Monitoring income by itself does not expose actual profitability of businesses. Directly influencing your bottom line, tax responsibilities, and strategic decision-making, the cost of goods sold (COGS) is a vital financial statistic.

The article looks at techniques and formulas for precisely calculating the cost of goods sold across several business structures. Beyond basic calculations, we will explore how modern asset tracking systems might revolutionise inventory management, automate calculations, and provide accurate financial insights—empowering you to extract significant intelligence from your product costs.

What is Cost of Goods Sold (COGS)?

The cost of goods sold (COGS) includes all direct expenses paid for manufacturing or acquiring commodities sold over a certain period. Unlike regular expenses like marketing or administration, COGS directly relates to items leaving your inventory.

For retailers, COGS primarily includes supplier purchase prices plus costs to bring products to selling locations. Manufacturers face more complex calculations incorporating raw materials, direct labor, and production-related overhead.

The formula for cost of goods sold links inventory management to financial performance, providing critical insights into gross profit margins and operational efficiency. Well documented COGS minimises taxable income as an acceptable business expense. With changes in the cost of goods sold equation typically indicating operational problems seeking management attention, financial analysts examine COGS trends to evaluate cost control methods and production effectiveness.

Why is COGS Important for Businesses?

Meticulously tracking and calculating COGS formula extends beyond basic accounting compliance, serving as the foundation for numerous critical business decisions.

COGS directly determines gross profit—revenue minus production costs—revealing your core operations’ fundamental profitability before overhead expenses. Without accurate calculations, businesses risk operating under illusory profit margins that mask underlying issues.

When establishing pricing strategies, the cost of goods sold calculation provides the baseline minimum price needed to avoid losses. Sophisticated pricing models build upon COGS with markup percentages ensuring adequate profit margins while remaining competitive.

From a tax perspective, COGS represents a substantial legitimate deduction that reduces taxable income. Miscalculating it can lead to overpaying taxes or triggering audits.

Unlike fixed overhead expenses, COGS varies directly with sales volume; hence, it is a variable expense that needs ongoing monitoring. For businesses involved in Financial Reporting to their stakeholders, COGS accuracy directly affects important performance measures that assess the company’s situation. Trend analysis made possible by consistent tracking helps management find seasonal trends or developing cost pressures before they seriously affect profitability.

The Formula for Calculating COGS

Fundamentally, the cost of goods sold formula relies on a basic accounting concept: what you had (opening inventory), plus what you got (purchases), less what remains (close inventory). This fundamental equation catches the flow of inventory through your business over a given accounting period.

The standard formula to calculate COGS can be expressed as:

COGS = Opening Inventory + Purchases – Closing Inventory

Let’s break down each component:

Opening Inventory: The entire value of inventory available for sale at the beginning of your accounting period. This value often matches your previous accounting period’s closing inventory, ensuring financial continuity.

Purchases: This includes all inventory purchased during the accounting period, including manufacturer raw materials and retailer finished goods. Shipping, customs duties, and handling fees should be added to the base purchase price to prepare items for sale.

Closing Inventory: This reflects the value of unsold inventory remaining at the end of your accounting period, determined through physical counting or perpetual inventory tracking systems.

To illustrate this costs of goods sold formula in action, consider a clothing retailer with these figures for the quarter:

- Opening inventory: $75,000

- Purchases during the quarter: $125,000

- Closing inventory (determined by physical count): $85,000

Applying the formula: COGS = $75,000 + $125,000 – $85,000 = $115,000

This calculation reveals that $115,000 worth of inventory was sold during the quarter, providing the foundation for gross profit calculations and further financial analysis.

Step-by-Step Process to Calculate COGS

Accurately determining the cost of goods sold requires a systematic approach. Follow these detailed steps to ensure precision in your calculations:

Step 1: Identify Opening Inventory Value

Begin by determining the monetary value of all inventory available for sale at the start of your accounting period. This inventory valuation should align with your chosen inventory accounting method (FIFO, LIFO, or weighted average). For businesses using a perpetual inventory system, this figure is continuously updated and readily available in your inventory management software. Alternatively, those using periodic systems must rely on the previous period’s ending inventory figure.

Step 2: Track All Inventory Purchases

Meticulously document every inventory acquisition throughout the accounting period. This includes not only the base purchase price but also all additional costs required to make inventory ready for sale:

- Transportation and freight charges

- Import duties and customs fees

- Insurance during transit

- Handling and storage costs directly related to acquired inventory

Using an asset tracking system significantly simplifies this process by automatically capturing purchase transactions and associated costs.

Step 3: Account for Inventory Returns and Allowances

Subtract any inventory returned to suppliers or allowances received for damaged goods. These adjustments ensure your COGS calculation reflects only inventory that genuinely contributed to your available-for-sale pool.

