Discover what Active RFID is, how active tags function, and the key benefits and use cases that make this technology essential for modern tracking systems.

Given the high cost, it is a priority to maximise the return on your valuable assets. The difficulty lies in finding the ideal equilibrium: not using resources enough can save assets but hurt efficiency, and using them too much can lead to quicker deterioration and increased maintenance expenses.

It is essential to manoeuvre this delicate balance carefully. This is why innovative companies use asset utilisation metrics to measure usage and find effective strategies for improvement.

Asset utilisation is a critical business aspect in a variety of industries, such as manufacturing, healthcare, real estate, and supply chains. The goal is to optimise utilisation of resources and effectiveness, extending beyond tangible assets to encompass a company's resources such as technology and staff.

The aim is to utilise all resources in a manner that is both economical and environmentally friendly. Technology is a valuable tool that heavily contributes to reaching this objective using contemporary, sophisticated instruments for immediate asset oversight. This involves predicting the need for assets and avoiding interruptions by planning maintenance in advance.

In this manual, we will outline a comprehensive method for assessing asset usage and provide five successful tactics to enhance it, enabling you to maximise the efficiency of your assets.

Key Points:

- Asset utilisation evaluates how efficiently and effectively an organisation utilises its assets, striving for the ideal equilibrium between maximising productivity and preventing excessive use. This measure is crucial in many industries and includes more than just tangible assets, incorporating human resources, intellectual property, and software programs.

- Determining asset utilisation includes evaluating the hours of operation compared to periods of downtime, which includes scheduled and unscheduled maintenance, quality defects, and inefficiencies in production rates. Companies use software programs for precise, automated computations and surveillance, enabling immediate observations, pattern examination, and enhanced upkeep planning.

- In addition to asset utilisation, OEE, product yield, maintenance spending, and unplanned downtime are important performance indicators that offer a more comprehensive perspective on operational efficiency. These measurements are useful.

- Effective asset management strategies involve thorough fixed inventory assessments, maintenance process optimization, investment in high-quality equipment, focused employee training, and the use of asset tracking software.

What Is Actual Asset Utilisation?

Although high asset utilisation levels signal that assets are being optimised to create value, striving for a utilisation rate nearing 100% may backfire, indicating possible overuse and neglected maintenance.

This measurement can be used for different assets in a company, such as machinery, vehicles, and IT equipment, providing a comprehensive evaluation of resource utilisation for meeting business goals. Basically, real asset usage gives an understanding of identifying the perfect balance between maximising utilisation and preserving asset integrity.

Different Types of Assets

Asset utilisation goes beyond just machinery and equipment to include intangible assets that are considered essential by different sectors. Below are the types of assets, along with how asset utilisation can be relevant to each category.

- Human resources: They are a valuable asset in service industries such as consulting. Measuring asset utilisation involves considering metrics like employee productivity and billable hours. Maximising productivity and efficient use of time can have a direct impact on a company's financial performance.

- Intellectual Property: It includes non-physical assets such as patents, trademarks, or copyrights. In a pharmaceutical company, the implementation of a patented drug formula in production can have a substantial effect on profits. Assessing and improving how assets are used in this situation could result in higher profits from intellectual investments.

- Software applications in IT: They go beyond the physical hardware and function as deployable assets within the IT infrastructure. The use of valuable software is frequently analysed to ensure the highest possible value is obtained. Utilising metrics like "active users divided by total users" for a resource planning system can provide insights into application usage, improve deployment strategies, and achieve a higher return on investment.

Significance of Asset Utilisation

Maximising asset utilisation is crucial for reaching peak efficiency. This enables businesses to be both cost-efficient and environmentally-friendly in the future. Businesses can achieve cost savings and increased productivity by maximising assets, leading to improved profitability.

Additionally, efficient utilisation of assets can decrease a company's environmental footprint, aiding in its corporate social responsibility initiatives. Companies can reduce their environmental impact by utilising resources efficiently and avoiding excessive waste. Therefore, directing attention towards effectively utilising assets can support the alignment of business operations with sustainable practices and fulfil social responsibilities.

By the close of the day, optimal asset utilisation doesn't only benefit a company internally but also impacts its competitiveness. Businesses that excel in leveraging their assets can improve their market position. However, companies that fail to optimise their assets may lag behind more effective competitors, potentially damaging their market position.

