Asset management compliance is at the heart of an efficient and accountable enterprise. To the head of any business or an asset manager, every piece of equipment, software, and resource must adhere to the relevant set standards and regulations. Whether asset compliance management or auditing standards, the notion of compliance serves to minimise risks, avoid huge fines, and allow for smooth operations. The benefits range from saving your organisation from legal headaches to efficiently using your assets and ensuring employees are safe.

This comprehensive guide covers asset management compliance, different compliance standards for various types of assets, and ways to build a strong compliance strategy. We'll also explore the risks involved and how to handle them effectively. Upon completing this guide, you will know exactly how to simplify your compliance processes, protect your organisation, and increase the value of your assets.

What Is Asset Management Compliance?

What is asset management compliance? It is a question for many businesses in these changing times, with increased regulation and development in technology. Simply put, asset management compliance is the process of bringing all assets—physical, financial, and digital—to the level of standard set by the industry or the government regulations laid out. This would involve asset monitoring, protocols set for their control, and periodic checks to ensure everything is compliant.

Asset management compliance is a necessity in today's business environment. Meeting auditing standards by a firm is quite important to ensure that everything from laptops to heavy machinery is properly accounted for and maintained. Compliance isn't about following the rules. On the contrary, it's about adding value to the business through proper stewardship of company resources. Think of it as a continuous asset audit that keeps your business efficient, competitive, and ready for financial audits.

Further, asset management compliance would build transparency and accountability in an organisational system where properly documented and maintained assets show a clear picture of the company's financial health, support effective decision-making, and make sure that all stakeholders are well-informed. Further, it helps meet the demands made by external audits, avoid potential penalties which could be imposed by the concerned authorities, and maintains its good reputation in the industry.

Asset Types and Their Compliance Requirements

Different types of assets come with distinct compliance requirements. Let's break down each asset type and explore their specific regulations and best practices.

Fixed Assets Compliance

Fixed assets compliance refers to the compliance standards for physical assets like machinery, buildings, or vehicles. These assets must meet safety standards, maintenance schedules, and depreciation reporting requirements. A unique feature of fixed assets compliance is their physical nature, which requires regular inspections to ensure both functionality and safety. It’s not just about keeping things running; it's about ensuring equipment safety and compliance in a way that prevents any hazard.

Fixed assets also need to adhere to regulatory standards related to financial reporting, which affects the company’s balance sheet. Ensuring compliance for fixed assets includes tracking depreciation, maintenance history, and inspections to avoid costly breakdowns and maintain accurate financial data. One of the major best practices for fixed asset compliance includes implementing preventative maintenance schedules that reduce downtime and extend the life of an asset. Again, routine maintenance not only achieves compliance but extends equipment life, hence assuring maximum return on investment.

Fixed assets also usually involve legal compliance regarding property ownership, environmental regulations, and safety standards. To this end, firms should be concerned with maintaining proper permits on file, environmental impact assessments, and updated safety records regarding potential industrial regulations.

Cloud Asset Compliance

The rise of cloud computing has introduced a whole new category: cloud asset compliance. Cloud assets include digital services, virtual machines, and databases that are hosted online. Ensuring compliance for cloud assets can be a bit more challenging due to the nature of data security, remote access, and different regional regulations.

To achieve cloud compliance, companies must implement best practices like data encryption, regular audits, and access controls. Cloud providers are also liable to face many other kinds of certifications, like ISO standards, which need constant updating. An organisation should ensure that it comprehends and meets such requirements to prevent data breaches that may lead to leakage and loss of data privacy.

Another challenge with cloud asset compliance is in interpreting the shared responsibility model. Compliance responsibility in cloud settings typically falls on both the provider and the customer. Companies should make crystal clear who bears these responsibilities and how they will work with cloud providers to ensure data security and user access. Moreover, this compels businesses to establish strict mechanisms in handling data across multiple jurisdictions where data are involved, especially in relation to international data privacy laws like the GDPR.

