The history of asset management has its roots deep in centuries. People have always sought ways to manage their property. We’re surrounded by assets, from laptops to equipment to phones, and this has always been the case. Therefore, jobs from construction to healthcare have always needed to keep track of what they own.

Since ancient Egyptian times, early asset registers have existed to manage what workers have owned and have had access to. Inventory lists have long been needed and used.

The benefit, therefore, has been seen throughout history that knowing what you own speeds up operations and creates a clear and transparent view of budgets and deadlines.

The Early Beginnings: Managing Wealth in Ancient Civilisations

Asset management traces its roots back to ancient times. In early civilisations like Mesopotamia, Egypt, and Greece, people managed wealth and property in basic ways. They traded goods, used early forms of money, and kept records to track their assets. These practices were the building blocks of modern financial systems. For example, in ancient Egypt, wealthy individuals stored grain, livestock, and gold in temples, using these items as a store of value.

Governments also took part in managing assets by creating taxation systems and organising land ownership. This was a simple but effective way to track wealth and maintain control. These early steps shaped the development of the history of asset management, creating the foundation for more complex systems that followed.

The Growth of Financial Institutions in Medieval Europe

Fast forward to medieval Europe, where financial systems started to evolve rapidly. The asset management market gained momentum as banks emerged, particularly in Italy. The Medici family, famous for their banking empire, played a pivotal role. They didn’t just safeguard wealth but also helped manage it through lending and investing. These early bankers laid the groundwork for what we now recognise as asset management.

Trade was booming at this time, and merchant banks were on the rise. With the expansion of trade routes across Europe, merchants needed secure ways to manage their finances. This is where banking became more sophisticated, and the need for asset management became evident. The history of asset management in Europe grew from these beginnings, developing into something more structured and professional.

The Birth of Modern Asset Management: 19th and 20th Centuries

During the Industrial Revolution, the world saw a major shift in how assets were handled. New financial institutions appeared, and with them, the birth of modern asset management. Investment trusts and mutual funds became popular in the 19th and early 20th centuries, offering people new ways to grow their wealth.

The 1930s brought challenges, especially with the Great Depression. Financial markets collapsed, and regulations tightened. One key regulation was the Investment Company Act of 1940, which introduced rules for managing mutual funds. This helped shape today’s asset management market by protecting investors and ensuring transparency.

Large financial institutions, such as J.P. Morgan, played key roles during this era. They professionalised asset management, creating systems that helped clients manage their wealth more effectively. The history of asset management truly took off during this time, setting the stage for future innovations.

Asset Management in the Post-War Era

During the Industrial Revolution, the world saw a major shift in how assets were handled. New financial institutions appeared, and with them, the birth of modern asset management. Investment trusts and mutual funds became popular in the 19th and early 20th centuries, offering people new ways to grow their wealth.

The 1930s brought challenges, especially with the Great Depression. Financial markets collapsed, and regulations tightened. One key regulation was the Investment Company Act of 1940, which introduced rules for managing mutual funds. This helped shape today’s asset management market by protecting investors and ensuring transparency.

Large financial institutions, such as J.P. Morgan, played key roles during this era. They professionalised asset management, creating systems that helped clients manage their wealth more effectively. The history of asset management truly took off during this time, setting the stage for future innovations.

After World War II, the global economy boomed. People were saving more, and pension funds became huge players in the asset management market. This era marked the rise of institutional investors, with pension funds, insurance companies, and mutual funds managing massive amounts of wealth.

Technological advancements also played a role. Computers helped automate many processes, and globalisation opened new opportunities for managing assets worldwide. This era saw the rise of both active and passive management strategies, with the introduction of asset-tracking systems and index funds like Vanguard’s famous product in the 1970s.

Index funds allowed investors to own a small piece of many companies, creating a simple yet effective way to diversify. This was a game changer in the history of asset management, making it accessible to everyday people, not just the wealthy.

The Use Of Spreadsheets

In the early 21st century, spreadsheets were mostly used for asset management. The concept was the same as it is today. In one column, a unique asset would be listed. Then, in other columns, asset information such as maintenance dates and depreciation costs would be added.

This was limited as it required a lot of manual input. Every time an asset would change location or status, the asset register would become out of date.

Therefore, in the early days of modern asset management, a few gaps appeared. The risk of ghost and zombie assets was heightened as there was difficulty in controlling an asset register and keeping it accurate and up to date.

But in the near future, computers will start to revolutionise asset management. Algorithmic trading, robo-advisors, and data-driven strategies took off. Spreadsheet vs cloud-based software became a key debate as companies moved towards cloud-based platforms for greater flexibility and efficiency.