What You Should Know About Asset Utilisation Calculation

In order to accurately provide utilisation calculation, start by finding the yearly operational hours (8,760 hours) and deducting the machine's downtime hours. If your asset is not being used for 3,000 hours each year, its utilisation would be around 65%, calculated by subtracting 3,000 from 8,760, resulting in 5,760 hours of use. To better analyse and find areas for improvement, categorise the downtime into specific groups.

Start with Scheduled Yearly Downtime

Annual scheduled downtime is the time when equipment is planned to be offline each year for maintenance purposes. Although reducing this downtime is important, taking a proactive stance on maintenance can improve the overall use of assets.

Picture a factory running an essential machine that needs 200 hours of maintenance every year, as per the maintenance schedule. Maintenance periods are scheduled for times of reduced productivity, such as holidays or weekends, to minimise impact.

Determine the Amount of Time Lost Due to Operational Disruptions

This includes times when equipment is not in use outside of scheduled downtime, like holidays, extra maintenance stages, or changeover periods.

In addition to regular maintenance, the machines are also inactive on public holidays, amounting to 120 hours annually. Moreover, switching between product lines can take as long as 180 hours per year because of the intricate nature of changing manufacturing configurations.

Loss of Working Hours Due to Address Production

This scenario occurs when machinery is not used because of lower demand, supply chain problems, or decreased sales, resulting in lost working hours.

Imagine if the demand for the goods produced by this equipment changes seasonally. The machinery is not used for about 400 hours in total when demand is low. Furthermore, production was paused for 150 hours due to delays in raw material delivery caused by supply chain disruptions.

Integrate Unexpected Periods of Inactivity

Unplanned interruptions like equipment failure, breakdowns, or accidents causing production halts result in unscheduled downtime.

Even with regular maintenance, the equipment suffered two major malfunctions in the year, leading to 100 hours of unanticipated downtime for repairs.

Identify Losses in Quality

Quality losses occur when time is dedicated to producing products that cannot be sold. To measure, determine your product's yield and translate this percentage into the specific amount of time wasted. could be considered as nonproductive.

Quality control measures show that 15% of the products either require rework or are wasted, as the machinery maintains an 85% yield rate. 750 hours, or 15% of the total 5,000 hours of operation, are wasted on producing subpar products when the machine runs.

Complete the Utilisation of Real Assets

Adding up the hours from previous steps and deducting this total from the annual operational hours (8,760) will yield the true asset utilisation. Convert this into a percentage to easily understand the efficiency of utilisation. Incorporate this measure with additional KPIs like product yield, overall equipment effectiveness (OEE), and maintenance efficiency to enhance understanding of asset performance. These extra measurements can identify inefficiencies and lead to specific enhancements.

Additional Notes

Businesses are often interested in such seemingly simple questions as “Is utilities expense an asset?”.

Nonetheless, it is very important to know if you want cost management to be as effective as possible. So, are utilities expenses assets or liabilities?

Without a doubt, we can answer that they are categorised as operating expenses. Assets are resources owned by a business that provide future economic benefits, while liabilities are obligations the business must settle in the future. Utility expenses represent the cost of consumed services and are recorded on the income statement as part of the operating expenses, reducing the net income for the period.

Tracking Solutions and Asset Monitoring Capabilities

The benefits of implementing tracking tools can be very potent. They include:

- Enhanced Precision: Removes mistakes in inputting data and calculations.

- Further Examination: Combines with additional operational data for thorough performance assessment.

- Analysis of Trends: Recognizes patterns and possible problems in the long run.

- Proactive Maintenance Scheduling: Schedule maintenance according to real-time usage to minimise downtime.

- Broadening Asset Understanding: Additional KPIs for Asset Usage

How to Calculate Asset Utilisation? Asset Utilisation Formula

The asset utilisation ratio is a key metric that measures how effectively a company uses its assets to generate revenue. It is calculated by dividing total revenue by total assets. The formula is:

Revenue: This is the total income generated from the company's operations, including sales of goods or services. It represents the top line of the income statement and is a crucial indicator of business performance.

Total Assets: This includes all the company's resources expected to provide future economic benefits. Total assets are listed on the balance sheet and encompass current assets (like cash and inventory) and fixed assets (like machinery and buildings).

This ratio provides insight into how efficiently a company's assets are being used to produce income. A higher ratio indicates better asset utilisation.

Step-by-Step Calculation of Asset Utilisation Ratio

- Determine Total Revenue: Calculate the total income from sales or services.

- Identify Total Assets: Sum up all assets, including fixed, current, and intangible assets.

- Apply the Formula: Divide the total revenue by total assets.