Digital Asset Compliance

The term digital asset compliance covers everything from software licenses to intellectual property. Software licensing is a huge part of this compliance category, as the fines involved for unauthorised usage can be considerable. Digital assets also need to comply with data protection laws such as the GDPR or CCPA. What one tries to do here is lock in the data, license items correctly, and attain transparency into the digital resources.

Digital compliance involves monitoring licensing agreements, providing access to sensitive data only to those authorised to do so, and updating digital assets regularly to protect against vulnerabilities. The company should document all digital assets. Software inventories should be up-to-date, with users' permission, and all software and data should be patched and updated to maintain safety from cyber threats.

Data integrity can also form another face of digital asset compliance, whereby business entities are supposed to apply measures that guarantee all digital data is accurate, consistent, and safeguarded against unauthorised modifications. This can, to a certain extent, be one aspect of the complete digital compliance strategy, one which avoids breaches and ensures sensitive information remains intact, applying access control, data encryption, and multi-factor authentication.

IT Assets Compliance

This would include computers, servers, network equipment, and any other infrastructure used by IT. The IT assets should comply with data security standards, software licensing agreements, and maintenance protocols. Compliance for IT assets ensures that all software is licensed, hardware is well-maintained, and data is kept secure from any potential threat of cybercrime.

Organisations may ensure their compliance with IT assets through periodic audits to track inventories, regular software patch updates, and deployment of cybersecurity controls such as firewalls, antivirus software applications, and data encryption. Compliance management shall also be supported with the aid of software compliance that manages IT assets concerning notifications for impending license renewals or requirements about system maintenance.

Compliance, in terms of IT assets, is part of asset lifecycle management. This ranges from procurement to decommissioning. Proper disposal of IT assets, including the wiping of data from hard drives, is critical in securing that laws concerning data protection are complied with and unauthorised access to sensitive information does not occur.

Intangible Assets Compliance

Intangible asset compliance refers to assets that are not physical in nature. For example, intellectual property, trademarks, patents, and goodwill. For this class of assets, compliance would mean maintaining adequate records, updating renewals when due, and protecting the organisation's rights concerning its intellectual property.

For sustaining this compliance in case of intangibles, a system of tracking the dates of renewals should be instituted regarding patents and trademarks. Non-compliance within the prescribed time results in loss of rights, which may prove highly detrimental to the business. Compliance offers protection against infringement by third parties through legal action or monitoring tools.

Intangible assets similarly need to be correctly valued and booked for financial reporting. Correct valuation and accounting are quite important in ensuring that financial standards are met and clear views are given concerning the company's financial health.

Human Resource Assets Compliance

Compliance with human resource assets is in a league of its own. Specialised processes are required to maintain compliance with labour laws, health and safety regulations, and employment standards. Employees are normally considered one of a firm's best assets, and managing compliance in terms of these assets becomes an important concern for any organisation seeking a healthy and productive workforce.

Other human resources compliance includes minimum wage laws, working hours, health and safety standards, and non-discrimination policies. It also involves maintaining current employee certifications and training where such an industry requires a certain qualification.

It is also worth noting that an organisation should adopt a method of protecting its employees' private data. This ensures adherence to the data protection law when handling sensitive information involving social security numbers, health records, or personal contact details. Compliance in human resource management not only helps avoid any legal penalties but also contributes to the satisfaction and retention of employees.

Creating an Asset Management Compliance Strategy

Compliance doesn't happen by accident; it requires a strategy. Below are listed some of the steps and key components you need to develop to achieve an effective compliance strategy.

- Compliance Objectives Definition: Establish what you must comply with in terms of industry regulations, internal policies, legal standards, and so on. This way, it will be easier to understand your compliance objectives.

- Asset Audit: Conduct an initial asset audit to identify all assets and their current compliance status. This must include physical, digital, and cloud-based assets. An asset audit forms a baseline that helps understand what must be done to achieve compliance while also tracking improvements over time.

- Asset Management Compliance Checklist: Design an asset management compliance checklist with action items like frequent audits, updating maintenance records, and verification of software licenses to ensure the continuity of operations and a couple of items on the docket just to make sure something is not left out.

