Published on December 18, 2024 •

7 min read

Think of inventory as the silent force driving every product-based business. It’s what turns ideas into tangible goods, sitting ready to fulfil customer needs. Yet, inventory isn’t just “stock on hand”—it’s money tied up, waiting to move. And in the world of accounting, inventory is considered a current asset, which is no small deal.

So, what exactly is a current asset? Simply put, it’s anything a business owns that can be converted into cash or consumed within a year. The importance of this classification runs deeper than finance jargon—it’s a way to gauge how agile a business really is. With inventory sitting in this category, it reflects not only what a company owns, but also what it can do in the short term to stay competitive and liquid.

What Is Considered an Asset?

An asset is basically anything valuable that a business owns. This is the "what we've got" part of the equation. It's what keeps the business going, helps it grow, and lets it make money. Some assets are easy to see, like the money in your register or the laptops your workers use. Some aren't as obvious, but they're still important, like the logo on your shopfront or the patent for a product you designed.

Broadly speaking, assets fall into two categories:

- Physical assets are tangible things—things you can touch, move, or see. This could be your delivery vans, shelves stocked with products, or the building you operate out of. Even the desk you’re sitting at counts as an asset.

- Intangible assets are trickier to spot but just as valuable. Think about a brand’s reputation, intellectual property like patents or trademarks, or even software licenses. You can’t hold them in your hands, but they’re powerful drivers of business value.

Within these categories, we get even more specific, and this is where current assets come into play. These are assets a business expects to turn into cash—or use up—within a year. This is important because current assets show how quickly a business can respond to immediate expenses, like paying suppliers or covering operating costs.

Inventory Classification in Accounting

Any company based on products depends on inventory as its lifeblood. Inventory keeps operations running ahead, whether it's completed goods ready for sale or raw materials just waiting to be fashioned into something valuable. Without it, sales freeze, manufacturing pauses, and a company's expansion finds a dead end.

Inventory in accounting is the term used to describe items owned by a company just for use or sale in manufacturing. But inventory is not only one large heap of goods; it is well classified into three main categories:

- Raw Materials: These are the starting point—the basics. Think about rolls of fabric for a clothing brand or flour in a bakery. They’re the first step before a product becomes anything meaningful.

- Work-in-Progress (WIP): These are halfway there. A table that’s been sanded but not varnished or a car on the assembly line waiting for its final parts—WIP inventory is mid-production, not quite ready to hit the shelves.

Finished Goods: The final product. Ready to sell, ready to ship, ready to bring in revenue.

On the balance sheet, inventory is classified as a current asset because it’s expected to turn into cash within a year. This makes it essential for short-term financial stability. While assets like equipment or buildings stick around for years, inventory is constantly moving—bought, processed, and sold. That quick movement is what keeps cash flowing and operations humming along.

Many times, companies use an asset register, a tool that tracks inventory and value, to properly control this. This guarantees nothing slips through the gaps—no missing stock, no falsified statistics. Ultimately, inventory is more about what those shelves mean for the company's bottom line than it is about what is on the shelves.

Correct classification and tracking of inventory gives leaders a clear picture of the short-term situation of a company, guiding their decisions on sales strategies, manufacturing, and expenditure.

Examples of Current Assets

The resources a company expects to use, sell, or convert into cash within a year are known as current assets. They are the resources maintaining operations, paying bills, and lights on. Businesses lose their capacity to react fast to temporary needs or opportunities without them.

These are the most often used examples of current assets together with their real meaning:

- Cash and Cash Equivalents

A company can have this most liquid asset. It covers actual cash in hand, money in bank accounts, and almost instantaneous investments like treasury bills. Just a moment's notice will find it ready for use.

2. Accounts Receivable

Money that customers owe to the company. For instance, accounts receivable shows the payment you are still waiting for but should soon be collected if you sold a good on credit.

3. Inventory

Inventory represents goods a business holds for sale or production. This includes raw materials, work-in-progress products, and finished goods inventory—the final products ready to ship to customers. Because these goods are expected to generate revenue within the operating cycle, inventory is a current asset.

4. Short-Term Investments

Investments that a business plans to cash out or sell within the year—things like stocks, bonds, or other marketable securities. They’re liquid but also earn a little extra return in the meantime.

