Organisations that hold assets on their records must be realistic about their business environment, which is bustling today, particularly in the long run. An asset audit is a crucial process that helps businesses maintain control, optimise performance, and comply with regulatory standards. Whether you are managing a small start-up or leading a big corporation, knowing how to conduct an asset audit effectively will go a long way in determining the financial health of your organisation. This guide outlines the steps for carrying out an asset audit. By the end, you will have the insight and tools necessary to run an asset audit that not only ensures compliance but also adds value to your business.

What is an Asset Audit, and Why Is It Important?

An asset audit is a structured process to verify the existence, condition, and value of a company’s assets. It serves as a critical tool for ensuring that financial records reflect the firm’s array of assets. It involves understanding what is really held by a business and that all those assets work to their best abilities.

The asset audit meaning goes beyond mere inventory. It identifies inefficiencies, potential risks, and examines whether all the assets are properly accounted for in the financial statements. This is where a good asset audit may point out inefficiencies — be it underutilised equipment or record discrepancies — that can actually generate cost savings and better asset management.

However, taking an asset audit can be challenging. How to maintain a fixed asset register in the right way? Such challenges include accounting and keeping track of assets spread over several locations, ascertaining the value of an asset that is sure to have depreciated over the years, and updating all records. Businesses should, therefore, adopt a well-structured approach, utilising modern tools that will make auditing less of a chore. Knowing how to audit assets effectively can make all the difference in maintaining accurate financial records and making sound business decisions.

How to Conduct an Asset Management Audit: A Detailed Checklist

An asset management audit is a fundamental process that provides the effectiveness of a company’s asset management practices and their conformance to internal policies or regulatory standards. It involves reviewing the procedures and controls in place for managing assets throughout their life cycle.

Most importantly, an asset management audit checklist needs to be drawn up, covering each of the following areas in detail:

- Asset Identification: Ensure that all assets are correctly identified, tagged, and recorded in the asset management system.

- Asset Valuation: Verify that assets are valued accurately, considering depreciation, market value, and any impairment.

- Asset Utilization: Assess whether assets are being used efficiently and effectively to support business operations.

- Compliance: Review asset management procedures to ensure they comply with relevant laws, regulations, and internal policies.

- Risk Management: Identify and assess risks associated with asset management, including potential losses or obsolescence.

- Asset Disposal: Confirm that there are proper procedures for disposing of assets that are no longer needed or have reached the end of their useful life.

During the audit, it is also important to validate the accuracy of records related to the assets. This involves physical inspection of assets to identify their existence and condition, cross-referencing records, and ensuring all associated documentation is up-to-date.

Best practices for asset management internal audit include periodic reviews of asset records, maintaining a strong tracking system, and training on the best asset management procedures. By adhering to a systematic audit program, businesses can avoid costly mistakes, enhance efficiency, and ensure assets are managed to support long-term growth.

Why Auditing Intangible Assets Is Essential for Business Valuation

Intangible assets such as patents, trademarks, goodwill, and intellectual property are becoming increasingly relevant in today’s business climate. Conducting an audit of intangible assets is one avenue toward giving the truest values in a company’s financial statements.

Auditing intangible assets can be contentious due to the difficulty in determining their value, as they lack physical substance.

Below, we find the steps required for auditing intangible assets:

- Identification: Identify all intangible assets, whether acquired or internally developed.

- Valuation: Determine the value of each intangible asset. This is often a tricky process and requires technical knowledge and the application of methods such as discounted cash flow analysis or market comparison.

- Amortisation and Impairment: Review and verify the amortisation schedules of intangible assets and determine whether impairment has occurred that necessitates a write-down of the asset’s value.

- Documentation: Ensure all documentation related to intangible assets, like patents or licenses, is complete, actual, and correctly filed.

Proper valuation of the assets is crucial, especially for business valuation purposes, acquisition or fundraising activities. Other critical audit areas for intangibles include market conditions, potential future earnings, and the remaining useful life of the intangible asset.

A systematic approach to auditing intangible assets will help businesses manage, report, and maximise the value of such important assets.

A Step-by-Step Guide to Auditing Fixed Assets

For any business, fixed assets comprise massive investments in the form of buildings, machinery, and vehicles. A thorough audit of fixed assets ensures they are properly recorded and well maintained to protect the financial integrity of the company and operational efficiency. Since fixed assets are long-term investments that are not easily convertible to cash, proper record-keeping and regular auditing are essential for any business.

Step 1: Fixed Assets Identification and Tagging

The first step in fixed asset inventory is to ensure proper identification and tagging of all such assets. Unique identification numbers are assigned to each of the existing assets, which are then logged in a fixed asset register. The asset register should contain details such as purchase date, cost, location, and a description of the asset.

Technology Tip: Use fixed asset software for an automated tagging process. Advanced systems can generate barcodes or QR codes, which are easy to scan and identify, highly reducing potential human error.