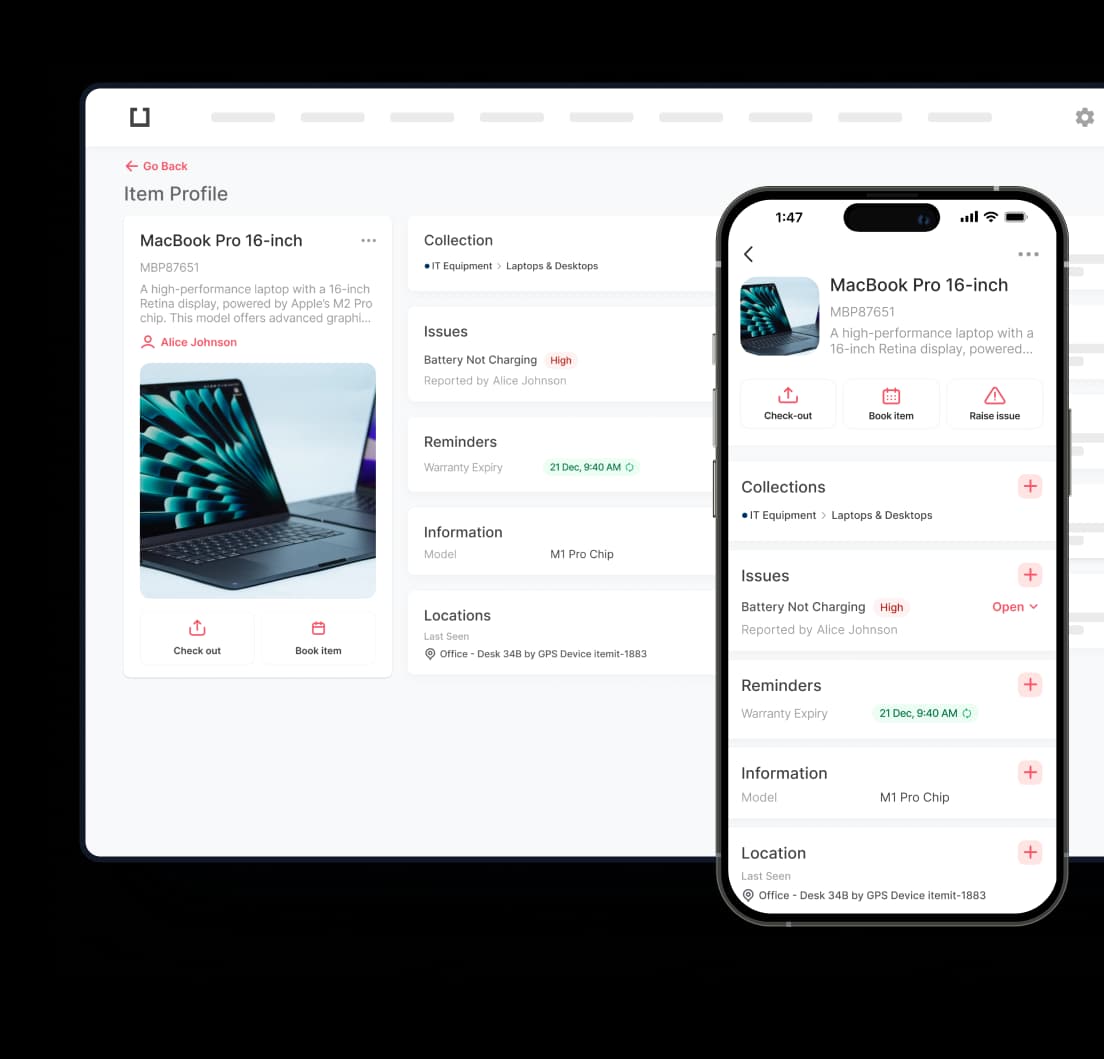

- Deploy Asset Management Compliance Software: Through asset management compliance software, the process of compliance will be smoother. The software will track assets, audit schedules, and reports. For advanced compliance software solutions, there is an added advantage in that they generate immediate alerts on non-compliance issues for immediate corrective action.

