Published on February 26, 2020 •

7 min read

When starting to compile your fixed asset register, you might be a bit lost when it comes to what to include. Here, we’ll cover the types of assets that should be listed in your fixed asset register and the essential information to ensure it is complete.

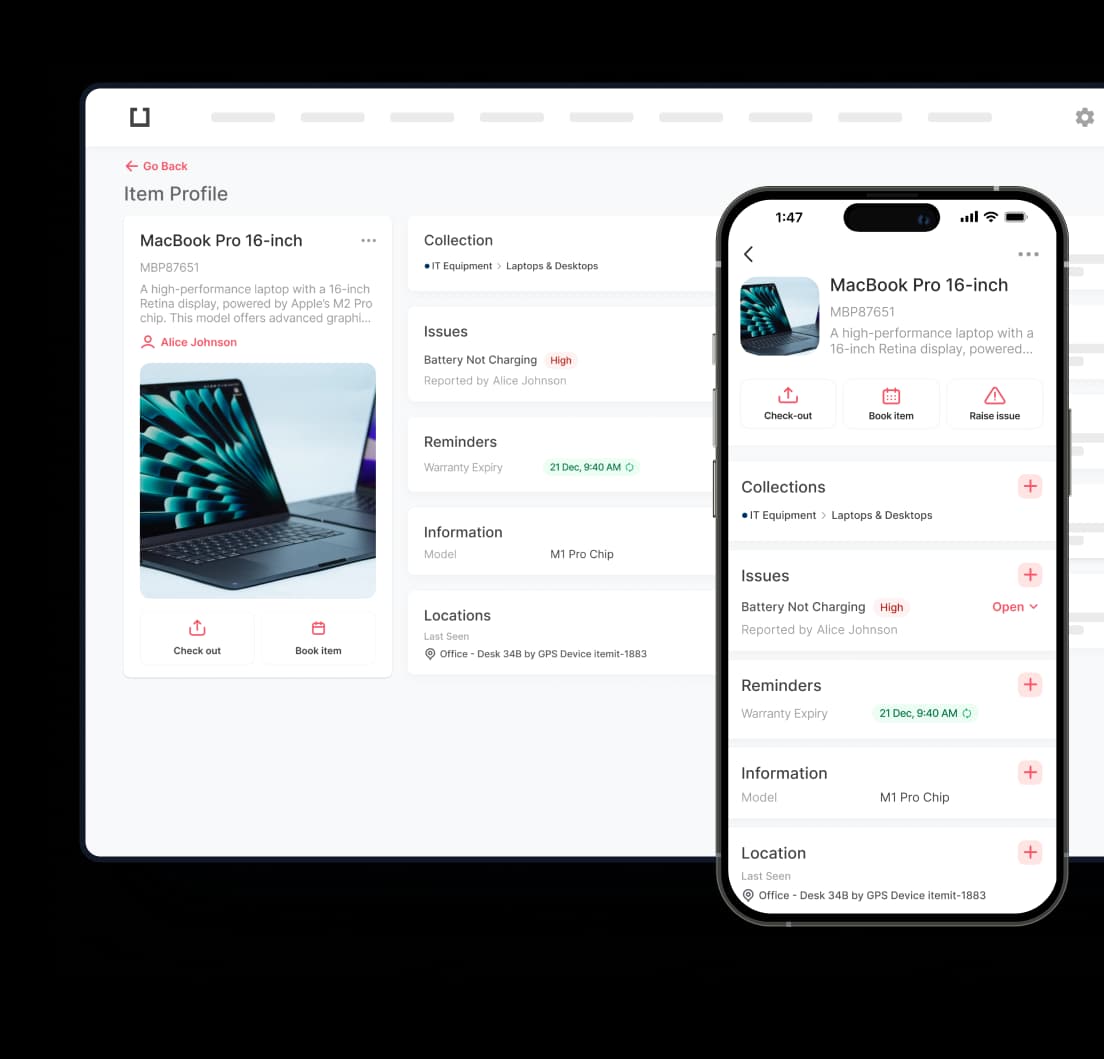

itemit is an asset tagging and management system that creates a fixed asset register for you as you go. This means that all the information you need will be available and ready for future export as a PDF or Excel file.