Best Practice: The register should be periodically checked, and all new assets acquired should be registered. Those that have been disposed of or have become obsolete should be removed from it.

Step 2: Checking of Existence and Condition of Fixed Assets

There has to be a physical verification of the existence and condition of the assets immediately after the identification and tagging of all assets. This step is very important because it identifies all discrepancies between the recorded information and the actual assets. During this process, auditors have to look at every asset to check that it actually exists, is still in use, is in good condition, and is located where it is supposed to be.

Organise teams to conduct a physical inspection of all fixed assets. The identification numbers or tags will help reconcile the physical asset with the records.

Condition Assessment: Assesses the physical condition of each asset, which will help in judging the need for repairs, replacements, or disposals. Note any indication of wear, tear, damage, or obsolescence.

Audit Checklist: Create a comprehensive checklist of parameters to be inspected, including maintenance logs, safety compliance certificates, and operational status reports.

Step 3: Valuation of Fixed Assets

Proper valuation of fixed assets is essential in keeping financial records because it ensures reliability. In valuation, the original purchase price, calculation of depreciation, impairment, or appreciation based on market conditions, and upgrading an asset are considered.

Methods of Depreciation: Apply the most appropriate depreciating method for each asset. The different methods include the Straight-Line Method, Declining Balance, and Units of Production. Apply a method suitable for the accounting standards to accurately reflect the useful life of assets.

Revaluation: Circumstances may require the revaluation of the assets. Mainly, this will be where there have been significant improvements or market conditions have radically changed.

Market Comparison: For some assets, particularly real estate, a market comparison must be performed to ensure that the values accounted for are in line with current market prices. This may involve consulting real estate appraisers or referencing independent data sources.

Impairment Testing: Determine whether any fixed assets are impaired. An impairment exists if an asset carrying amount is higher than its recoverable amount. If impairment is identified, write down the value of such assets appropriately in the books.

Step 4: Reviewing and Applying Depreciation

Depreciation is a critical aspect of fixed asset management, as it shows the asset’s declining value over time. A properly conducted audit will review the methodology for calculating depreciation and verify the use of methods consistently applied and correctly calculated for all assets.

- Consistency Check: The depreciation method adopted shall be consistent for similar types of assets. Inconsistency leads to inaccuracy in financial statements, impacting decision-making.

- Useful Life Assessment: Reassess periodically the useful life of assets. The depreciation schedule shall be altered if the usefulness of an asset is forecasted to last longer or shorter than it was originally estimated.

- Residual Value Review: Residual value is the value that an asset will be worth at the end of its useful life; it should be reviewed periodically. This step helps in making proper calculations of depreciation.

Step 5: Documentation and Record-Keeping

Effective and detailed record-keeping is at the heart of a fixed asset audit. Proper documentation allows for compliance with law and accounting provisions while supporting various decision-making processes.

- Audit Trail: Ensure that all transactions related to fixed assets are clearly properly documented and traced, from acquisition through depreciation to disposal. Keep all relevant documents, such as purchase invoices, contracts, maintenance logs, and disposal records.

- Regular Updates: Update the fixed asset register periodically to reflect changes in status, value, and location. The implication is that the records will be up-to-date and accurate at all times.

- Digital Records: Consider relocating to digital record-keeping systems if you haven’t already done so. Cloud-based asset management software will provide easy access, advanced security features, and automatic updates, minimising the risks of errors or loss of information.

Step 6: Addressing Discrepancies and Reconciliation

During an audit, discrepancies between physical assets and records may arise. It is essential to deal with these variances to ensure correct records and protect the integrity of the finances.

- Reconciliation Process: Physical asset inventory and fixed asset register for audits should be compared. Any discrepancies, such as missing assets, being in the wrong locations, or wrong valuations, must be recognised.

- Investigate Discrepancies: Find out the cause of discrepancies. It may be a result of data entry errors, disposal not recorded, or even theft. Proper investigation into these matters will prevent further errors and losses in the future.

- Adjusting Records: The identified discrepancies should be investigated, and appropriate records should be adjusted accordingly, such as updating the asset register, depreciation schedules, and reporting of losses.

Step 7: Reporting and Compliance

The final step in the fixed asset audit process is to consolidate all findings into a detailed report. This report should outline discrepancies, provide recommendations for improvement, and confirm that all assets have been accounted for and valued correctly.

- Audit Report: The report should include an executive summary, detailed findings, and actionable recommendations. It helps management understand the current status of fixed assets and make meaningful decisions.

- Compliance Review: Ensure that audit findings adhere to all applicable accounting standards and regulatory requirements. This may require reviewing by financial experts or legal advisors.

- Follow-up Action: In case of submission of the audit report, the recommended actions need to be performed thereafter. It could be in the area of bringing changes to asset management policies or upgrading record-keeping practices; sometimes, it involves scheduling follow-up audits to maintain compliance.

