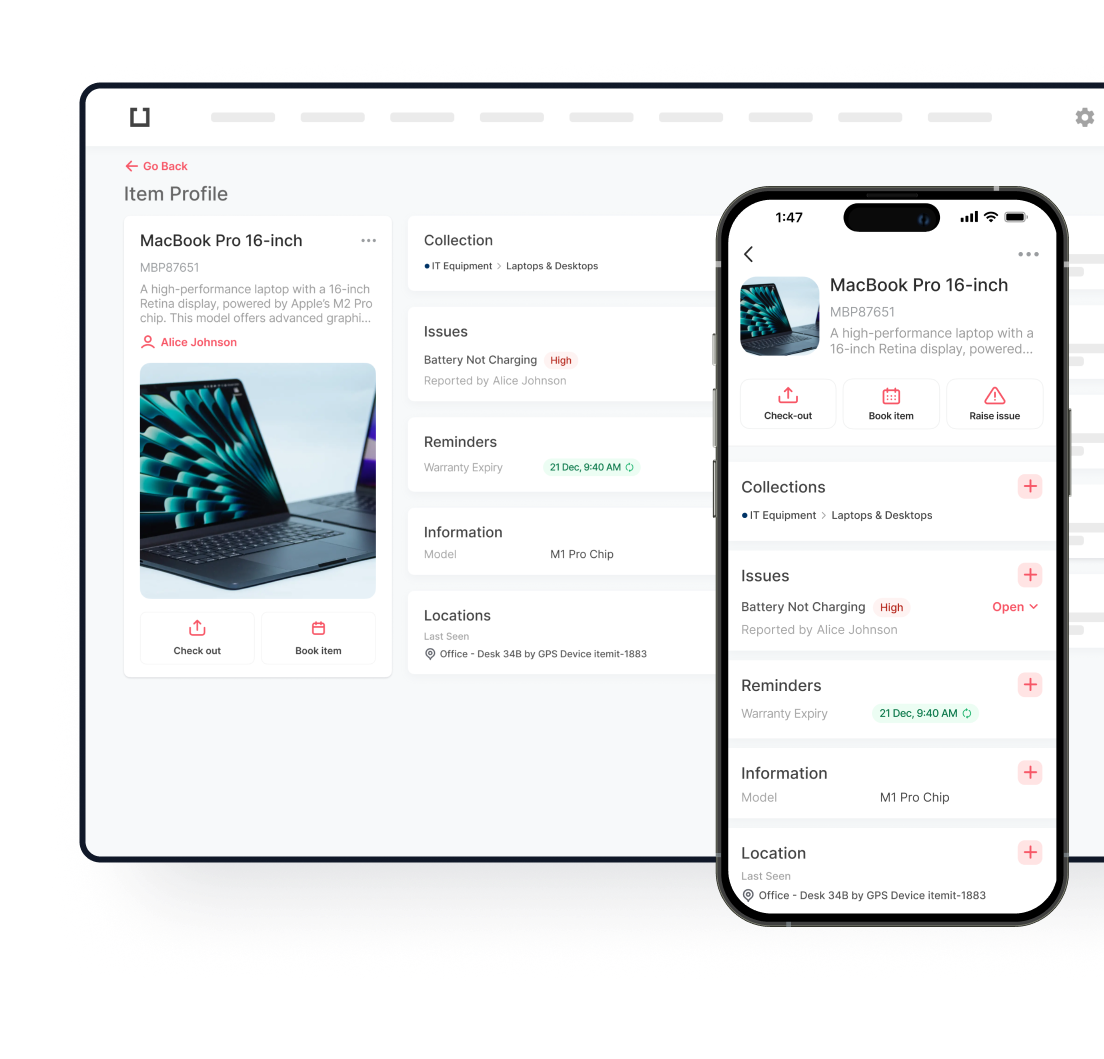

itemit is a useful and effective asset management software that can help you inventory and create a fixed asset register with ease.

If you want to do all of this, it’s more helpful to have a handy asset management app with you that you can share with your colleagues, rather than simply relying on spreadsheets.

Spreadsheets can be limited and frustrating, so use itemit instead to save valuable time and money.

To find out more, you can contact the team at team@itemit.com or fill in the form below to start your 14-day free trial.

Try itemit

Choose a better way to track your assets. Start your free 14-day trial now!

Keep Learning

itemit Blog

Tips, guides, industry best practices, and news.

Fixed Asset RFID Tracking: The future of equipment tracking

Why is fixed asset RFID tracking the future of equipment tracking? Find out how to save time and money with effective asset management.

How Does Asset Register Software Work?

Find out how asset register software works. Why should you use software over spreadsheets? Save more money with asset tracking.

How A Fixed Asset Register Will Transform Your Operations

A fixed asset register system will transform your operations. Save time and money with increased transparency and control over your assets.