In the spirit of spooky season, we’re diving into one of the most haunting issues your business may face. The dreaded ghost asset. These ghosts will float around your fixed asset register and spook your finances.

Ghost assets will make you lose money and they pose a dark threat to your tax and insurance returns. You have to exorcise these assets before they drain too much from your business.

What Are Ghost Assets?

Ghost assets are assets that exist in your asset register but are not physically accounted for. As such, they’re literally ghosts on your system.

So, if you’ve decommissioned a laptop and scrapped it, for example, if this change isn’t then reflected on your asset register, then that asset becomes a ghost asset.

Any asset, therefore, can become a ghost asset as they are digital echoes of once physical, in use assets. This is where they get their spooky name from.

Why are they such an issue, though, and why should you exorcise your fixed asset register from these ghouls?

Why Are They Such A Problem?

Ghost assets pose a number of issues, both financial and physical. For example, there is the immediate issue of needing to use an asset, checking if it exists on the register, and finding it has turned up missing.

So, first and foremost ghost assets cause productivity issues and can create slack times where your colleagues are searching for assets rather than using said assets.

Maybe, therefore, ghost assets won’t jump out and scare you or your colleagues or whisper haunting words in an empty hallway, but they will definitely cause a sigh and an eye roll.

What will scare you and your colleagues is the amount of money these assets will lose you. The lack of transparency and accountability translates into your tax and insurance operations.

If there are assets on your fixed asset register that you’re not using and that you have decommissioned, these assets will still be logged in your returns. Therefore, you’ll either risk fines for incorrectly logging a value or you’ll pay too much insurance because you’re insuring more assets than you actually own. Scary, right?

How To Bust Ghost Assets

So, how do you get rid of these accounting spectres? Should you call in the experts? No.

When you use fixed asset management software, you become the ghost-buster due to simple accountability-driven features and functionality. The best fixed asset tracking software is super simple to use meaning you won’t need years of ghost-busting training (or a proton pack), either.

This ease of use also means that you and your colleagues don’t have to cross the streams to contribute to your ghost-busting efforts. Instead, you can all pick up and use the system and lessen the accounting load for everyone.

Why can’t you just use spreadsheets? Spreadsheets are like tombs in that they’re old, unkempt and haunted by ghost assets. Any change an asset goes through makes your spreadsheet out of date, which is impossible to keep track of. Every time an asset is decommissioned, therefore, there’s a possibility that that asset will cross over to the spirit realm and remain on your fixed asset register.

This is where fixed asset tracking software gives you more functionality, as any changes are quick, easy and manageable. On top of this, you can run reports on your asset changes and export snapshot spreadsheets, giving you the best of both worlds without the spookiness.

