Published on October 25, 2024 •

5 min read

The various types of assets employed by the business can be challenging to manage, especially when trying to classify supplies vs inventory. These two play different roles in an enterprise, and their correct differentiation is very relevant in proper management and financial reporting. In this article, we shall look at the critical differences between supplies and inventory, examine in greater detail how they are accounted for, and highlight best practices to apply in their management. By the end, you should have a better idea of how to track and optimize supplies and inventory for the smooth running of business.

What's the Difference Between Supplies and Inventory?

The terms “supplies” and “inventory” are often used interchangeably in business, though they serve different purposes within company operations. To effectively manage and have competent financial reporting, one must know how to differentiate between the two types.

Supplies are things consumed in the course of ongoing operations. Although they are tangible and represent assets, supplies differ from inventory because supplies are not held for resale. Examples include office supplies such as paper, pens, and cleaning materials. The answer to the question “Are supplies an asset?” depends on their classification—usually, they are considered current assets until they are used, after which they become an expense.

Their classification, however, depends upon their nature in that the usual stock usually consists of current assets until they are consumed and then become an expense.

Inventory, on the other hand, is those items that a business sells or uses in the production of goods for resale. Inventory includes raw materials, work-in-progress, and finished goods. For example, inventory for a furniture store includes wood and nails used in production, and completed chairs ready for sale. Inventory is the largest asset for many businesses, and the management of inventory is very important to a company's profitability.

This means that the basic difference between supplies vs inventory involves their purpose: supplies make the operations possible, while inventory is directly linked to revenue generation. Proper differentiation between these categories aids in making appropriate decisions regarding purchasing, storing, and financial planning.

What Are Supplies?

Supplies in accounting are things that a business buys to help it continue with its day-to-day activities. Unlike inventory, such items are not sold to customers, yet they are essential to the business. Supplies can also be classified in terms of usage into office supplies, operating supplies, and maintenance supplies.

Examples are office supplies, such as stationery, printer ink, and cleaning products. Medical supplies can be as simple as gloves, syringes, or sanitizing agents. In the construction industry, personal safety gear and tools are considered supplies. These types of items are usually consumed directly at an expense, and their effective tracking enables smooth and timely business operations.

Supplies are essential in the efficient running of the business, and even though they tend to be considerably lower-valued than the inventory, supplies hold a great deal of importance in everyday operations. For example, without cleaning supplies in a restaurant, it creates hygiene problems-a factor that most definitely drives away customers and also violate health regulations. Similarly, having too few medical supplies in a healthcare facility can lead to disruptions in operations and create serious risks to the care of patients.

What is An Inventory?

What is inventory in accounting? Inventory, in simple terms, is the merchandise or materials that a business owns for reselling or to produce. Inventory is one of the most important parts of the inventory and supply chain since it includes raw materials, components, and finished products already ready for sale or manufacture another product.

Examples might include shirts, pants, and accessories at a retail clothing store. At a manufacturing company, the inventory would include raw materials such as fabric and thread, work-in-progress garments that have been partially sewn, and finished goods that are ready to ship. Unlike supplies, inventory relates directly to revenue, and thus, it must be carefully managed through planning so that enough items are available to meet demand.

Inventory is effectively managed to ensure demands will be met by the business and neither overstocked nor understocked. Overstocking leads to having capital tied up, and the storage costs are increased, whereas understocking sometimes results in lost sales and dissatisfied customers. It is the concern of a business to be closely monitoring its levels of stock. Careful analysis of inventories for such considerations as lead times, seasonal demand, and production cycles is absolutely necessary for the optimization of the stock levels in the organisation.