Step 4: Determine Closing Inventory Value

At the end of the period, conduct a comprehensive count of remaining inventory. For physical products, this typically involves a complete stocktake, where items are counted and valued according to your chosen inventory method. Businesses employing sophisticated asset utilisation tracking technologies can often determine closing inventory values without disrupting operations through continuous tracking systems.

Step 5: Apply the COGS Formula

With all components identified, apply the formula for cost of goods sold: COGS = Opening Inventory + Purchases – Closing Inventory

For example, if your manufacturing business began the month with $200,000 in inventory, purchased $350,000 in additional materials and components, and ended with $180,000 in remaining inventory, your COGS calculation would be:

COGS = $200,000 + $350,000 – $180,000 = $370,000

This figure represents the actual cost of products sold during the period, forming the foundation for gross profit determination and further financial analysis.

Different Methods for Valuing Inventory

The inventory valuation method you select significantly impacts how you calculate COGS from inventory. Three predominant approaches exist, each with distinct implications for financial reporting and tax obligations.

First-In, First-Out (FIFO)

The FIFO method assumes that inventory items purchased first are sold first—mirroring the natural flow of goods in many businesses. Under this approach, older inventory costs are allocated to COGS while newer purchases remain in ending inventory.

During inflationary periods, FIFO typically results in lower COGS figures as older, less expensive inventory is expensed first. Consequently, this method generates higher reported gross profits and potentially increased tax liabilities.

For instance, imagine a retailer purchasing three batches of identical products:

- January: 100 units at $10 each ($1,000)

- February: 100 units at $12 each ($1,200)

- March: 100 units at $15 each ($1,500)

If 150 units are sold by quarter-end, FIFO would calculate COGS as: COGS = (100 × $10) + (50 × $12) = $1,000 + $600 = $1,600

Last-In, First-Out (LIFO)

LIFO assumes that the most recently acquired inventory is sold first. This method assigns newer (typically higher) costs to COGS while older inventory costs remain in ending inventory.

In inflationary environments, LIFO generally produces higher COGS values and lower reported profits, potentially reducing tax obligations. However, this approach can create unrealistically old inventory values on the balance sheet if some inventory items are rarely fully depleted.

Using our previous example, LIFO would calculate cost of goods sold as: COGS = (100 × $15) + (50 × $12) = $1,500 + $600 = $2,100

Weighted Average Method

This approach calculates the average cost of all similar inventory items available during the period, regardless of purchase date. This single unit cost is then applied to both ending inventory and COGS calculations.

The weighted average method smooths out price fluctuations and provides a middle ground between FIFO and LIFO results. It’s particularly suitable for businesses dealing with indistinguishable inventory items stored together.

For our example, the weighted average cost would be: Average cost = ($1,000 + $1,200 + $1,500) ÷ 300 units = $12.33 per unit.

Therefore, the COGS calculation would be: COGS = 150 units × $12.33 = $1,849.50

The difference between periodic and perpetual inventory systems also influences these calculations. In periodic systems, average costs are determined at the end of the accounting period, while perpetual systems recalculate average costs after each inventory transaction.

Common Mistakes When Calculating COGS

Accurately determining the cost of goods sold requires avoiding several common pitfalls that can distort financial reports and business decisions.

Misclassifying Expenses

The most prevalent error involves incorrectly categorising costs that should be treated as operating expenses rather than COGS. Remember that COGS should only include direct costs associated with producing or acquiring sold products. Frequently misclassified expenses include:

- General warehouse utilities not directly tied to production

- Marketing and advertising expenditures

- Sales commissions

- Administrative personnel salaries

For example, while a factory utility bill directly supporting production properly belongs in the COGS calculation, general office utilities do not.

Neglecting to Include All Direct Costs

Conversely, some businesses understate COGS by failing to incorporate all legitimate direct costs. When you calculate COGS formula, remember to include:

- Freight-in and transportation costs for acquired inventory

- Import duties and customs fees

- Direct labor costs for manufacturing businesses

- Production supervisor salaries directly oversee the manufacturing

- Quality control costs tied directly to production

Inaccurate Inventory Counts

Physical inventory discrepancies dramatically impact COGS accuracy. Causes include:

- Theft or shrinkage not properly documented

- Damaged inventory not properly written off

- Clerical errors during manual counting

- Double-counting or missing items in warehouse locations

Implementing a robust asset tracking system with barcode scanning or RFID technology significantly reduces these counting errors.

Inconsistent Inventory Valuation Methods

Switching between inventory valuation methods (FIFO, LIFO, weighted average) without proper accounting adjustments creates inconsistencies that distort COGS trends over time. Tax regulations typically require consistency in inventory valuation unless specifically approved changes are documented.