5. Prepaid Expenses

Payments made upfront for things like rent, insurance, or subscriptions. While these don’t turn into cash, they’re considered current assets because they provide value in the short term

6. Supplies

Office materials, packaging supplies, or factory stock used in daily operations fall into this category. They’re consumed quickly and help keep processes running smoothly.

In short, current assets are what keep businesses agile and financially secure. They help pay short-term debts, fund operations, and provide breathing room when unexpected costs pop up. Without them, a business might have valuable assets but no ability to cover immediate expenses—and that’s where problems start.

Understanding Liquid Assets

Liquid assets are those things you could rapidly turn into cash without appreciably losing value. Simply said, they are the resources a company can grab practically right away to pay debt, cover costs, or grab unanticipated prospects. Liquid assets differ from other asset forms in their capacity to "turn into cash fast".

Cash is the ultimate liquid asset—it is already in its most usable form. Because it can be sold quickly, usually within days, and with little to no loss in value, other assets—stocks or short-term bonds—are also said to be highly liquid.

Now, how does inventory compare? Inventory is classified as a current asset, but it isn’t always as liquid as cash or accounts receivable. Here's why:

- Conversion Time: Turning inventory into cash involves several steps—it must first be sold, and then the payment must be collected. Depending on the business type and market demand, this can take days, weeks, or even longer.

- Value Risk: Unlike cash, inventory can lose value over time due to factors like market changes, obsolescence, or damage. For example, unsold seasonal products or outdated electronics may need to be discounted heavily, reducing their worth.

That said, inventory still plays a critical role in liquidity, especially when demand is steady. For businesses that move products quickly—like grocery stores or fast-fashion retailers—inventory can behave almost like a liquid asset. However, compared to cash or accounts receivable, it sits lower on the liquidity ladder.

In short, liquid assets offer immediate financial flexibility, while inventory, although essential, requires a bit more effort to convert into cash. Understanding this distinction helps businesses manage their resources wisely, ensuring they have enough liquid assets to stay agile and meet short-term financial needs.

Excess Inventory as Waste in Business Operations

To meet customer needs, inventory must be kept on hand. However, having more than necessary can quickly become a burden instead of a benefit. Having too much inventory wastes time and money and makes it harder for a business to make money.

Here’s why holding too much inventory can harm operations:

- Increased Holding Costs

To store, protect, and manage your inventory, it costs more the more of it you have. Costs for things like storage space, insurance, utilities, and labour all add up. These holding costs eat away at profits over time without adding any real value.

- Risk of Obsolescence

Things don't always keep their value. When there is too much inventory, especially in tech, fashion, or food, it can quickly become out of date, expired, or unsellable. Then, companies have to offer discounts or write off these goods, which costs them money.

- Tied-Up Cash Flow

Inventory may be a current asset, but it is not cash until it is sold. Having too much stock locks up working capital that could be used for growth, paying suppliers, or dealing with unexpected costs. Keeping money in goods that haven't been sold can make it harder for businesses to stay lean and hurt day-to-day operations.

- Operational Inefficiency

Managing too much inventory can clog up workflows. Overcrowded warehouses make it harder to locate products, track stock, or maintain accurate records. This slows down operations and increases the likelihood of errors. Businesses that prioritise easy asset management often perform better because they streamline inventory processes and reduce unnecessary complications.

Excess inventory also throws the balance sheet from an accounting standpoint. Although inventory is considered a current asset, its actual worth relies on the sales rate. Too long idle stock causes asset efficiency to be lowered, which reduces the company's profitability from the level it can be.

Businesses must find a balance to avoid waste: keeping enough inventory to satisfy customer demand while avoiding extra stock that would eat into earnings. Companies can maximise their inventory levels and maintain effective operations by means of smart inventory forecasting, frequent audits, and the adoption of reliable asset management tools.

Inventory Classification for Tax Compliance

When tax season comes knocking, inventory isn’t just numbers in a spreadsheet—it’s something businesses need to classify and value carefully. The reason? How you handle inventory for taxes can directly impact profits, expenses, and ultimately, how much you owe.

So, what does “inventory classification” even mean for taxes?

At its core, it’s about separating inventory into clear categories. Businesses break it down into:

- Raw Materials – The unprocessed stuff that hasn’t yet been touched. For example, steel rods for a car manufacturer or coffee beans at a roastery.

- Work-in-Progress (WIP) – Products that are halfway done. Think of an unpainted chair in a furniture shop—it’s not raw, but it’s not ready to sell either.

