Published on February 17, 2025 •

8 min read

Managing inventory and assets effectively can be the difference between thriving and merely surviving in competitive industries. For businesses balancing growth with operational efficiency, inventory financing offers more than just a financial lifeline—it enables smarter, more strategic asset management. This approach ensures that companies can acquire the goods they need to meet demand without being held back by upfront costs.

However, having the inventory on hand is only part of the equation. Without a reliable asset tracking system, even the most well-stocked business can face inefficiencies. These systems transform how businesses monitor and control their resources, offering real-time visibility, minimising waste, and enhancing operational transparency.

By bridging the gap between capital availability and resource management, the combination of inventory financing and an advanced asset tracking system ensures businesses don’t just keep up—they get ahead.

What is Inventory Financing?

Fundamentally, inventory financing is a customised funding source that lets companies buy goods without immediately compromising their cash flow. Designed to guarantee companies can keep stock levels to satisfy demand, this short-term loan or line of credit is guaranteed by inventory as collateral. Companies with seasonal sales cycles or those needing to bulk-buy items at the best pricing will especially benefit from this kind of financing.

Here’s how it works: when applying for an inventory loan, a company is approved depending on the value of either current or future stock. Approved, the company gets money to buy the required supplies. The loan is repaid as the inventory is sold, so generating a cycle that drives ongoing activities without draining other financial resources.

A company's size, industry, and financial structure will determine the several inventory financing options that are accessible. These comprise trade credit given by suppliers, inventory lines of credit, and conventional bank loans. From reduced interest rates on secured loans to flexible repayment terms catered to corporate needs, every alternative provides special advantages.

Retail, manufacturing, and e-commerce are just a few of the sectors that depend mostly on inventory loans to keep stock levels and satisfy customer demand. Seasonal companies—such as those in the fashion or holiday goods industries—also find these solutions quite helpful for remaining competitive and sensitive to market trends.

