Published on September 22, 2023 •

3 min read

When it’s time to audit your business you need to know you have it under control. Making sure that you can show you’re complying with regulations can be easier said than done. The good news is that an equipment register can help with this. In fact, a register such as this can help your business in a wide variety of ways. But first, let’s take a look at what an asset register is. Then, we’ll explore how it can be useful for audits.

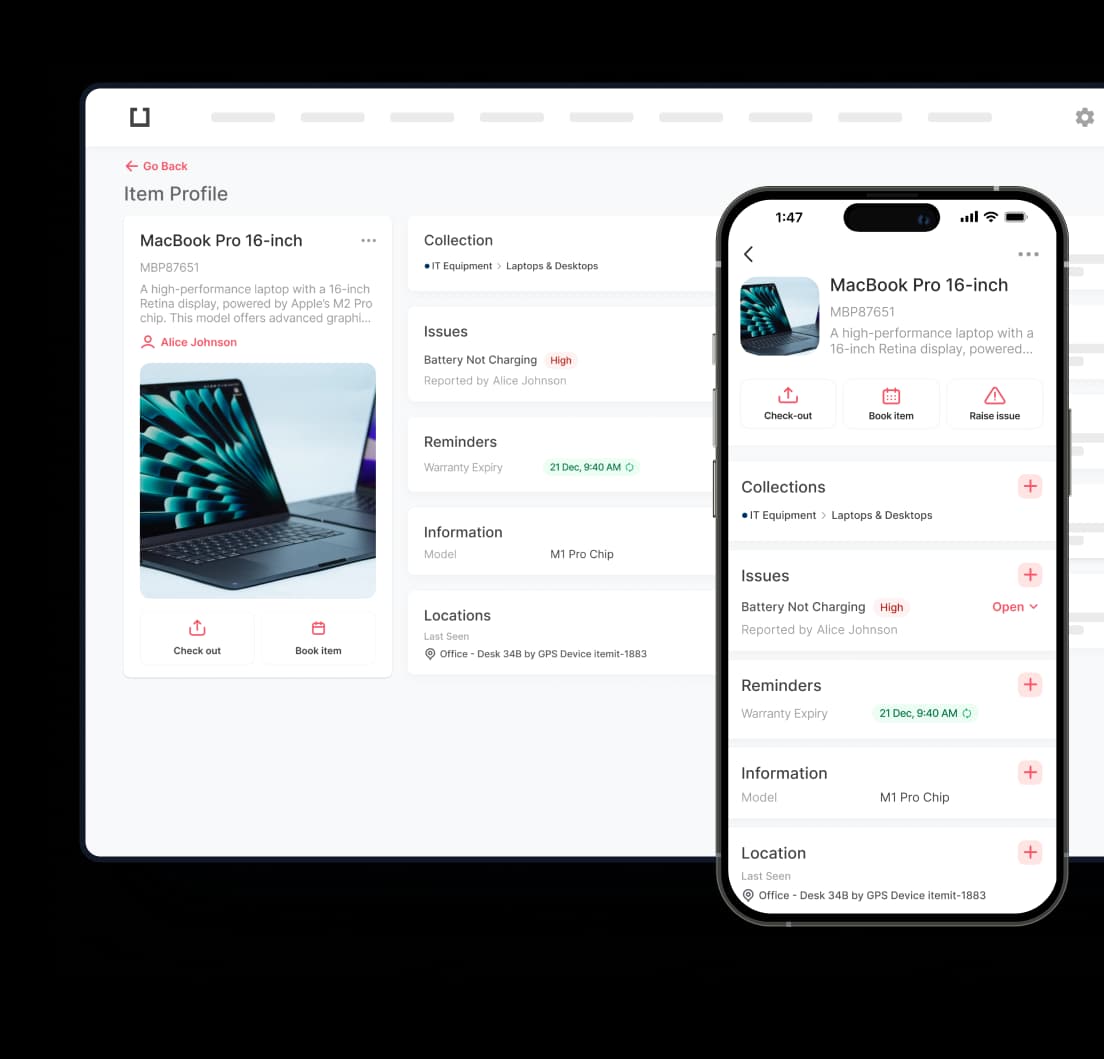

What An Equipment Tracking Register Is

An equipment tracking register/equipment register is a type of digital database that stores a host of information. This information will relate to every asset that is entered into the register. A good register is one that’s updated frequently and is full to the brim with details about each asset. These details include each asset’s:

- Make and model number

- Seller

- Purchase cost

- Date of purchase

- Serial number

- Warranty and insurance information

- Estimated current value

- Expected life span

- Maintenance schedule

- And any other details that you wish to add

In addition to adding all of the above details, you can update your register as and when you please. If you purchase a new asset you can add it to the register. If an asset has been discarded, you can remove it from the equipment tracking register. Keeping everything up to date can be helpful if you need to access details about each asset in the future.

Verifying Your Records

As soon as you have updated your asset register you can print off a report. Some asset register software allows you to do this. So, when you have exported and printed your reports you can verify it. The verification process can ensure that your audit is accurate thereby allowing you to show you’re complying with regulations.

Imagine being able to export and print off reports about all of your assets. This is something that you could do if you use a register that details all of your assets. Just make sure that the software you choose offers you this feature.

The Accounting Process

This part of an audit involves you physically verifying your assets. Once this stage is complete you can potentially eliminate any ghost assets in the system. Another benefit of this is that you can quickly check the condition of each asset.

The accounting process also involves ensuring that figures such as asset costs, depreciation, and tax are correct. While this may not seem like a lot of fun, having an equipment register to hand can make the process much easier.

Asset Depreciation

Every single asset that you own will lose value over time. The loss of value is referred to as “Depreciation”. Working out or calculating an asset’s depreciation is a vital part of the audit process. When assets in your equipment tracking register lose value it needs to be recorded. As a result, you may need to adjust your insurance and tax figures.

There are a few different methods for calculating depreciation. For example, you could use the units of production way, the written down value, or even the straight line method. The choice is yours. However, once you have calculated everything, you’ll need to update your register. Finally, don’t forget to update your insurance and tax values. This could help you to save money and that’s never a bad thing.

The Valuation

The final step of the auditing process relates to the valuation of your assets. This valuation needs to include every single piece of equipment that you own. You may have a lot of equipment and it could seem like a task but it’s vital everything’s included. As soon as you have confirmed the value of everything you’ll need to do one more thing. You’ll need to check that your business is meeting the regulatory requirements. This is often an anxiety-provoking task. However, if you take your time you can potentially iron out any issues. Don’t rush any part of this process. Take as long as you need to ensure that your business is meeting those regulations. When you are certain, then you can disclose everything.

Using an equipment tracking register can prove to be very useful for the auditing process. You could have all of the information you need about your assets in one place. You may not have to go running around a warehouse or factory, for example, trying to gain the information you need. You can simply log into your tracking software and have access to the details you need for your audit. Consequently, this potentially stressful time could be made so much easier.

Would you like to speak with someone knowledgeable about using an equipment tracking register to help you with audits? Contact us now at team@itemit.com.