The Creation Of Asset Management Software

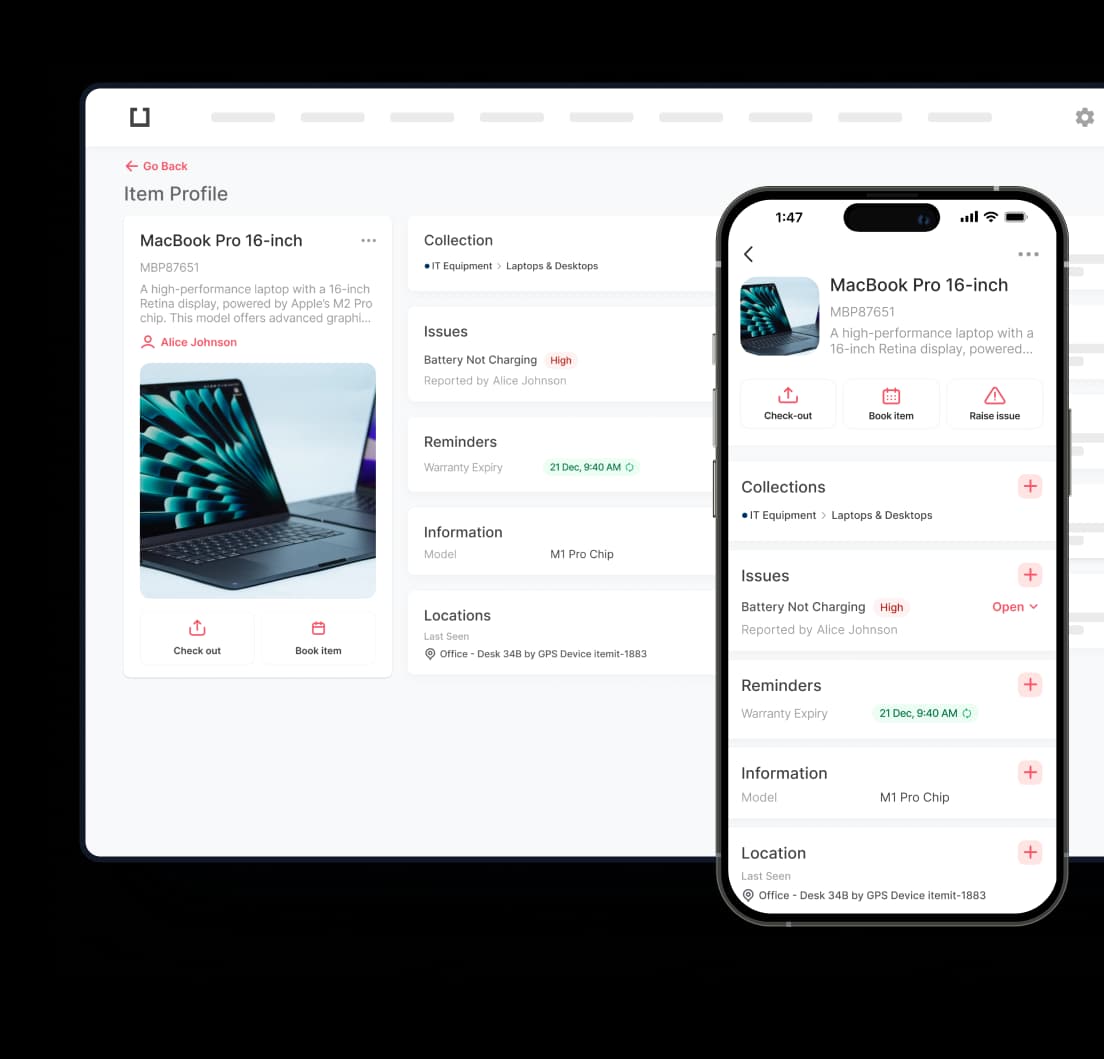

The gaps spreadsheets created provided a need for a better system. As smartphones and shareability entered the centre stage in the 21st century, the ability to create a better, more automated system also arose.

This led to the introduction of asset management software.

With asset management software, the concept remained that unique assets would need to be tracked and managed and monitored. The software itself only created the ability to add more features and automation to this procedure.

For example, with the development of the barcode, more automation was possible. Asset tags in the form of QR codes and barcodes could then be used to link unique asset profiles on software with physical assets.

This also allowed for last-seen location tracking and the ability to quickly open and edit asset information.

Current Trends in Asset Management

New trends like ESG (Environmental, Social, and Governance) investing help to define the asset management market nowadays. Emphasising sustainability and social impact, more people are seeking moral approaches to invest their funds. This change has generated increasing demand for asset managers able to match investments with personal values.

Moreover, artificial intelligence is increasingly involved in portfolio management since it provides more exact and tailored solutions. Concurrently, distributed finance (DeFi) is becoming popular and using blockchain technology to let individuals independently manage assets, so subverting established banking systems.

Examining the history of asset management makes one realise how fundamentally the discipline has changed. From prehistoric societies to the digital era, asset management has always changed to fit new financial environments, increasing accessibility, efficiency, and ethical relevance.

The Future Of Asset Tracking

More and more features have been added to asset management software since its creation. Now it’s much easier and quicker to audit assets and verify that they’re in the correct place and have the correct financial data.

This will continue to grow, creating more automation and shareability. As asset management software is shareable and cloud-based, any changes made by someone will be updated across the board. More helpful features will improve the way that this works.

Also, there will be more automation through emerging technologies. Fixed RFID asset tracking is innovative and relatively new, but it is expected to become ubiquitous in the future. Therefore, asset audits will require no manual input.

To find out more about how itemit’s asset management software can help you track your assets, you’ll be able to book a demo using the button below.