The Role of Inventory Tracking Systems in Asset Management

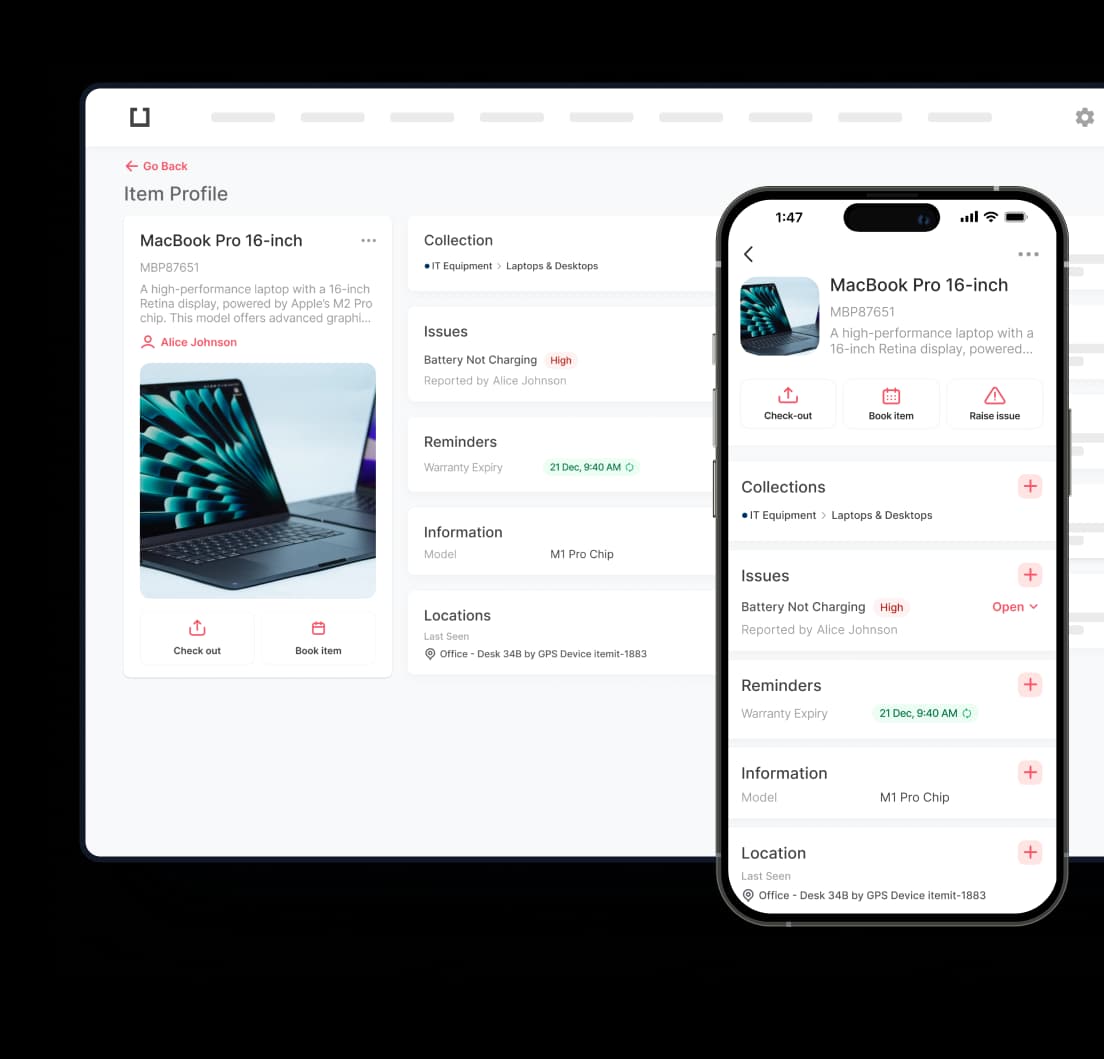

Managing assets effectively is a balancing act, and businesses need tools that can provide clarity, control, and confidence in their operations. Inventory tracking systems are one such solution—technological frameworks designed to monitor and manage inventory in real time. By blending automation with accessibility, these systems are transforming inventory management while becoming a critical part of broader asset management strategies.

What Are Inventory Tracking Systems?

Fundamentally, inventory tracking systems are digital tools that allow companies a bird's-eye view of their inventory. These systems track every item, including specialised tools in the field and physical items in a warehouse. With just a few clicks, they clearly show what is available, what is in use, and what requires attention using technologies, including barcodes, QR codes, and cloud integration.

How Inventory Tracking Systems Drive Asset Management Success

- Real-Time Visibility

It is extremely valuable to know where your assets are and their present situation. Tracking systems provide real-time inventory updates, so removing blind areas. A distributor can, for instance, quickly restock items that are approaching stock-out levels at several sites, so preventing downtime.

- Accuracy That Reduces Waste

Manual processes often lead to errors—miscounts, missed updates, or misplaced items. Automated tracking replaces guesswork with precision, ensuring inventory records match reality. This not only reduces overordering but also cuts unnecessary expenses tied to discrepancies.

- Enhanced Control Over Assets

With a reliable system, businesses gain a new level of control over their inventory. Alerts for stock thresholds, expiration dates, or usage patterns allow for proactive decisions. For instance, a healthcare provider can track critical medical supplies, ensuring they’re available when needed while avoiding overstock.

- Actionable Insights and Reporting

Inventory tracking isn’t just about keeping tabs—it’s about leveraging data. Modern systems generate detailed reports that reveal patterns like high-turnover items, seasonal demands, and storage inefficiencies. These insights help businesses refine their processes and make smarter, data-driven decisions.

Inventory tracking systems are more than just tools; they are strategic partners. For sectors including retail, manufacturing, and logistics, they provide the basis for improved planning, more seamless operations, and closer customer bonds. Through combining visibility, accuracy, and control, these systems enable companies to remain agile and effective in a competitive environment.

How Inventory Financing Enhances Asset Tracking Efficiency

For businesses aiming to optimise operations, balancing the need to stock inventory with investing in advanced tools can be challenging. Inventory financing offers a solution by providing the financial flexibility to acquire essential inventory while also enabling investments in modern inventory tracking systems. This dual benefit improves both day-to-day operations and long-term efficiency.

