Walk into most small businesses, and you'll find owners wrestling with a deceptively simple question: "Are we making enough money on each sale?" Despite years of experience, many entrepreneurs still confuse markup with margin—a misunderstanding that silently drains profits month after month.

This confusion isn't just an accounting headache. A shop owner who diligently applies a 50% markup across their product range might be shocked to discover their actual profit margin sits at just 33.33%. This mathematical reality creates a substantial gap between projected and actual profits, often leaving business owners wondering where their money went.

Understanding Markup: The Foundation of Strategic Pricing

What Is Markup? The Essential Definition

Markup represents the amount you add to your product cost to arrive at a selling price. It answers a practical question: "How much should I charge above what I paid?"

Expressed as a percentage of cost, markup provides the starting point for establishing prices that cover expenses while generating profit. But be careful—it's not the same as the profit you'll ultimately keep.

The Markup Formula: Precision in Calculation

To calculate markup as a percentage, use this clear formula:

Markup % = ((Selling Price - Cost) ÷ Cost) × 100

Real-world example: A furniture retailer purchases desks for £200 and applies a 75% markup:

Selling price = £200 + (£200 × 0.75) = £350

Markup confirmation: ((£350 - £200) ÷ £200) × 100 = 75%

Businesses strategically implement markup to:

- Cover direct and indirect operational expenses

- Ensure consistent profitability across diverse product lines

- Remain competitive whilst meeting financial objectives

- Establish scalable pricing structures as the business grows

- Account for seasonal fluctuations in demand and supply costs

Different businesses apply vastly different markups:

- Supermarkets run on tight 15-25% markups, focusing on high volume and rapid inventory turnover.

- Fashion retailers might apply 50-300% markups to offset seasonal risks and eventual markdowns.

- Electronics stores typically work with 20-45% markups in a market where prices steadily decline as products age.

- Luxury brands command remarkable 100-500% markups, leveraging exclusivity and brand prestige.

- Furniture businesses generally use 40-200% markups to cover showroom space, delivery logistics, and slow inventory cycles.

Understanding Margin: The True Measure of Business Profitability

What Is Margin? Beyond Surface-Level Profits

Margin—your actual profit percentage—reveals how much of each pound from a sale remains after covering costs. Unlike markup, which is based on cost, margin calculates against your selling price, giving you a clearer picture of profitability.

A strong margin doesn't just look good on paper; it sustains your business through market fluctuations, covers unexpected expenses, and funds growth opportunities.

The Margin Formula: Clarity in Profit Analysis

The precise formula for calculating margin is:

Margin % = ((Selling Price - Cost) ÷ Selling Price) × 100

Practical application: Returning to our furniture example with a desk selling at £350 with a £200 cost:

((£350 - £200) ÷ £350) × 100 = 42.86%

This reveals a crucial insight: a 75% markup yields a 42.86% profit margin—not 75% as many business owners incorrectly assume.

How Margin Impacts Business Decisions

Understanding your true margins enables:

- Accurate financial forecasting and cash flow management

- Strategic discount decisions without compromising profitability

- Effective resource allocation across product categories

- Informed pricing adjustments when supplier costs fluctuate

- Confident scaling decisions based on genuine profitability metrics

The Critical Differences Between Markup and Margin: A Complete Analysis

The difference between markup and margin extends beyond their mathematical calculations, influencing every aspect of business strategy:

Calculation Basis

Markup uses cost as its baseline, while margin calculates from the selling price.

Primary Business Function

Markup is primarily used to set initial prices, whereas margin focuses on measuring actual profitability of sales.

Formula Structure

Markup calculates as ((Selling Price - Cost) ÷ Cost) × 100, while margin uses ((Selling Price - Cost) ÷ Selling Price) × 100.

Fundamental Focus

Markup shows how much to add to costs for pricing, while margin reveals how much profit actually remains from revenue.

Practical Example

For a product with a £200 cost sold at £350, the markup is 75%, but the margin is only 42.86%.

Business Visibility

Markup often functions as an internal pricing strategy tool, while margin frequently appears in reports to external stakeholders.

Strategic Application

Companies use markup primarily to set pricing strategy, whereas margin is a key metric for evaluating overall business performance.

This fundamental difference explains why businesses that focus solely on markup without understanding margin may appear profitable on paper but struggle with persistent cash flow problems and unsustainable growth patterns.

The Mathematics of Conversion: Translating Between Markup and Margin

Understanding how to accurately convert between markup vs margin is essential for precise pricing and financial planning:

From Margin to Markup: Finding Your Optimal Price Point

To determine the markup needed to achieve a specific target margin:

Markup % = (Margin % ÷ (100 - Margin %)) × 100

Strategic application: If your business requires a minimum 35% margin to cover all expenses and generate acceptable profit, the required markup would be:

(35 ÷ (100 - 35)) × 100 = (35 ÷ 65) × 100 = 53.85%

This means you must add 53.85% to your cost price to achieve that critical 35% profit margin.