The Strategic Importance of a Thorough Asset Audit

While an asset audit may be a statutory requirement, it serves a broader strategic purpose. It offers valuable insights into your business’s financial health and operational efficiency. A well-executed audit covering all types of assets, from fixed and tangible to intangible and intellectual property, ensures that your business remains compliant, efficient, and poised for growth.

Adopting best practices in asset management auditing enhances the accuracy of your records, reduces risks, and optimises the use of resources. When approached strategically, conducting an asset audit becomes an opportunity to strengthen the core of your business and set the stage for long-term success.

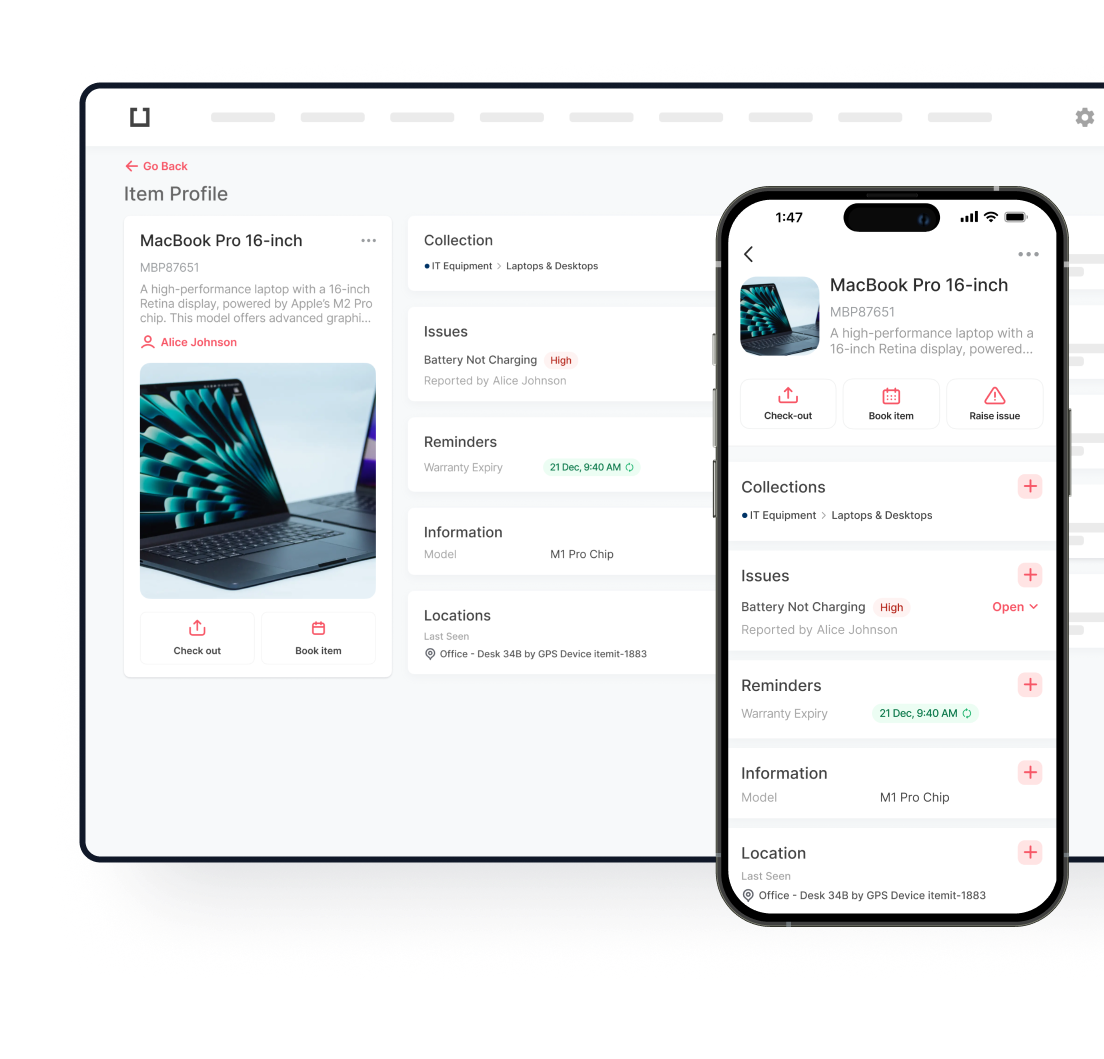

Try itemit

Choose a better way to track

your assets.

Start your free 14-day trial now!

Keep Learning

itemit Blog

Tips, guides, industry best practices, and news.

How to Keep Track of Computer Inventory

Keeping track of all of your computer inventory isn’t easy. Read this article now to learn how to make computer inventory management work!

How Do You Prepare An Asset Register?

Asset register apps can be beneficial to businesses as they can help owners to keep control of their assets. Read this article to find out more!

How Does Asset Tracking Software Save Your Business Money

The right asset tracking software can help to save your business money in a variety of ways. Read this article to find out how!