When managing your business’s resources, it’s crucial to know the difference between fixed assets and inventory. In short, your inventory is consumables or stock, whereas your assets are the things you physically use day-to-day.

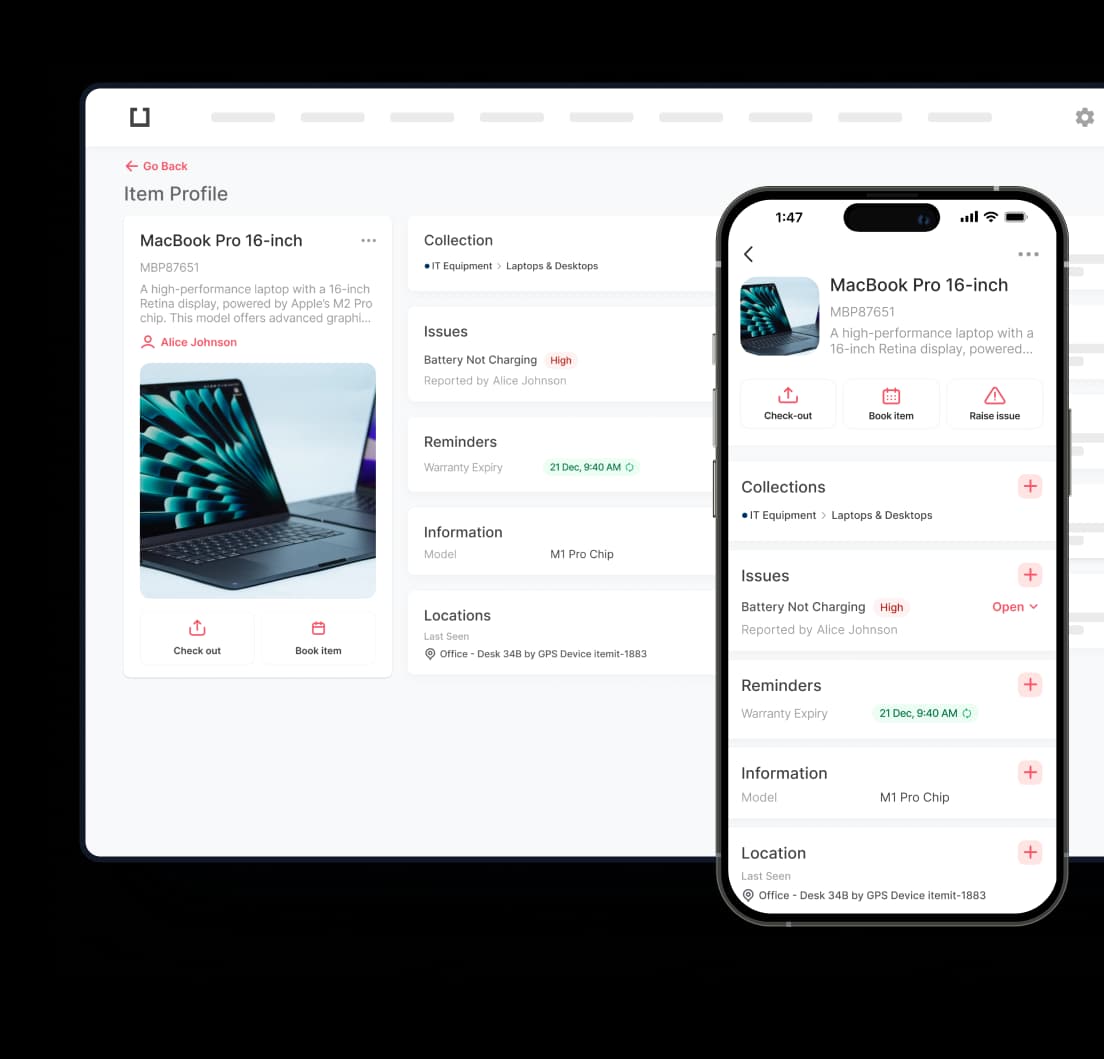

As such, having a system for either helps you track and manage different things. An inventory management system will help you keep track of inventory levels, and a fixed asset register software will help you monitor asset locations and use.