Neglecting Period-End Adjustments

Failing to account for inventory returns, damages, or obsolescence at period-end leads to overstated inventory values and understated COGS. Proper period-end procedures should include thorough evaluation of inventory condition and marketability to ensure appropriate write-downs are recorded.

Solution: Integrated Systems and Procedures

To avoid these common mistakes, implement a comprehensive approach:

- Develop clear cost classification guidelines for accounting staff

- Utilise integrated inventory and accounting software systems

- Conduct regular cycle counts rather than relying solely on year-end inventories

- Implement proper approval workflows for inventory adjustments

- Document inventory valuation methodologies in your accounting policies

COGS in Different Business Sectors

The approach to “How to calculate cost of goods sold?” varies significantly across business sectors, reflecting fundamental differences in how value is created and inventory is managed.

Retail Businesses

For retailers, COGS primarily consists of the purchase price of sold merchandise plus any direct costs to bring products to the selling location. The COGS formula application is relatively straightforward:

COGS = Opening Inventory + Purchases – Closing Inventory

Key considerations for retailers include:

- Freight-in costs for merchandise acquisition

- Import duties and customs fees

- Direct handling costs at distribution centers

- Inventory shrinkage due to theft or damage

For example, a clothing retailer might calculate COGS percentage relative to sales to benchmark against industry standards, typically targeting 50-65% COGS-to-sales ratios depending on market positioning.

Manufacturing Companies

Manufacturers face a more complex COGS structure encompassing:

- Raw materials consumed in production

- Direct labor costs for production line workers

- Manufacturing overhead directly attributed to production (factory utilities, production supervision, equipment depreciation)

A furniture manufacturer might apply the cost of goods sold equation by tracking:

- Wood, fabric, and hardware inputs (raw materials)

- Production line worker hours (direct labor)

- Factory equipment depreciation and maintenance (manufacturing overhead)

Sophisticated manufacturers implement job costing systems to calculate COGS for each production batch, allowing precise profitability analysis by product line.

Service-Based Businesses with Physical Components

Hybrid service businesses providing both expertise and physical products require specialised approaches. Examples include:

- Restaurants combining food ingredients (inventory) with preparation services

- Construction firms utilising building materials alongside labor services

- Dental practices using medical supplies and prosthetics with procedural services

For these businesses, only the direct material components enter the COGS calculation. The service elements typically appear elsewhere in the income statement as labor or operational expenses.

A restaurant might calculate COGS formula specifically for food and beverage items (typically targeting 28-32% of food sales), while treating chef and server wages as separate operating expenses.

Software and Digital Product Companies

Even businesses selling digital products encounter COGS considerations. While lacking physical inventory, their cost of goods sold may include:

- Server hosting costs directly support product delivery

- Third-party software licensing fees embedded in products

- Customer support personnel directly handling product technical issues

Software companies implementing proper asset utilisation tracking can distinguish between development costs (typically capitalised) and ongoing delivery costs (appearing in COGS).