From Markup to Margin: Revealing Your True Profit Percentage

To accurately determine the margin resulting from your current markup:

Margin % = (Markup % ÷ (100 + Markup %)) × 100

Business intelligence example: Your marketing team proposes a 60% markup on a new product line. To understand the actual profitability:

(60 ÷ (100 + 60)) × 100 = (60 ÷ 160) × 100 = 37.5%

This calculation reveals that a 60% markup will yield a 37.5% profit margin—essential information for evaluating the proposal against your business requirements.

Common Margin-Markup Conversion Reference

For quick reference, here's how common markup and margin percentages relate to each other:

- A 10% markup yields a margin of 9.09%, while achieving a 10% margin requires an 11.11% markup.

- A 25% markup results in a 20% margin, and similarly, a 20% margin target requires a 25% markup.

- A 50% markup produces a 33.33% margin, which precisely matches the relationship where a 33.33% margin requires a 50% markup.

- A 75% markup creates a 42.86% margin, while achieving a 40% margin would require a 66.67% markup.

- A 100% markup delivers a 50% margin, and obtaining a 50% margin demands a 100% markup.

- A 150% markup generates a 60% margin, which matches the requirement that a 60% margin needs a 150% markup.

- A 200% markup yields a 66.67% margin, whereas achieving a higher 70% margin would demand a 233.33% markup.

- A 300% markup produces a 75% margin, while reaching an 80% margin would necessitate a significant 400% markup.

Why This Distinction Matters for Inventory Management

The relationship between markup vs margin directly impacts your inventory management strategy in several critical ways:

Impact on Inventory Turnover and Cash Flow

- Overpricing (excessive markup without understanding margin): Results in slower sales velocity, increased warehousing costs, elevated insurance premiums, and potential obsolescence risks.

- Underpricing (insufficient margin despite acceptable markup) creates a dangerous cycle in which products sell quickly but generate inadequate profit to support operations and replenish inventory.

Effective stock vs inventory management requires finding the optimal balance that ensures both healthy turnover and sufficient profitability to sustain business operations.

Using Margin Analysis to Optimise Inventory Investment

A sophisticated inventory management system for small businesses should integrate margin analysis to:

- Identify high-margin products deserving additional inventory investment

- Flag low-margin items requiring pricing adjustment or potential discontinuation

- Calculate the true carrying cost of slow-moving inventory against its margin contribution

- Prioritise restocking based on margin contribution rather than just sales velocity

- Adjust ordering quantities to optimise both storage costs and quantity discounts