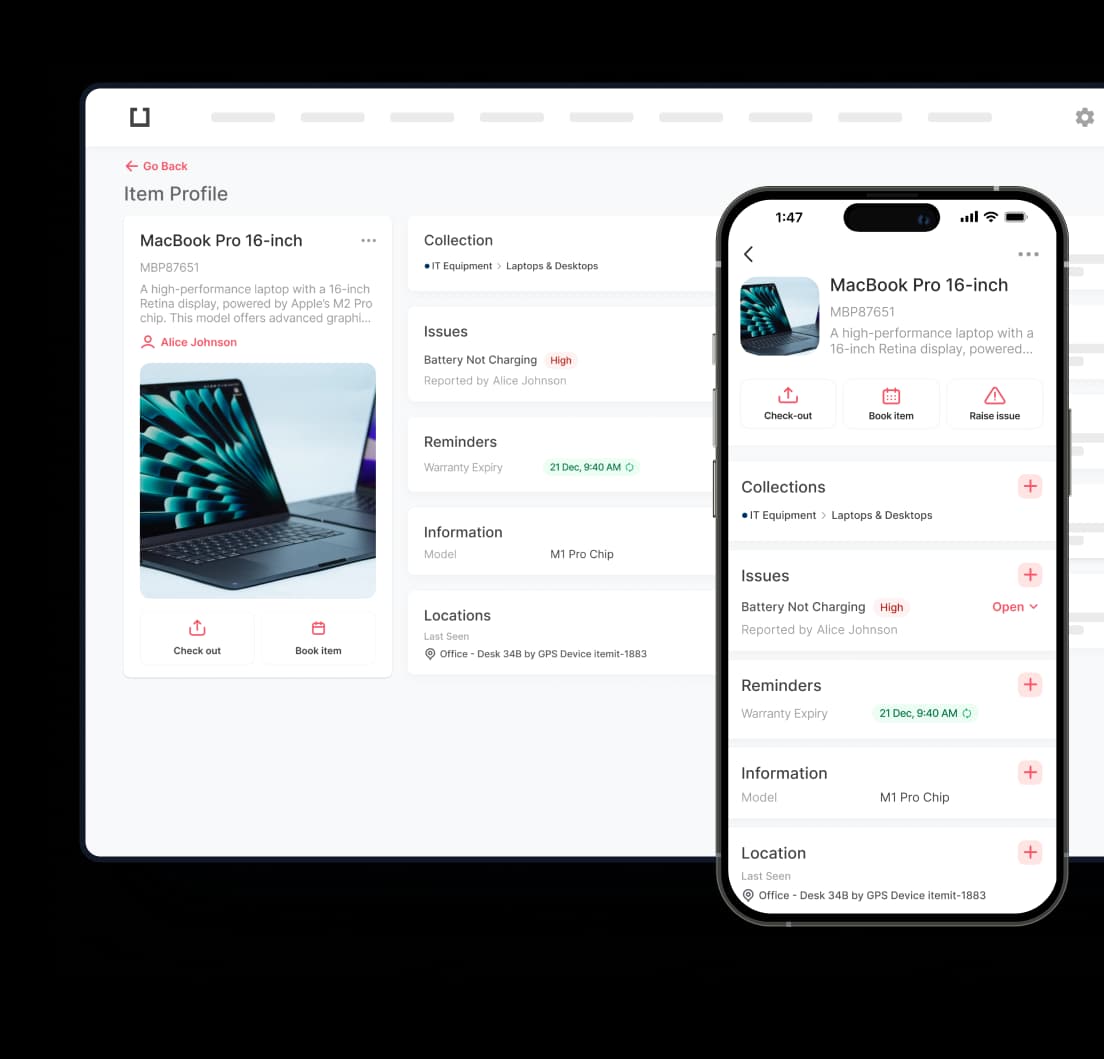

Check Out the Benefits of itemit Asset Management System

itemit Asset Management System is one of the most powerful asset-tracking and inventory management platforms out there. Be it office supplies tracking or complicated inventory systems management; Itemit has an intuitive system that will get the job done by simplifying your asset management processes and, in turn, save you lots of money and time.

Itemit will provide a business with the ability to record all their assets, be they supplies or inventory. In particular, IT inventory software will prove very helpful in tracing IT assets and hence give businesses the ability to know its usage, maintenance schedules, and its replacement needs. This can help reduce costs due to the prevention of buying what might already be in existence. Better visibility also implies an opportunity for businesses to minimize losses and prevent misplacement, ensuring better operation efficiency.

One of the strong suits that itemit can offer is the ability to give real-time insight into the location and condition of assets. This, of course, is especially valuable for businesses operating in multiple locations or with mobile-based assets. With easy tagging and scanning features, itemit means that you can track both inventory and supplies with efficiency and little chance of human error.