- Finished Goods – The final product, polished and ready for customers. For instance, a car on a dealership floor or baked goods displayed at a bakery.

These categories aren’t just for bookkeeping—they’re essential for calculating the cost of goods sold (COGS), which directly affects taxable income.

Here’s why it matters:

At the end of the year, businesses must value all inventory still sitting in-house. If inventory is worth more, taxable income tends to increase (since COGS is lower). On the flip side, if inventory is valued lower, taxable income drops. The key lies in choosing the right valuation method:

- FIFO (First-In, First-Out): Assumes the oldest stock sells first. If prices are rising, FIFO usually makes profits look bigger—and tax bills higher.

- LIFO (Last-In, First-Out): Works in reverse, assuming the newest stock sells first. During inflation, this keeps profits (and taxes) lower. But not every country allows LIFO, so check the rules.

- Weighted Average Cost: Blends costs into an average, smoothing out highs and lows. It’s a simpler, middle-ground method.

What happens if you get it wrong?

Misclassifying inventory or applying an incorrect valuation can throw off your COGS, overstate profits, or trigger tax penalties. It’s why businesses, big or small, need airtight systems for managing inventory records. And while it might feel tedious, staying organised saves headaches later.

At the end of the day, whether you’re tracking raw materials, unfinished goods, or final products, inventory isn’t just “stuff”—it’s tied to how much you pay the taxman. Keeping those numbers right is key to staying compliant and keeping profits where they belong.

Items That Do Not Qualify as Inventory

Not everything a business owns counts as inventory, even if it feels like it “belongs” to operations. Inventory has a very specific definition in accounting: it includes goods that are held for sale, raw materials, or products still in production. Anything outside of that scope falls into a different category, and it’s easy to get tripped up.

Here are some items that are commonly mistaken for inventory but don’t make the cut:

- Office Supplies

Daily operations depend on pens, printer paper, cleaning supplies, even toner cartridges, but they are consumables rather than inventory. Instead of being sold to customers, these materials are consumed while running the company.

- Equipment and Machinery

Although they seem connected to inventory, a warehouse forklift or the machinery used on a manufacturing line are not. Because they are long-term investments that, over time, help create goods or income, equipment and machinery belong under fixed assets. Here, the current asset vs. fixed asset difference is evident: equipment is a long-term asset meant to last years, while inventory is short-term (expected to convert to cash within a year).

- Tools and Spare Parts

Production tools—drills, hammers, wrenches—are operational assets rather than inventory. Like replacement belts for a machine, spare parts—which support the equipment—do not count as inventory themselves.

- Office Furniture

Running the office requires desks, chairs, and filing cabinets—but not inventory. Since these items are used for a long time and are not for sale, they are categorised as fixed assets, similar to tools.

- Property and Real Estate

Should a company own warehouses, buildings, or land, those are fixed assets—not inventory. The space might house inventory, but the property itself is a separate investment with long-term value.

- Samples and Promotional Items

Free samples or marketing materials handed out to attract customers are sometimes confused with inventory. However, since they’re not meant to generate direct sales, they don’t qualify. Instead, they’re considered marketing expenses.