Fixed Assets: The Backbone of Your Business

Things that are fixed in value are what keep your business running every day. Think about your office chairs, computers, tools, or even the delivery van that's parked outside. You don't plan to sell these things; they're just tools that help you do your job.

Now think about what would happen if you didn't keep track of these things correctly. You might buy a new laptop that has been unused in a closet for a while, or you might forget that an important machine needs to be serviced. That's why a fixed asset record is useful. You always know what you own, where it is, and how well it's working.

It's not enough to just know what you have, though. Fixed assets typically lose value over time as they are used. Keeping track of this helps you better handle your money and make plans for when to replace things in the future. Also, this keeps you from being surprised when it's time to file your taxes, since depreciation changes how you report your income.

To stay on top of your resources and avoid unnecessary losses, it’s essential to prepare a fixed asset register that captures key details like location, usage, and maintenance.

To put it simply, fixed assets keep your business running. If you treat them well, they'll keep things running smoothly.

Inventory: The Ever-Changing Flow of Goods

When it comes to inventory, things are very different. These are the things you run a business on or consume. Consider it as the lifeblood keeping your company running—raw materials, completed goods, even office supplies like paper and pens.

Inventory doesn't remain around for very long, unlike fixed assets. It flows in and goes out and is traded regularly. Tracking is more about knowing your numbers than about knowing the precise location of every single object. You should be aware of your stock level, which is selling quickly and which is gathering dust on the shelf.

Imagine yourself running a retail store and then discovering you have run out of a top item. Worst still, you have boxes of out-of-date merchandise occupying precious space. Good inventory control provides a comprehensive insight into your supply levels and trends, thereby helping you to prevent these situations.

Good inventory control helps you to estimate demand more accurately, prevent stockouts, and maintain customer satisfaction. It's about being proactive instead of reactive, which eventually saves money and time.

Inventory vs Asset: Why Mixing Them Up Can Be Costly

You’d be surprised how often businesses blur the lines between inventory vs asset. At first glance, some items can appear to fit both categories. Take a delivery van, for example. The vehicle itself is a fixed asset, but the goods it transports are inventory. Similarly, a box of tablets might be considered inventory, but if those tablets are assigned to employees for work, they’re treated as assets.

Mixing up the two can lead to serious financial headaches. Misclassifying assets as inventory—or vice versa—can mess up your books, cause incorrect depreciation records, and even lead to issues with tax compliance. Not to mention, it can impact cash flow. Imagine thinking you’ve got more stock than you actually do, only to realise you’ve been making purchases you didn’t need.

So, why keep them separate? It’s all about the level of detail you need. Fixed assets require more granular tracking. You want to know where each laptop is, who’s using it, and whether it’s due for maintenance. With inventory, you’re looking at broader trends—how much stock you have, how fast it’s moving, and where it’s going.

Getting this distinction right means fewer headaches down the line and more confidence in your financial reporting.

The Financial Risks of Misclassifying Assets and Inventory

Misclassifying items isn’t just a technical error—it can have real financial consequences. For instance, if you mistakenly record inventory as a fixed asset, you’ll end up calculating depreciation for something that doesn’t need it. Over time, this can skew your financial reports, making it harder to understand your actual costs and profits.

Then there’s the issue of taxes. Fixed assets are subject to tax rules that are different from those of inventory. If you’ve got your classifications wrong, you could be filing inaccurate tax returns, leading to penalties or audits. Nobody wants that kind of stress.

Cash flow is another area where things can go wrong. Let’s say you think you’ve got plenty of stock, so you don’t reorder. But in reality, what you’ve got on hand is mostly fixed assets, not sellable goods. Before you know it, you’re facing a supply shortage and scrambling to restock.

Taking the time to distinguish between assets and inventory might seem tedious, but it’s worth it. By ensuring you create an asset register that accurately distinguishes between fixed assets and inventory, you reduce the risk of financial errors and improve compliance.