itemit’s Fixed Asset Management Software

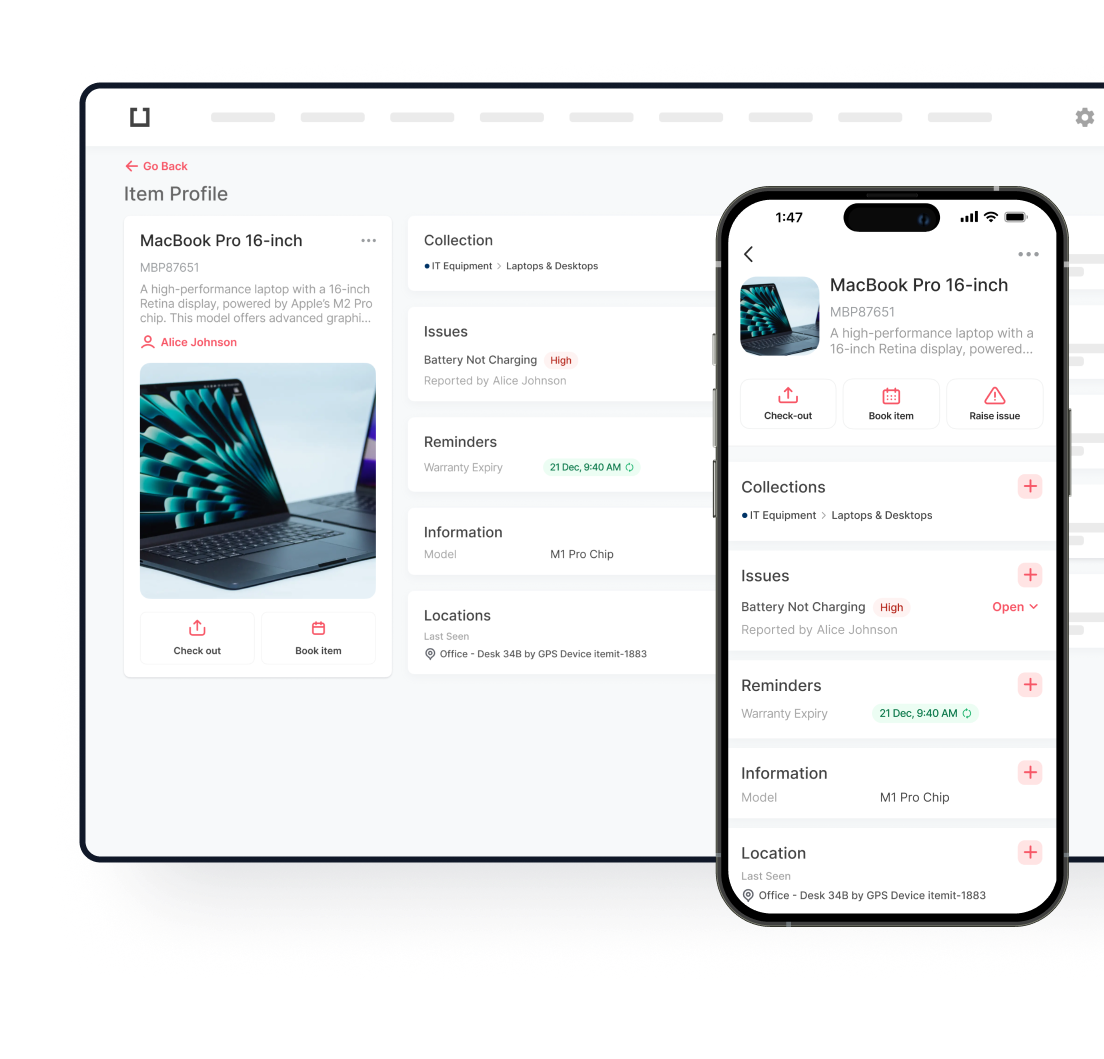

itemit’s fixed asset management software gives you all of this and more. Built to help you keep track of your assets, you get more accountability and control over your tools and equipment with itemit.

You can track any asset on the system in multiple, easy-to-manage ways. This means that you can exorcise your ghost assets with consistent, speedy audits and run reports.

Fixed asset management shouldn’t be complicated, unwieldy, or time-consuming. Instead of staring into the void of unwieldy spreadsheets, return to the land of the living with effective software.

Our support team is always keen to make sure you’re getting as much return on investment as possible. This means that if you do need someone to call, you’re best reaching us at +44 (0)1223 421611. You can also contact us at team@itemit.com with any questions. We’ll help you bust your ghost assets.

Try itemit

Choose a better way to track

your assets.

Start your free 14-day trial now!

Keep Learning

itemit Blog

Tips, guides, industry best practices, and news.

The Importance and Benefits of Asset Management

Asset management underpins the success of any business and with the correct tools in place businesses can enjoy numerous benefits. Discover why.

How to Manage Your IT Assets with Ease

Keeping control of your IT assets is just good business. IT asset management software can make your life a whole lot easier.

Asset Tracking Do’s and Don’ts

itemit’s asset tracking software exists to make your life easier. Check out the do’s and don’ts associated with using our asset tracking software!