- Ongoing Training: Your compliance program should provide regular training for the staff to make sure that everyone is on the same page regarding compliance requirements. Compliance is a team effort, and informed staff can avoid accidental non-compliance. Training sessions also need to be updated regularly to reflect any changes in regulations and/or internal processes. Engagement of staff through workshops, online courses, and scenario-based training helps to set compliance into the organisational culture.

- Establish Roles and Responsibilities: Define and establish clear roles and responsibilities regarding who is responsible for different aspects of asset compliance. Roles assist in bringing about accountability, ensuring that each and every task of compliance has an owner who manages it. A compliance officer or an asset manager can oversee the entire process and offer a contact point regarding any compliance issues.

- Record Keeping and Documentation: Proper documentation can also achieve due diligence. Maintain comprehensive records regarding asset audits, compliance checklists, training programs, and follow-up actions taken thereafter. These might become very handy in case any audit takes place and may prove of immense help in establishing your company's sincerity in complying with the laws.

Compliance Risks in Asset Management

Identifying Compliance Risks

Some of the more common causes of compliance risks in asset management include poor record-keeping, non-updated software, and failure of tangible assets. For example, if one fails to track the asset lifecycle, there can be a chance for wrong depreciation, which will directly implicate financial reporting.

- Poor Recordkeeping: The huge risk involved here is that the organisation does not refresh the asset information from time to time. Without that, the organisation runs the risk of non-compliance due to a missed maintenance schedule, an expired software license, or even physical deterioration of an asset. This may further lead to differences at the time of audits or even attract penalties.

- Vendor Management: The other risk could relate to vendor management. In cases where there are third-party cloud or digital asset vendors, one ought to ensure his vendors are also compliant with the relevant regulations. Therefore, vendor compliance assessments should be part of your compliance strategy to minimise risks which may actually come from third-party service providers.

- Unannounced Compliance Audits: Companies should be equally prepared even for unannounced compliance audits. Regular internal audits and readiness assessments should be performed to prepare themselves. Surprise internal audits assist in finding the gaps in compliance before an outside auditor does, thus saving you from a compliance event or penalty.

- Dynamic Regulations: The organisation should also remember that regulations are dynamic in nature. Laws and standards that touch on data privacy, environmental impacts, and asset safety change daily. This calls for eternal vigilance, whereby monitoring needs a compliance team or officer to implement revised regulations if needed.

Strategies to Minimise Compliance Risks

In particular, to minimize compliance risk in the asset management area, businesses should take advantage of IT asset management software that tracks not just the assets but also their compliance with a standard. This includes updating documentation, periodic checks of auditing standards, and ensuring digital assets are secured. It prevents early identification and resolution of compliance risks of business disruption and penalties; hence, it's a very important aspect of the asset management process.

- Regular Training: Another key strategy involves regular staff training. Well-informed employees know how to recognise and mitigate compliance risks well before they can escalate. These training programs should include compliance protocols, new regulations, and updates on internal procedures. Understanding one's role in compliance helps reduce human error, one of the leading causes of non-compliance.

- Documentation and Recordkeeping: Strong documentation and good recordkeeping also aid in mitigating compliance risks. The detailed record of asset history, maintenance schedules, and compliance-related activities contributes to an audit trail that happens to be quite useful during external audits. Proper documentation will ensure that you are able to demonstrate adherence to compliance standards and will help speed up discrepancy resolution.

- Stringent Internal Controls: Besides all these, it will also be important for the businesses to establish stringent internal controls. For internal controls to be in practice, regular audits and checks for compliance would be required. Internal controls determine your weaker points inside the compliance processes and guarantee that corrective steps are taken without wasting any further time. Companies can invest in compliance management tools with real-time alerts and reporting capabilities to stay one step ahead of compliance issues and take immediate action in case such a need arises.