What Assets Should I Include?

First, let’s clarify the types of assets that should be included in your fixed asset register.

You may have various types of assets, and it’s worth noting that inventory and fixed assets are different. Fixed assets are permanent fixtures in your company that don’t generate revenue through buying, selling, or renting.

Instead, fixed assets contribute to the company’s profitability through their usage. For example, IT assets such as laptops and phones are fixed assets because your team uses them to generate revenue. Construction tools are fixed assets, too as they are permanent fixtures used to generate revenue.

So, how do you decide which assets to include in your fixed asset register? The answer varies from company to company, but with a streamlined system, there’s no limit to what you can track and manage. Some commonly recorded fixed assets include:

With itemit, each of your assets has a unique profile, allowing you to identify each asset uniquely and record all the required information in your fixed asset register.

Using a fixed asset tracking system like itemit also allows you to QR tag your assets. This makes identification and future interaction with your assets quick and easy.

The purpose of a fixed asset register is to maintain and manage your assets along with all relevant information.

It’s important to record information specific to each unique asset, as not all information will overlap, but it should all be collated in a fixed asset register.

There are five key pieces of information that should be recorded in your fixed asset register:

- Location and Usage Data – This enables you to track asset use and movement. Knowing where your assets are and who has them is crucial in any asset tracking process.

- Compliance Information – This varies depending on the specific assets, making a unique profile per asset, or digital twin, necessary. Adding fire compliance information against fire doors or GDPR compliance information against laptops is essential.

- Financial Information – This helps with depreciation and asset lifecycle management. Knowing the purchase price and warranty information helps with better-informed decision-making.

- Insurance Information – In case of an unfortunate event, you can add insurance information to your asset register. Having this compounded by movement data and proof of responsible use can assist with insurance claims.

- Maintenance Information – Recording all historical maintenance information helps determine which assets have become uneconomical to repair. This information enables better-informed replacement decisions and improves budgeting and forecasts.

For a better understanding of a properly formed fixed asset list, let’s look at the more detailed information with examples below.

Key Components of a Fixed Asset Register Detailed

Asset Description

The first and most important element of your fixed asset register is the asset description. Every item recorded on your fixed asset list needs a clear and concise description. This description should include information regarding the type, model, and manufacturer of the asset, along with other relevant details that help distinguish this particular asset from the rest. For example, a computer might be listed as "Dell Optiplex 7070 Intel i7 16GB RAM 512GB SSD." With this level of detail, any item in your list of fixed assets can be easily identified.

Asset Identification Number

The first and most important element of your fixed asset register is the asset description. Every item recorded on your Assigning a unique ID number to each fixed asset is crucial for organisational requirements in the area of fixed assets. Identification helps distinguish similar items and serves as an essential procedure for the control and management of stock. You can have these ID numbers generated automatically and assigned within itemit’s fixed asset system, adding them to your asset registry. This is especially useful for large organisations with huge inventories of fixed assets, as it reduces the probability of errors. fixed asset list needs a clear and concise description. This description should include information regarding the type, model, and manufacturer of the asset, along with other relevant details that help distinguish this particular asset from the rest. For example, a computer might be listed as "Dell Optiplex 7070 Intel i7 16GB RAM 512GB SSD." With this level of detail, any item in your list of fixed assets can be easily identified.

Location of Assset

This is particularly important for businesses with operations across multiple sites. itemit allows customers to see the exact location of each item included on their list of fixed assets. This feature is incredibly helpful to companies managing assets across different locations, ensuring that everything, from furniture to machinery, is accounted for. So, if you are wondering, “Is furniture an asset?” then, well, yes, it is, of course. Equally important is knowing exactly where it is located within your premises.