The Connection Between Financing and Tracking Systems

One of the primary reasons businesses delay adopting inventory tracking systems is budget constraints. Many prioritise acquiring stock to meet demand, leaving little room for operational upgrades. Inventory financing modifies this dynamic by providing companies with the capital required to not only preserve inventory levels but also apply cutting-edge tracking systems to improve effectiveness. By minimising mistakes, lowering waste, and raising production, these tracking systems sometimes show a quantifiable return on investment (ROI).

For example, stores can incorporate RFID technology by means of financing, so facilitating real-time product tracking over several sites. IoT-enabled tracking tools that give manufacturers a comprehensive understanding of inventory movement will help them simplify supply chain operations.

How Financing Improves Cash Flow

Inventory loans directly address one of the biggest barriers to operational efficiency: cash flow limitations. By offering access to working capital, these loans allow businesses to:

- Replenish inventory promptly: Financing ensures stock levels remain optimal, preventing costly delays or stockouts.

- Allocate funds strategically: With predictable cash flow, businesses can plan for both inventory purchases and technology upgrades without financial strain.

Improved cash flow also creates a ripple effect on operations. Businesses can track assets more effectively, reducing downtime and enhancing customer satisfaction by maintaining consistency in supply.

Long-Term Savings Through Smarter Investments

Although inventory tracking systems call for an initial outlay, over time, they save the business money. Automation lowers the possibility of understocking or overstocking, two events that might cause major losses. Real-time data also reduces manual tracking-related mistakes, lowers labour costs, and helps to avoid disparities that might cause operations to be disrupted.

For example, a distribution company that implemented a barcode-based system using financing found that it drastically reduced lost or misplaced items, leading to lower replacement costs and improved fulfilment rates.

Key Benefits of Combining Financing and Tracking Systems

When businesses leverage financing to adopt inventory tracking tools, they unlock several advantages:

- Enhanced visibility: Real-time updates on stock levels and asset locations improve decision-making.

- Reduced errors: Automated systems minimise manual tracking mistakes.

- Timely replenishment: Businesses can restock inventory proactively, meeting customer demand without disruptions.

- Improved reporting: Tracking systems provide detailed analytics, helping businesses identify inefficiencies and refine their processes.

- Cost savings: By reducing waste and optimising inventory management, businesses save money over time.

The combination of inventory financing and tracking systems creates a powerful synergy. Financing removes the financial barriers to adopting modern tools, while tracking systems deliver operational improvements that drive growth. Together, they enable businesses to stay agile, competitive and prepared for the challenges of a rapidly evolving market.

Benefits of Inventory Financing for Asset Management

Inventory financing offers more than just a solution for purchasing stock—it’s a strategic tool that enhances overall asset management. By bridging financial gaps, it empowers businesses to optimise their resources, implement better tracking systems, and achieve sustainable growth.

- Improved Cash Flow Management

One of the most significant advantages of inventory financing is the ability to maintain healthy cash flow. Instead of tying up capital in inventory purchases, businesses can allocate funds toward other critical areas, such as investing in asset tracking systems, paying operational expenses, or pursuing growth initiatives. This flexibility ensures smoother day-to-day operations and reduces financial strain during high-demand periods.

- Enhanced Ability to Scale Operations

For businesses looking to expand, inventory financing provides the capital necessary to increase stock levels without overstretching resources. With more inventory on hand, companies can meet rising customer demands or enter new markets. Combined with efficient asset management, scaling becomes more manageable and less risky.

- Access to Better Asset Management Tools

Inventory financing makes it possible for businesses to adopt advanced tools that improve asset visibility and control. For instance, investing in inventory tracking systems with the help of financing enables real-time monitoring, reduces errors, and provides actionable insights, ultimately streamlining asset management.

