The warehouse manager stands surrounded by boxes, some collecting dust for years, while other shelves sit mysteriously empty. Meanwhile, the finance director questions why capital remains tied up in stock while certain customer orders face constant delays. This disconnect represents more than miscommunication—it reveals a fundamental metric many businesses struggle to optimise: inventory turnover.

Inventory turnover ratio measures how efficiently a company sells and replaces its stock during a specific timeframe. Far from just another financial calculation, this figure reveals operational efficiency, cash flow health, and even market alignment. Companies with optimised inventory turnover typically outperform competitors in profitability by 20-30%, making this metric worth mastering.

When businesses optimise this ratio, they experience multiple benefits: reduced holding costs, minimised obsolescence risks, improved cash flow, and stronger customer satisfaction through consistent product availability. The challenge lies in finding your optimal balance point—the turnover sweet spot that maximises these advantages without creating stockouts or operational disruptions.

Defining Inventory Turnover: Beyond Basic Numbers

At its core, the inventory turnover ratio represents how many times a company sells and replaces its inventory during a specific period. This seemingly simple metric carries profound implications across departments:

- For finance: Capital efficiency and liquidity management

- For operations: Production scheduling and warehouse utilisation

- For sales: Product availability and fulfilment capabilities

- For purchasing: Order timing and quantity decisions

The standard inventory turnover formula divides sales by average inventory:

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory Value

This calculation provides insight into how many times you “turn” your inventory during the measurement period. A ratio of 6 means you effectively sell and replace your entire inventory six times annually.

Some businesses prefer alternative calculation approaches:

- Sales-based approach: Uses revenue instead of COGS (helpful for retailers with consistent markup)

- Unit-based calculation: Measures physical units rather than financial values (eliminates price fluctuation effects)

- Category-specific analysis: Calculates separate ratios for different product lines

Each approach offers unique insights, but the COGS-based calculation represents the industry standard for financial reporting and competitive benchmarking.

Calculating Your Inventory Turnover Ratio: Practical Steps

At its core, the inventory turnover ratio represents how many times a company sells and replaces its inventory during a specific period. This seemingly simple metric carries profound implications across departments:

- For finance: Capital efficiency and liquidity management

- For operations: Production scheduling and warehouse utilisation

- For sales: Product availability and fulfilment capabilities

- For purchasing: Order timing and quantity decisions

The standard inventory turnover formula divides sales by average inventory:

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory Value

This calculation provides insight into how many times you “turn” your inventory during the measurement period. A ratio of 6 means you effectively sell and replace your entire inventory six times annually.

Some businesses prefer alternative calculation approaches:

- Sales-based approach: Uses revenue instead of COGS (helpful for retailers with consistent markup)

- Unit-based calculation: Measures physical units rather than financial values (eliminates price fluctuation effects)

- Category-specific analysis: Calculates separate ratios for different product lines

Each approach offers unique insights, but the COGS-based calculation represents the industry standard for financial reporting and competitive benchmarking.

Calculating your inventory turnover ratio requires accessible data points and straightforward math. Follow this process for accurate results:

- Determine your measurement period (typically 12 months)

- Calculate your Cost of Goods Sold for this period

- Determine your average inventory value using this inventory turnover ratio equation:

Average Inventory = (Beginning Inventory + Ending Inventory) / 2

- Divide COGS by Average Inventory

For example:

- Annual COGS: $1,200,000

- January 1 Inventory: $250,000

- December 31 Inventory: $150,000

- Average Inventory: $200,000

- Inventory Turnover Ratio: 6 (inventory turns over six times annually)

For more precision, many businesses calculate average inventory using monthly or quarterly values rather than simply beginning and ending figures. This approach produces more accurate results for businesses with seasonal fluctuations.

The measurement period significantly impacts interpretation. While annual calculations provide a strategic overview, quarterly or monthly turnover metrics deliver tactical insights, revealing seasonal patterns and allowing for timely adjustments.

You can also derive the related “Days Sales of Inventory” (DSI) metric by dividing 365 by your turnover ratio. In our example:

365 / 6 = 60.8 days

This tells you inventory sits approximately 61 days before selling—a valuable cash flow planning metric.

Industry Benchmarks and Context

What constitutes “good” average inventory turnover varies dramatically across industries:

- Grocery stores: 12-18 (selling entire inventory every 20-30 days)

- Furniture retailers: 3-5 (turnover every 73-122 days)

- Automotive dealers: 6-8 (turnover every 46-61 days)

- Electronics manufacturers: 4-6 (turnover every 61-91 days)

- Fashion retailers: 4-6 (turnover every 61-91 days)

These variations reflect fundamental business model differences. Perishable goods naturally require faster turnover than durable equipment. High-margin products can afford slower turns than low-margin items, requiring volume efficiency.