Example Calculation

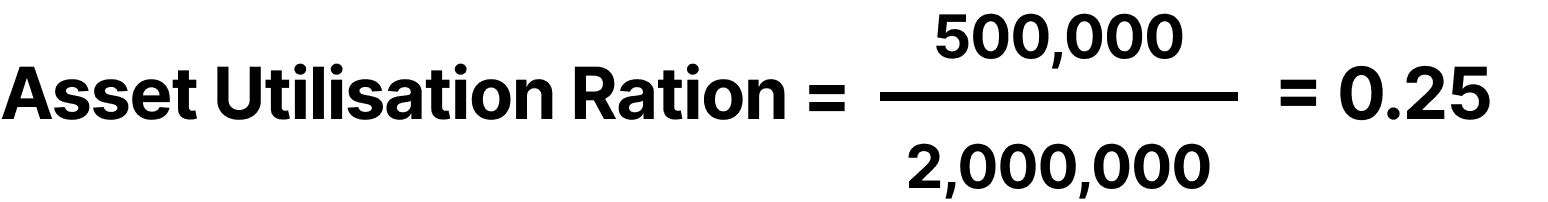

If a company generates $500,000 in revenue and has total assets worth $2,000,000, the utilization ratio would be:

This means that for every dollar of assets, the company generates 25 cents in revenue.

Asset utilisation ratios measure the efficiency of asset use by comparing the revenue generated against the total assets employed. These ratios help businesses understand whether they are making the most out of their resources. For example, if two companies generate the same revenue but one has fewer assets, the one with fewer assets has a higher utilisation ratio, indicating more efficient asset use.

Significance of Various Asset Utilisation Ratios

Different asset utilisation ratios measure can provide valuable insights into various aspects of asset efficiency:

- Fixed Asset Utilisation Ratio: This ratio focuses on the revenue generated from fixed assets like machinery and buildings. It helps in understanding how well the company is using its long-term investments.

- Current Asset Utilisation Ratio: This ratio measures how effectively a company uses its short-term assets, such as inventory and receivables, to generate revenue.

- Total Asset Utilisation Ratio: This provides an overall picture of asset efficiency by considering both fixed and current assets.

Understanding these ratios helps in asset monitoring and enables companies to conduct thorough asset audits. Regular audits ensure that assets are used optimally and highlight areas for improvement.

Regular monitoring and calculation of asset utilisation ratios are crucial for businesses aiming to maximise efficiency. These ratios provide a clear picture of how well assets are being used, guiding decisions on investments, maintenance, and operational improvements. Conducting regular asset audits and utilising these metrics can significantly enhance overall business performance.

Improving Your Asset Utilisation Ratio: Five Strategies

Improving asset utilisation requires grasping the idea and successfully executing techniques to guarantee the best outcomes. Implement these five tactics to enhance your asset utilisation ratios for a more streamlined and effective operation.

Perform an Evaluation of Assets to Establish an Inventory

Through performing an asset inventory, you have the opportunity to gather information regarding the whereabouts, status, and upkeep record of your equipment. This data enables the detection of patterns and trends to enhance asset utilisation.

Imagine a situation in which a manufacturing company realised that poor asset utilisation was affecting efficiency and driving up expenses. Through the analysis of their equipment usage, they pinpointed machines that were often idle or running with low efficiency. Asset utilisation was increased by modifying production timelines and introducing preventive maintenance initiatives. The outcome led to higher productivity, less downtime, and an improved return on investment.

Here is a straightforward tip for maximising asset utilisation: Utilise a spreadsheet or specialised asset-tracking software to build an asset inventory for improved inventory management. Having a comprehensive list aids in evaluating your resources and their effectiveness and proactively identifying possible problems.

After acquiring this inventory, utilise data analytics to extract insights that can determine real asset usage and boost profitability. The data-driven trends could provide insights into your maintenance records, personnel levels, and investments in new equipment.

Enhance the Procedures for Maintenance

Including scheduled maintenance is even more impactful. Develop a system in which you consistently check, replace, and adjust parts. Data analytics are essential in improving maintenance processes by offering a look at possible problems before they become more serious. It leverages information from different sources like machine sensors, operation logs, and maintenance records to predict equipment failures and recommend required steps.

An example is when sensors installed on a manufacturing machine track data points like temperature, pressure, and vibration levels. Analysing the gathered data can help identify patterns or irregularities. If the system detects an abnormal rise in vibration levels indicating a possible breakdown, it will prompt an alert for maintenance.