- Reduction in Operational Risks

Stockouts or overstocking can lead to lost sales or wasted resources, both of which are detrimental to a business. Financing allows companies to maintain optimal inventory levels, reducing the likelihood of these costly mistakes. This stability improves asset utilisation and minimises disruptions in the supply chain.

- Increased Agility and Competitiveness

By ensuring businesses have the inventory they need, when they need it, financing improves operational agility. Companies can respond quickly to market shifts, seasonal demands, or unexpected opportunities without being held back by cash flow constraints. This flexibility strengthens their position in a competitive marketplace.

- Stronger Supplier Relationships

Financing helps businesses maintain timely payments to suppliers, which fosters trust and can lead to better terms, discounts, or priority access to products. A reliable supply chain is integral to effective asset management, ensuring that businesses can maintain consistent inventory levels.

- Cost Efficiency Over Time

While inventory financing involves borrowing costs, it often saves money in the long run by reducing inefficiencies. With the right tools and sufficient stock, businesses can avoid emergency purchases, expedited shipping fees, or losses associated with poor inventory control.

The benefits of inventory financing extend beyond immediate financial relief—it’s a catalyst for smarter operations and better decision-making. By combining financing with modern asset management practices, businesses can reduce risks, improve efficiency, and lay the groundwork for sustainable growth.

Tips for Integrating Inventory Financing with Asset Management

Integrating financing solutions with asset management practices requires thoughtful planning and execution to maximise efficiency. When done right, this synergy can streamline operations, improve decision-making, and support long-term growth. Here are some practical tips to ensure a smooth integration of inventory loans with asset tracking systems and asset management strategies.

Before implementing any systems, ensure your tracking software and financial tools can communicate seamlessly. Many modern platforms offer integration features or APIs that allow data sharing between different systems. This compatibility eliminates silos and ensures that financial decisions align with real-time inventory data.

2. Prioritize Real-Time Data Synchronization

Synchronising data between your financing records and asset tracking software is critical for accuracy. By ensuring both systems update in real-time, businesses can maintain a clear picture of their inventory levels, loan usage, and repayment schedules. For instance, linking inventory tracking software with financing tools can help track how financed inventory is sold, allowing for more informed repayment strategies.

3. Establish Clear Operational Goals

Set measurable objectives for how financing will enhance your asset management practices. For example, aim to reduce stockouts by a specific percentage, shorten order lead times, or increase turnover rates. Having clear goals ensures that the integration serves as a strategic initiative rather than just an operational adjustment.

4. Train Teams to Leverage Integrated Systems

A well-integrated system is only as effective as the people using it. Provide training for your team on how to use the tracking and financing tools together. This could include understanding how to analyse data from both systems, recognising trends, and identifying opportunities for cost savings or efficiency improvements.

5. Monitor Key Metrics Regularly

Track key performance indicators (KPIs) to measure the success of your integration. Metrics like inventory turnover, repayment timelines, and asset utilisation rates can provide insights into how well the systems are working together. Regular monitoring helps identify gaps or inefficiencies, allowing for timely adjustments.

6. Leverage Predictive Analytics

Modern tracking systems often include analytics tools that forecast demand or highlight patterns. Use these insights to align your financing strategy with anticipated inventory needs. For example, predictive analytics can help determine when to apply for financing or how much capital to request to meet future demands.

7. Maintain Transparency Across Departments

Ensure that your finance, operations, and supply chain teams have access to shared data. Transparency promotes collaboration, reduces redundancies, and helps teams make cohesive decisions regarding purchasing, financing, and asset management.

8. Evaluate and Adapt

Integration is not a one-time task—it requires ongoing evaluation to stay effective. Regularly assess whether the chosen financing options and tracking tools continue to meet your business’s needs as it grows or as market conditions change. Be prepared to upgrade systems or adjust strategies to maintain alignment.

Bringing inventory financing and asset management together is less about quick fixes and more about creating a system that works cohesively to support business growth. The integration should feel like a natural extension of your operations—where the tools, data, and strategies align seamlessly. By focusing on synchronisation, clear goals, and proactive use of technology, businesses can turn this partnership into a competitive advantage.