Leveraging Technology for Markup-Margin Mastery

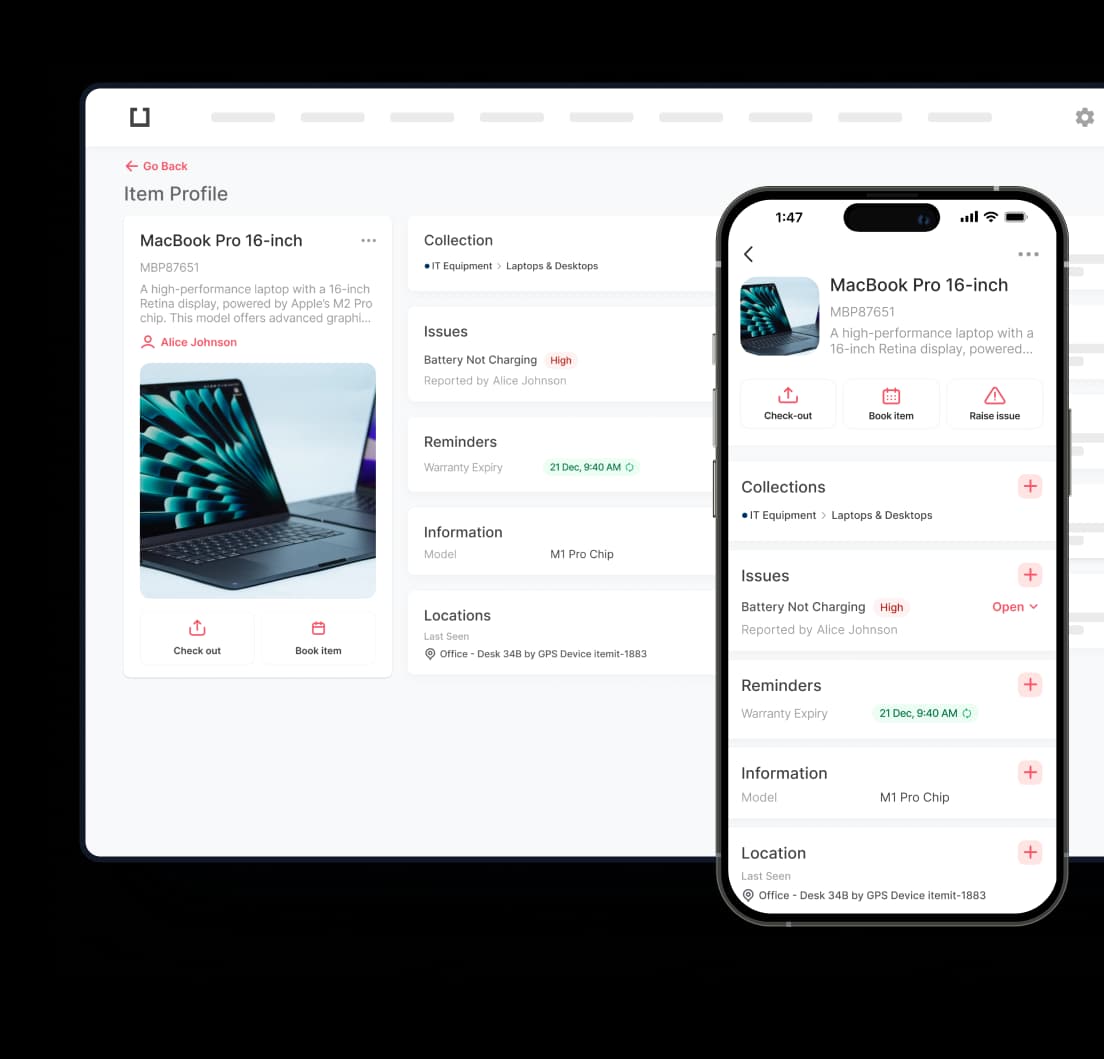

How Modern Inventory Systems Transform Pricing Strategy

Today's advanced inventory management solutions offer powerful tools to:

- Automatically calculate and convert between markup and margin across your product range

- Visualise profitability trends with customisable dashboards highlighting margin changes

- Set minimum margin alerts to prevent accidental underpricing during promotions

- Track margin evolution over time as supplier costs fluctuate

- Simulate various pricing scenarios and their impact on overall profitability

The Integration Advantage: Equipment Tracking and Pricing Strategy

Implementing equipment checkout software that integrates with your inventory system delivers additional benefits:

- Track depreciation of capital equipment to understand its true cost over time

- Factor equipment utilisation into product margin calculations for more accurate profitability analysis

- Identify hidden costs in your production or service delivery process that erode margins

- Optimise equipment maintenance schedules based on utilisation and margin contribution

- Create comprehensive cost models that inform more strategic pricing decisions

Common Pricing Pitfalls and How to Avoid Them

6 Critical Pricing Mistakes That Erode Profitability

- Confusing markup with margin: As demonstrated, they represent fundamentally different measurements of business performance

- Neglecting overhead allocation when calculating the markup needed for sustainable operations

- Maintaining static pricing despite fluctuating supplier costs and market conditions

- Focusing exclusively on margin without considering competitive positioning and market expectations

- Implementing blanket discounting without understanding the margin impact across different product categories

- Ignoring the psychological elements of pricing that influence consumer perception and purchasing behaviour

Strategic Pricing for Sustainable Growth

To avoid these pitfalls, implement these proven strategies:

- Conduct regular margin audits across your product range to identify profitability trends

- Develop tiered pricing structures that protect margins while offering competitive entry points

- Create value-added bundles that maintain healthy margins while delivering perceived value

- Establish minimum margin thresholds for promotional activities and special offers

- Train sales staff to understand and communicate value beyond price

- Regularly review and adjust pricing based on comprehensive margin analysis

Case Study: Transforming Profitability Through Margin Awareness

The Challenge

A mid-sized office furniture retailer consistently applied a 50% markup across its product range yet struggled with persistent cash flow issues despite steady sales. Its inventory turnover was inconsistent, with some items selling rapidly while others accumulated in the warehouse.

The Solution

After implementing an integrated inventory management system with margin analysis capabilities, they discovered the following:

- Their actual profit margins ranged from just 15% to 33% across different product categories

- Fast-moving items often had the lowest margins, while high-margin products moved slowly

- Carrying costs for slow-moving inventory were eroding overall profitability

- Supplier price increases had gradually reduced margins without corresponding retail price adjustments

The Results

By realigning its pricing strategy based on margin rather than markup, the company:

- Increased overall gross margin from 28% to 36% within six months

- Reduced warehouse space requirements by 22% through optimised inventory levels

- Improved cash flow by £157,000 in the first year

- Created category-specific pricing strategies that balanced turnover with profitability

- Established automatic margin-based alerts when supplier prices changed

Mastering the Margin-Markup Relationship for Business Excellence

Understanding the difference between markup and margin transcends basic accounting knowledge—it's the cornerstone of building a sustainable and profitable business in today's competitive landscape. By mastering these concepts and their strategic application, you can:

- Establish pricing structures that accurately reflect your complete cost architecture

- Ensure consistent profitability across diverse product categories and market segments

- Implement intelligent inventory management practices that optimise both cash flow and customer satisfaction

- Make data-driven decisions about promotions, discounts, and special offers

- Achieve the optimal balance between sales volume, inventory turnover, and profit retention

The most successful businesses don't simply prioritise one metric over the other but rather develop a sophisticated understanding of how markup and margin work in tandem to drive sustainable growth. With the right inventory management system for small businesses, you can transform these pricing concepts from potential confusion into powerful competitive advantages.

Implementing Margin-Based Pricing in Your Business

Ready to transform your pricing strategy and boost profitability? Here's a detailed roadmap for implementing a margin-based approach in your business:

1. Conduct a Comprehensive Margin Analysis

Start with a complete product line assessment:

- Calculate the actual margin for each SKU in your inventory using the formula: ((Selling Price - Total Cost) ÷ Selling Price) × 100

- Include all costs in your calculation: product cost, shipping, import duties, packaging, and allocated overhead.

- Group products by category to identify patterns in margin performance

- Create a margin distribution chart showing how many products fall into each margin range (0-10%, 11-20%, etc).

Practical approach: Begin with your top 20% of products by sales volume, then expand to your full catalogue. This focused analysis provides immediate insights without overwhelming your team.

2. Identify and Address Margin Issues

For products with insufficient margins:

- Examine products with margins below your minimum threshold (typically 30% for retail, though this varies by industry)

- Analyse root causes: high supplier costs, excessive discounting, inefficient processes, or market positioning issues

- Categorise low-margin products into three groups:

- Products needing immediate price adjustment

- Products requiring cost negotiation with suppliers

- Products to potentially discontinue if margins cannot be improved

For exceptional performers:

- Identify your highest-margin products (typically above 50%)

- Analyse what makes these products successful: unique value proposition, minimal competition, or superior sourcing.

- Create a strategy to expand or promote these high-margin lines.

3. Develop Strategic Category-Specific Pricing Guidelines

Create detailed markup guidelines by product category:

- Calculate the necessary markup for each category to achieve your target margins

- Consider category-specific factors such as:

- Competitive pricing pressure in each segment

- Seasonal fluctuations that may require flexible markups

- Product lifecycle stage (new launches vs mature products)

- Bundling opportunities with complementary products

Document your strategy:

- Create a pricing policy document that outlines your margin requirements and markup guidelines for each product category

- Establish approval workflows for exceptions to standard markup rules

- Set review cycles to evaluate and adjust your pricing strategy (quarterly or with major market changes)

4. Leverage Technology for Margin Management

Select and implement appropriate tools:

- Choose an inventory management system that automatically calculates both markup and margin for each product

- Set up automatic alerts for products falling below margin thresholds

- Implement dashboard reporting that tracks margin performance by category, supplier, and sales channel

- Utilise forecasting tools that predict the margin impact of proposed price changes or promotions

Integration considerations:

- Ensure your pricing tool integrates with your point-of-sale and e-commerce platforms

- Connect your inventory management system for small businesses with your accounting software for complete financial visibility

- Consider equipment checkout software that tracks asset utilisation to identify hidden costs affecting margins

5. Build a Margin-Conscious Company Culture

Develop comprehensive training programmes:

- Train sales teams to understand the relationship between discounting and margin erosion.

- Educate purchasing staff on how buying decisions directly impact margins

- Provide managers with margin analysis skills to make informed pricing decisions

- Create simple reference materials explaining markup vs margin for all staff

Establish margin-based performance metrics:

- Include margin targets in departmental KPIs

- Develop incentive structures that reward margin improvement rather than just sales volume

- Create regular reporting that highlights margin performance alongside revenue figures

- Schedule monthly review meetings focused specifically on margin analysis

6. Implement a Continuous Improvement Cycle

Establish an ongoing optimisation process:

- Schedule quarterly pricing reviews to assess margin performance

- Monitor competitor pricing and adjust your strategy accordingly

- Analyse the impact of promotions and discounts on overall margin performance

- Tested pricing elasticity through controlled price adjustments on selected products

- Document successful strategies and expand them across appropriate product categories

Measure and celebrate success:

- Track improvements in overall gross margin percentage

- Calculate the financial impact of your margin improvement initiatives

- Share success stories across departments to reinforce the importance of margin management

- Use improved margins to fund growth initiatives or increase team incentives

By methodically implementing these steps, you'll transform your business from markup-focused to margin-aware, creating a more profitable and sustainable operation capable of weathering market changes and building long-term financial strength.

Latest posts

Tips, guides, industry best practices, and news.