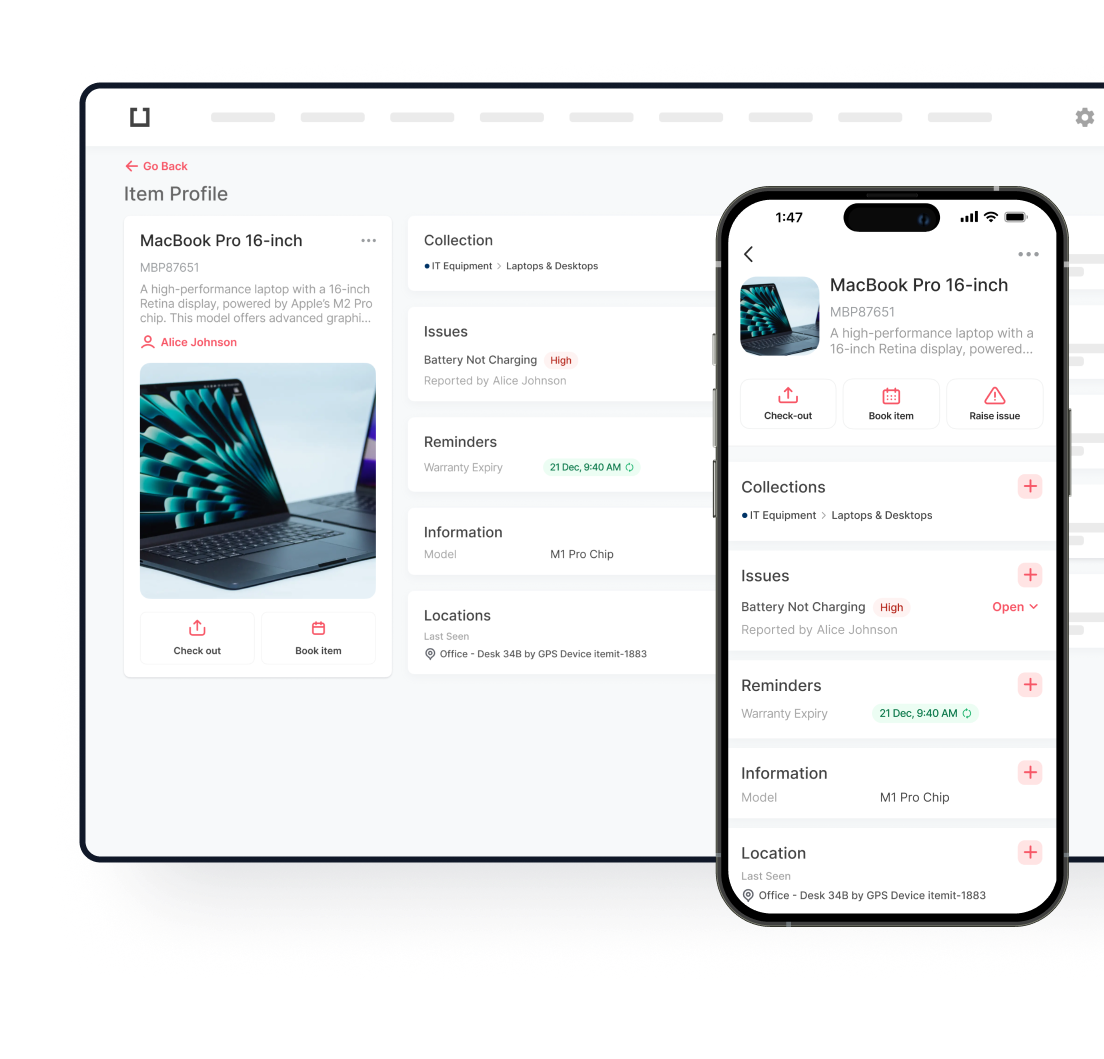

How Asset Tracking Software Helps with COGS Calculation

Modern asset tracking systems have revolutionised the accuracy and efficiency of how to find the cost of goods sold. These technological solutions offer numerous advantages over traditional manual approaches.

Real-Time Inventory Visibility

Advanced asset tracking platforms provide continuous visibility into inventory levels, eliminating the need for disruptive physical counts. By maintaining perpetual inventory records, businesses can:

- Access current inventory values at any moment without operational interruptions

- Identify slow-moving inventory before it becomes obsolete

- Detect theft or unusual inventory movement patterns promptly

- Generate real-time profitability analyses based on current COGS figures

Automated Cost Layering and Valuation

Sophisticated tracking systems automatically implement your chosen inventory valuation method, whether FIFO, LIFO, or weighted average. This automation:

- Eliminates manual calculation errors

- Maintains consistent application of accounting policies

- Adjusts inventory values automatically as new purchases arrive

- Provides audit trails documenting every inventory movement and valuation change

Enhanced Accuracy Through Technology

Barcode scanning, RFID tags, and IoT sensors dramatically improve inventory count accuracy compared to manual methods. These technologies:

- Reduce human counting errors

- Speed up inventory verification processes

- Enable more frequent cycle counts

- Provide location tracking for distributed inventory

Integration with Financial Systems

Today’s leading asset tracking solutions seamlessly integrate with accounting and ERP systems, automatically:

- Updating general ledger inventory accounts

- Generating COGS journal entries

- Preparing financial statements reflecting current inventory values

- Producing management reports analysing COGS trends

Data-Driven Inventory Optimisation

Beyond basic COGS calculation, advanced tracking systems provide analytical tools to optimise inventory levels:

- Identifying optimal reorder points based on lead times and usage patterns

- Highlighting excess inventory tying up working capital

- Forecasting future inventory needs based on sales trends

- Detecting seasonal patterns affecting inventory turnover

Implementing a comprehensive asset tracking system transforms inventory from a static accounting figure into a dynamic business asset. This provides the foundation for accurate cost-of-goods-sold calculations while simultaneously improving operational efficiency and working capital utilisation.

Try itemit

Choose a better way to track

your assets.

Start your free 14-day trial now!

Keep Learning

itemit Blog

Tips, guides, industry best practices, and news.

How to Optimise Product Inventory Management

Learn how to optimize product inventory management with effective strategies, a product inventory management system, and best practices for efficiency.

Buffer Stock in Inventory Management: How It Optimizes Supply Chain Efficiency

Learn the meaning of buffer stock, its role in inventory management, and how it optimizes supply chains. Explore strategies and tools for effective stock management.

How to Keep Your Asset Record Accurate and Up-to-Date

An accurate asset record is crucial for businesses aiming to optimise their operations, minimise costs, and enhance compliance. With itemit’s intuitive fixed asset management software, you can streamline your asset tracking process, ensuring that your records are always current and reliable.