Context matters tremendously when interpreting your ratio. A turnover rate of 4 might indicate inefficiency for a convenience store but represent exceptional performance for a luxury furniture retailer. Always benchmark against:

- Industry peers operating similar business models

- Your historical performance trends

- Specific business objectives (growth vs. profitability focus)

Some businesses strategically maintain lower turnover rates to ensure product availability or capitalise on anticipated price increases. Others prioritise extremely high turnover to minimise holding costs and maximise freshness. The “right” ratio aligns with your specific business strategy rather than arbitrary benchmarks.

Improving Your Inventory Turnover: Strategic Approaches

Businesses seeking improved inventory efficiency can implement targeted strategies across multiple operational areas:

Supply Chain Optimisation:

- Implement just-in-time ordering systems for high-volume items

- Negotiate faster supplier delivery for regularly stocked products

- Develop vendor-managed inventory arrangements with key suppliers

Demand Forecasting Improvements:

- Analyse sales data to identify seasonal patterns requiring adjustment

- Implement statistical forecasting methods beyond basic averages

- Segment product forecasting by sales velocity categories

Operations Enhancements:

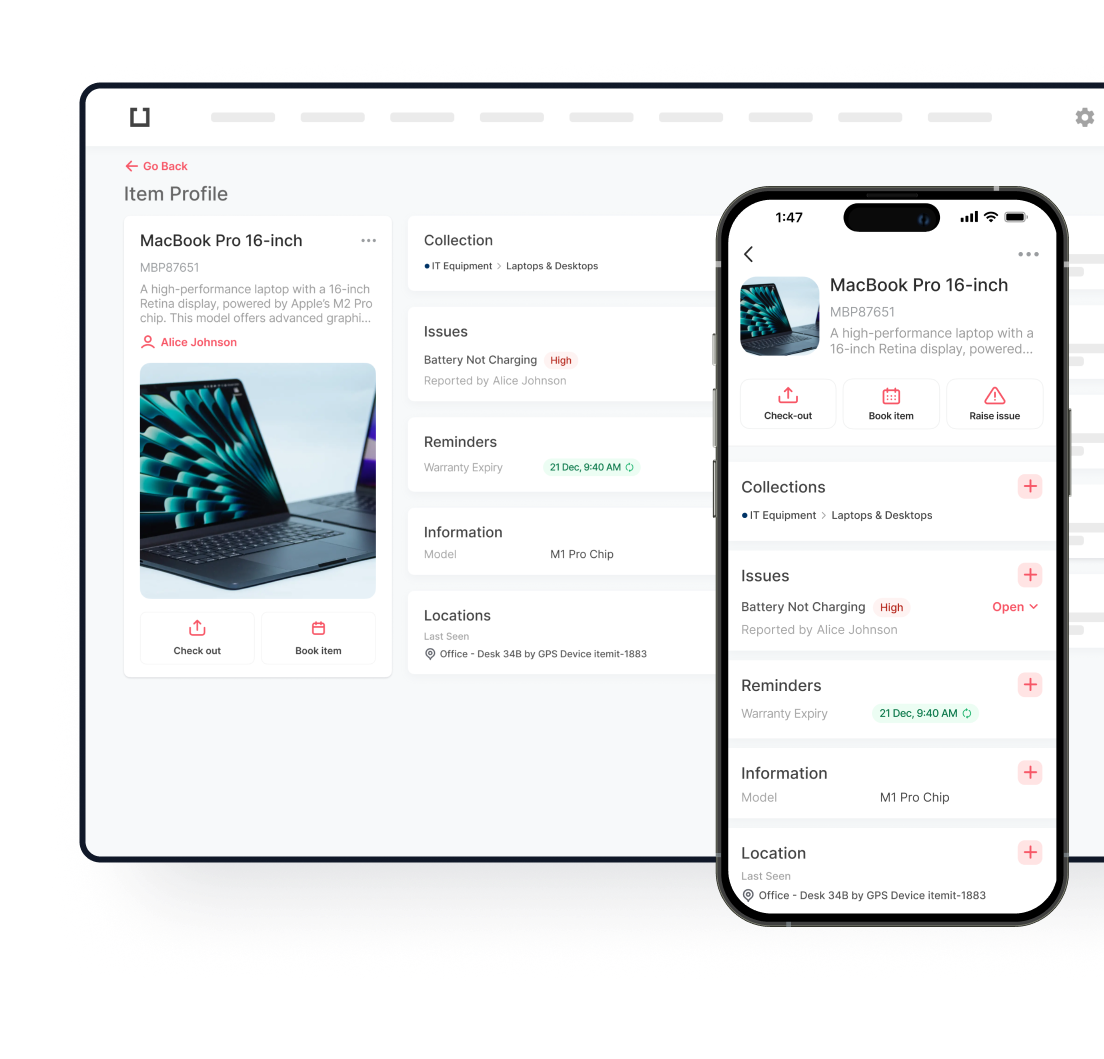

- Deploy equipment checkout software to track movable assets that support inventory handling

- Redesign warehouse layouts to prioritise high-turnover items

- Implement cycle counting instead of disruptive full inventories

Pricing and Marketing Strategies:

- Create targeted promotions for slow-moving inventory

- Implement quantity-based pricing tiers to move larger volumes

- Bundle slow-moving items with popular products

Technology Applications:

- Implement automated reordering at predetermined thresholds

- Use analytics platforms to identify sales velocity changes early

- Deploy inventory management systems with real-time visibility

A construction materials supplier increased their turnover from 4.2 to 7.8 annually by implementing three targeted changes: order frequency adjustments, supplier delivery schedules, and warehouse organisation based on turnover rates. This improvement released $3.7 million in cash previously tied up in excess inventory.

Inventory Turnover Analysis: Finding Actionable Insights

Basic turnover calculations provide valuable starting points, but deeper inventory turnover analysis reveals actionable operational insights:

Product Category Segmentation: Calculating turnover by product family often reveals surprising variations. A hardware retailer discovered their fasteners category turned 14 times annually, while power tools achieved only 3.2 turns. This insight prompted category-specific stocking strategies rather than applying single-policy approaches across different types of inventory.

ABC Analysis Application: Segmenting products by revenue contribution supports differentiated turnover goals:

- A-items (top 20% of revenue): May justify lower turnover to ensure availability

- B-items (middle 30%): Balanced turnover approach

- C-items (bottom 50%): Aggressive turnover targets minimise holding costs

Seasonal Adjustment Analysis: For businesses with predictable seasonality, comparing year-over-year same-period turnover reveals more valuable insights than overall annual metrics. A sporting goods retailer maintains separate summer and winter turnover benchmarks, recognising that seasonal inventory behaves differently.

Location-Based Comparison: Multi-location businesses benefit from comparing turnover across sites, revealing operational best practices and regional demand differences. A regional grocery chain discovered 32% turnover variation between seemingly similar stores, leading to optimized distribution practices.

The most valuable turnover insights often emerge from combining this metric with other KPIs. For example, comparing gross margin return on investment (GMROI) with turnover identifies products with lower turns but higher profitability—items potentially worth stocking despite slower movement.

Common Pitfalls in Turnover Analysis

Effective inventory management requires avoiding these common turnover analysis mistakes:

Overemphasising Industry Averages: Blindly pursuing industry benchmarks without considering your specific business model often leads to poor decisions. A medical supply distributor damaged customer satisfaction by pushing turnover too high after reading industry guides, not recognising their specific customer base needed higher availability than typical distributors.

Focusing on Overall Averages Only: Company-wide turnover figures frequently mask critical category problems. A manufacturing company maintained “healthy” overall turnover while specific component categories aged toward obsolescence, hidden within averaged metrics.

Ignoring Profitability Relationships: High turnover alone doesn’t guarantee profitability. Products with rapid turns but minimal margins can actually contribute less profit than slower-moving premium items. Always analyse turnover alongside margin metrics.

Insufficient Tracking Infrastructure: Many businesses struggle with turnover optimisation because their fundamental counting accuracy needs improvement. Implementing asset tags dramatically improves inventory accuracy, providing the reliable data foundation necessary for turnover management.

Calendar-Based Blindness: Analysing turnover solely on calendar periods (months/quarters) sometimes misses product-specific cycles. Components with 45-day optimal order cycles won’t align neatly with monthly reporting, creating artificial variance in turnover metrics.

Perhaps the most dangerous pitfall involves seeing inventory solely as a financial metric rather than an operational one. The most effective inventory optimisation occurs when finance and operations departments collaborate with shared objectives and metrics.