itemit Inventory Tracking Software

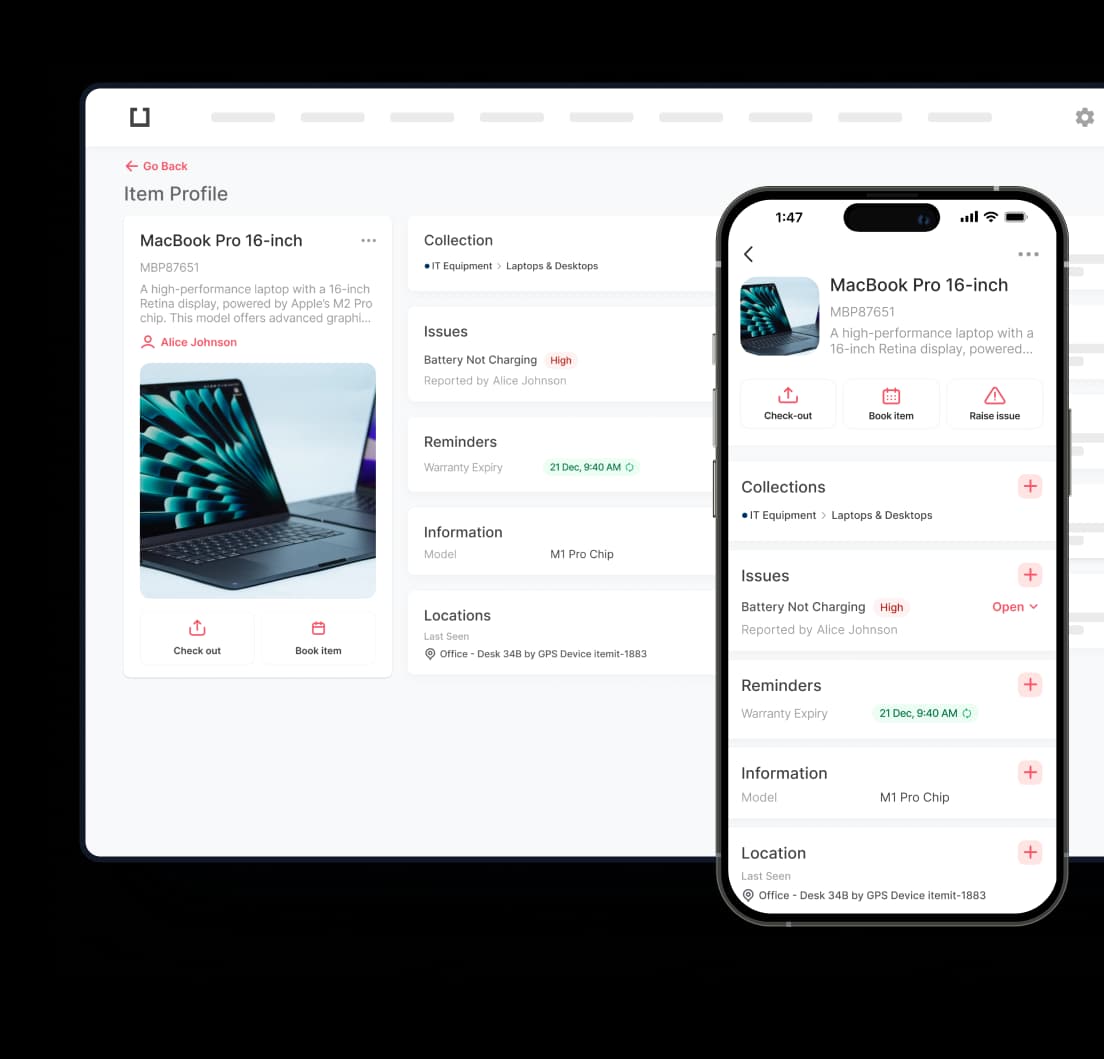

Managing inventory shouldn’t feel like chaos. But for many businesses, it does—endless spreadsheets, misplaced stock, and cash tied up in items no one’s buying. This is where itemit steps in. It’s more than just inventory management; it’s a smarter way to track, optimise, and streamline how you handle your assets.

Why does this matter?

Inventory problems eat into profits. Stock too much, and you’re wasting money on storage and excess goods. Stock too little, and you lose sales and frustrate customers. itemit solves both issues by giving you complete control and visibility over your inventory in real time.

Here’s how itemit helps businesses take charge:

Track Inventory Levels Instantly

With itemit, you always know what you have, where it is, and what’s running low. No more manual counting or last-minute surprises. Whether you’re dealing with raw materials, work-in-progress, or finished goods, itemit keeps your inventory organised and up to date.

Reduce Excess Inventory

Excess stock drains your cash flow. itemit highlights slow-moving items and helps you make smarter purchasing decisions. By identifying what isn’t selling, you can cut waste and free up cash to focus on what truly matters.

Improve Liquidity

Inventory isn’t just “stuff on shelves”—it’s money waiting to move. itemit makes it easier to turn stock into cash by showing you what’s selling fast and what’s holding you back. Better insights mean better decisions, leading to stronger cash flow and improved liquidity.

Simplify Asset Management

Managing inventory alongside tools, equipment, or other assets? itemit brings everything under one roof. It’s a complete asset-tracking system that helps businesses avoid losses, monitor usage, and reduce downtime caused by missing or mismanaged resources.

Plan Smarter with Accurate Data

Guesswork doesn’t belong in inventory management. itemit provides data-driven insights that help you forecast demand, plan future orders, and make decisions based on facts, not hunches.

If you have any questions left and want a direct discussion with our specialist, you can always contact us at team@itemit.com. Feel free to ask!