Date of Purchase

Recording the purchase date of each asset is important for calculating depreciation and understanding the asset’s lifecycle. This information is important not just from an accounting viewpoint, but also when planning future investments. A fixed asset system makes it easy to input, maintain and keep up-to-date. More importantly, it ensures your fixed asset register never becomes outdated, which is particularly important when you need to provide details of your fixed assets, such as in a balance sheet.

Purchase Cost

The acquisition cost of each asset is a primary piece of information that must be included in your fixed asset register. The basis for calculating depreciation and determining the total investment in your company's fixed assets is that amount. itemit's software makes it easy to input and manage these costs, ensuring that your fixed asset list reflects the value of your investment. This also helps in proper financial planning and budgeting, giving you a clear understanding of the decisions that need to be made regarding asset management.

Depreciation Method and Rate

Depreciation affects the book value of assets over time. Your fixed asset register should clearly state which method of depreciation is used: straight-line, declining balance, or something else, the rate at which the asset depreciates annually. The system used by itemit allows you to set depreciation for each asset, ensuring your list of fixed assets is up-to-date with each particular item's current value.

Accumulated Depreciation

Accumulated depreciation is the total of all depreciation charges that have accrued on an asset. This helps determine the current book value of the asset, which will be a part of your company's fixed asset list. The software automatically calculates accumulated depreciation, reducing human errors and ensuring your financial reports reflect the correct value of the fixed assets.

Current Value

Current value is the cost of purchase less depreciation. This value is important in financial reporting and decision-making of replacing or disposing of any asset. itemit makes it easy to calculate and update the value of every item on your list of fixed assets, keeping your accounts properly maintained and in compliance with accounting standards.

Expected Useful Life

Estimating an asset's useful life is good for planning future placement and understanding the long-term value of investments. This estimation also dictates the appropriate percentage of depreciation to apply. The fixed asset system allows users to track an asset's useful life and prepare for future capital expenditure.

Maintenance and Service Records

Keeping track of maintenance and service records is crucial to ensure assets remain operational. These records help plan for possible repairs or replacements, mitigating the risk of unplanned downtime. itemit features allow you to register and track maintenance for every item in your fixed asset list, keeping you informed of the item's condition and general care.

It is imperative that asset utilisation be recorded in the fixed asset register, including the date of disposal and any value realised. Such information on disposal is vital for better financial reporting and tax purposes. Software eases disposal management and recording. Keep your list of fixed assets up to date with all the financial records and disposal.

itemit's Streamlined Auditing and Reporting Processes

itemit streamlines and automates the process of creating a fixed asset register, a crucial tool for managing your organization’s physical assets. Whether you need to track office equipment, IT assets, or machinery, a well-organized fixed asset register helps ensure accurate financial reporting, enhances asset visibility, and improves decision-making related to asset management. By having a clear record of each asset's value, depreciation, and location, businesses can efficiently manage audits, compliance, and maintenance schedules, all while reducing unnecessary losses or expenses.

For auditing purposes, maintaining a detailed and reliable fixed asset register is essential. All you need to do is create an asset register profile, link it to the asset with a QR code, RFID tag, or barcode, and start tracking your asset. You can then add all the relevant information you need for your fixed asset register. The best bit is you can share this with your team to ensure the information remains up-to-date and accurate. It allows auditors to quickly verify the existence, condition, and valuation of assets.

In terms of fixed asset registers for audits, itemit will automatically create reports based on your assets, including a fixed asset register. Once you’ve added all the necessary assets and their information, simply go to the reports tab in our web portal, and you’ll be able to export your fixed asset register instantly, helping you stay audit-ready at all times.

Find out more about what itemit can help you prepare a fixed asset register by contacting the team or by filling in the form below to start building your fixed asset register today!