Setting up reminders for maintenance or replenishment is another key advantage. This is important in supply management because it means that at no time will an essential item not be available on demand. Automating such processes helps Itemit prevent businesses from experiencing downtime and sustains a good workflow.

This also means that asset data with itemit is accessible anywhere and at any time on its cloud-based platform, thereby enabling teamwork and facilitating decision-making. The system further assists in generating reports on the usage of assets, which helps in the analysis of trends and facilitates the optimization of asset allocation to reduce operation costs. Whether a small business or a large enterprise, itemit provides necessary tools for asset management and helps in improving overall efficiency.

Managing Inventory vs Supplies: Key Practices

Both inventories and supplies require proper tools and strategies for their effective management. The term inventory management would, in general, involve maintaining a record of stock and forecasting the demand to ensure that the optimum amount is available at the right time. Just-in-time inventory and Economic Order Quantity are some techniques that can help businesses to efficiently manage their levels of inventory to meet demand without necessarily holding excess inventory.

Inventory management software is probably one of the most important enablers in giving visibility to stock levels, therefore helping a business make informed purchasing and production decisions. Examples include barcode scanning, RFID technology, and cloud-based inventory systems that improve stock accuracy and reduce labor costs. This, therefore, means that with such adoption, there is the potential for businesses to minimize stockouts, cut unneeded inventory, and enhance overall efficiency.

With supply management, the concern is to have enough materials to enable the continuance of operations without interruptions. It is especially important to keep inventory for small businesses. It may include establishing reorder points, implementing supplier management systems, and maintaining good relations with vendors. Accounting inventory supplies using a hand-held computer facilitates the tracking process for easy monitoring of the usage level to prevent running out of vital supplies.

Another important practice in supply management involves periodic audits. Unlike inventories that are usually counted at the end of an accounting period, supplies may not be subjected to as much scrutiny. Periodic checks, however, will prevent waste and ensure that supplies are being used with the economy.

It's equally important to spell out clear policies on the use of supplies. For instance, having clearly defined policies on who can requisition supplies, what constitutes a worthwhile use of company time and resources for procurement, and how approval chains are set up, will go a long way in reducing wastage. Training employees on the judicious use of supplies and encouraging resourceful practices can also be done hand in glove with more efficient supply management.

Data analytics can play a very important role in developing better management practices for both inventory and supplies. Companies will be in a position to build far more accurate forecasts of demand by studying usage trends, seizing opportunities for cost savings, and fine-tuning their supply chain strategies. In addition, this will also create an ability to recognize various inefficiencies that relate to over-consumption or underutilization of supplies and inventory, respectively.

Accounting for Supplies vs Inventory

Unlike inventory, supplies and supplies expense have very different accounting treatments. Supplies in accounting often arise as current assets at purchase and then are expensed when consumed. This means they first show on the balance sheet, then later move to the income statement as an expense upon consumption.

Supplies are usually classified as operating expenses, and their consumption has to be correctly monitored to ensure that the operational expense of a company is accurately reflected. For instance, office supplies like paper and toner are immediately consumed upon usage and ultimately decrease the net income of the business. Proper tracking will mean that all these expenses are included in the budgeting and financial planning so that the business may make informed decisions on where to cut expenses and, therefore, understand what their operational costs are.

In accounting, where inventory is concerned, it presents more complex treatments. This is because, under the three-stage accounting model, an inventory is recorded as an asset on the balance sheet until its selling happens, and only when the sale has occurred is it treated as an expense-cost-of-goods sold. This difference in accounting treatment is important to financial reporting and taxes because it influences a company's profitability and its tax liabilities.

Inventory accounting methods, such as First-In, First-Out (FIFO), or Last-In, First-Out (LIFO), play a significant role in determining the value of inventory and the cost of goods sold. The selection of an appropriate method may have a profound effect on the financial statements, particularly when prices continue to fluctuate. Good inventory accounting works to ensure that the financial records of a company correctly show the cost and value of goods on hand, which is an important determinant of profitability.

The other critical aspect of accounting for inventory encompasses inventory valuation. The business has to intermittently appraise its inventory to ascertain its current market value and make sufficient provisions for the inventories that may have become obsolete or damaged. This process is generally referred to as a write-down of inventory. It helps ensure that one's financial statements correctly reflect the present value of inventory-very important for investors and stakeholders.