Implementation Case Studies

Wholesale Distribution Transformation: A regional wholesale distributor struggled with 3.2 annual turns against an industry average of 6.8. Analysis revealed 27% of warehouse space contained items turning less than once yearly. After implementing category-specific turnover targets and liquidating extremely slow movers, their ratio improved to 7.4 within nine months. This improvement released $1.2 million in working capital while reducing warehouse space requirements by 20%.

Retail Chain Optimisation: A speciality retailer with 32 locations discovered their turnover lagged 40% behind leading competitors. Deeper analysis revealed their purchasing processes inadvertently encouraged overbuying through volume-based staff incentives. By restructuring incentives around inventory efficiency metrics and implementing minimum turn requirements, they improved from 2.8 to 4.7 turns annually while increasing gross margin by 2.3 percentage points.

Manufacturing Component Management: A precision equipment manufacturer struggled with production delays despite abundant inventory investment. Turnover analysis by component category revealed severe imbalances: some common parts turned 25+ times annually while specialised components barely reached 1.5 turns. By implementing tiered stocking policies based on usage frequency and lead times, they improved overall turnover by 62% while simultaneously reducing stockout-related production delays by 74%.

These companies share a common approach: they moved beyond viewing turnover as merely a financial ratio and integrated it into operational decision-making across departments. This cross-functional approach produced substantially better results than treating inventory solely as a finance concern.

Taking Control of Your Inventory Performance

Understanding and optimising your inventory turnover ratio delivers multiple business benefits: improved cash flow, reduced warehousing costs, minimised obsolescence risk, and enhanced customer satisfaction through better availability. The process begins with accurate measurement but succeeds through consistent application across your operations.

Start your optimisation journey with these steps:

- Calculate your current inventory turnover using a consistent methodology

- Benchmark performance against relevant industry standards

- Segment analysis by product categories and locations

- Identify the highest-impact improvement opportunities

- Implement targeted strategies for different inventory segments

- Measure results and refine approaches continuously

For businesses serious about inventory optimisation, the itemit asset tracking solution provides the technological foundation for success. With customisable tagging options, real-time tracking capabilities, and comprehensive reporting features, itemit transforms inventory management from periodic counting exercises to continuous optimisation opportunities.

By implementing these strategies and leveraging appropriate technology solutions, your business can achieve the optimal inventory balance—maximising availability while minimising capital investment. The result isn’t just improved financial metrics but enhanced operational performance that delivers a competitive advantage in your marketplace.

Try itemit

Choose a better way to track your assets. Start your free 14-day trial now!

Frequently Asked Questions

What is a good inventory turnover ratio?

A good inventory turnover ratio varies by industry. Grocery stores typically aim for 12-18 turns annually, while furniture retailers target 3-5 turns. The optimal ratio depends on your specific business model, industry standards, and strategic objectives.

How do I calculate the inventory turnover ratio?

The standard inventory turnover formula is: Cost of Goods Sold ÷ Average Inventory Value. For example, with annual COGS of $500,000 and average inventory of $100,000, your inventory turnover would be 5, meaning you sell through your inventory five times per year.

What happens if my inventory turnover is too low?

A low turnover ratio often indicates excess inventory, tying up working capital, increasing storage costs, and risking obsolescence. This typically signals purchasing misalignment with sales, forecasting problems, or pricing issues that need addressing.

Can inventory turnover be too high?

Yes. While high turnover seems positive, extremely high ratios might indicate understocking, leading to stockouts, lost sales, and customer dissatisfaction. The optimal ratio balances efficient capital use with consistent product availability.

How can I improve my inventory turnover?

Improve turnover by implementing demand forecasting, adjusting order quantities, optimising pricing strategies, running targeted promotions for slow-moving items, and using asset tags with inventory management systems to improve tracking accuracy.

How often should I calculate my inventory turnover?

For most businesses, quarterly calculation provides the right balance of timeliness and meaningful data. However, businesses with high seasonality or rapid market changes may benefit from monthly analysis, while those with stable demand patterns might find semi-annual reviews sufficient.

Keep Learning

itemit Blog

Tips, guides, industry best practices, and news.

How to Avoid Inventory Mismanagement and Improve Efficiency

Learn how to avoid inventory mismanagement with effective strategies to improve tracking, reduce errors, and ensure efficient stock control for your business

Inventory

Discover how itemit simplifies inventory management with real-time tracking, user-friendly features, and seamless mobile access

How Asset Tracking Can Help Prevent Inventory Shortages and Stockouts

Struggling with stockouts? Discover how to manage inventory shortages, prevent disruptions, and optimize your supply chain with expert inventory management tips.