Begin by pinpointing essential equipment for implementing predictive maintenance within your operations. Following this, it is important to allocate funds for data-gathering technologies like sensors and IoT devices. Ensure you possess strong analytical software in order to understand the data gathered for forecasting insights. Keep in mind that many organisations may undergo cultural changes due to predictive maintenance. Therefore, stakeholders must understand its significance and analyse findings. It is important to have scheduled team meetings in order to review results and strategize for the future.

Purchase Equipment that is More Dependable

Purchasing updated, more dependable equipment might involve a substantial initial expense, but it has the potential to greatly enhance asset utilisation rates and increase your return on investment. When thinking about purchasing equipment, it's essential to take into account the overall cost of ownership (TCO), consisting of the initial purchase price, continuous maintenance expenses, downtime costs from equipment malfunctions, and disposal expenses. Nevertheless, it is not solely about the expenses. Considering how this new equipment can contribute to your business success is crucial, and this is where the ROI plays a crucial role.

For example, consider a company thinking about investing in a state-of-the-art CNC machine. Even though it is expensive at the beginning, it operates constantly with very little downtime. Advanced diagnostics enable predictive maintenance, which helps prevent unexpected stoppages and costs.

The firm can determine the ROI by measuring the rise in production, improvements in efficiency, and reduction in downtime. If the combined profit increase and reduced costs are greater than the total ownership cost within a reasonable timeframe, the investment is deemed justified.

Every company must consider both Total Cost of Ownership (TCO) and Return on Investment (ROI) when considering equipment utilisation or upgrades to ensure thorough financial evaluation. Continuously reassessing and adjusting asset utilisation strategies to align with changes in the business or technology environment is essential, as is monitoring for improved efficiency and waste reduction.

Allocate Resources for Employee Training and Professional Growth

Employees who are not proficient in operating your machinery can lead to lost operations time, unscheduled downtime, and quality losses.

Continuing education for your team is essential for getting the most out of your valuable fixed assets. When your employees have a thorough understanding of every machine, they can ensure peak operational performance and avoid expensive periods of inactivity.

Deploy Asset Monitoring Software

Asset tracking software is crucial for enhancing asset utilisation. It can play a crucial role in developing a definitive inventory evaluation.

Real-time tracking and analysis are two components of asset-tracking software that have a direct impact on how assets are used. They offer a constant view of your assets, making sure you are always informed of their location and usage.

Frequent assessments of your asset analytics reports should be incorporated into your management duties. These observations will enable you to identify trends and make educated strategic choices. If a specific asset is not used often, it may be more economical to rent rather than buy it. Through the utilisation of data analytics and continuous monitoring, you can effectively oversee how your assets are being used, leading to improved performance of your business as a whole.

Frequently Asked Questions

What is the Most Efficient Way to Determine Asset Utilisation?

Determine asset utilisation by dividing total revenue by total assets: Asset Utilisation Ratio = Revenue / Total Assets. Categorise downtime into sections such as planned maintenance, operational delays, and unexpected breakdowns. This thorough method assists in pinpointing inefficiencies and areas that need enhancement.

Is Utility Considered an Asset in Business?

No, utility expenses are not assets. They are operating expenses recorded on the income statement. Utilities represent costs for services like electricity and water, which reduce net income rather than provide future economic benefits.

What Measures Asset Utilisation?

The asset utilisation ratio measures how effectively assets are being used. Businesses can use the Revenue / Total Assets ratio to evaluate how effectively they are utilising their assets to generate revenue, reflecting their overall operational efficiency.

What Advantages Does Asset-Tracking Software Offer?

Asset tracking software boosts data precision, allows comprehensive performance evaluations with trend analysis, and aids in scheduling proactive maintenance. It offers live tracking and analytics, aiding companies in maximising asset usage, enhancing effectiveness, and cutting expenses.

What Steps Can Companies Take to Enhance Their Asset Utilisation Ratios?

Companies can enhance asset utilisation through regular asset inventories, predictive maintenance optimization, investing in dependable equipment, employee training, and asset monitoring software. These tactics guarantee effective asset utilisation, reducing idle time and enhancing efficiency.

What Is Active RFID? A Complete Guide to Smart RFID Tags

Everything You Need to Know About 2D Barcodes

Discover everything about 2D barcodes, including how they work, their benefits, and how they are revolutionizing industries and improving business operations

Complete Guide to Asset Lifecycle Management and Its Benefits

Learn about asset lifecycle management and how it helps businesses optimize asset usage, reduce costs, and improve efficiency throughout the asset's life.