Knowing the difference between fixed assets vs current assets can significantly impact your financial decisions and the overall health of your business. Why? Because understanding the difference helps you make informed choices, maintain a solid financial footing, and optimise how resources are allocated. Let’s dive into each type to explore how they shape a business’s financial strategy in detail.

Fixed Assets vs. Current Assets: A Brief Overview

Buildings, machinery, and vehicles – the long-term resources that a business owns and employs in daily operations are known as fixed assets. Usually, these assets are not turned into cash within a year. Instead, they are supposed to help the business over time. They enable continuous development and help create the fundamental infrastructure needed for companies to perform efficiently.

Conversely, current assets are transient and should be used up or turned into cash within one business cycle – typically a year. Examples comprise accounts receivable, cash, and inventory. Meeting urgent demands and responsibilities requires current assets, which also provide the liquidity required to maintain daily corporate operations free from hiccups.

Although fixed vs current assets may have different purposes in corporate operations, they complement one another to offer stability and liquidity – qualities necessary for running a profitable firm. While current assets maintain cash flow, fixed assets offer the means of operation.

What Is a Fixed Asset?

Any long-term asset a business intends to employ for operations for more than a year is known as a fixed asset. These comprise physical resources, including machinery, buildings, cars, and tools. Products, services, and sustaining overall corporate operations all depend on fixed assets. Unlike current assets, they are not simply convertible to cash.

Fixed assets, usually having a functional life longer than one year, demand a large financial outlay. Their long-term character makes them vital for a company’s development since they enable it to create products, increase capacity, or offer constant services.

One main feature of fixed assets is depreciation. Depreciation lets you distribute the cost of worn-down or obsolete assets throughout their useful life, presenting a better view of the financial situation. Depreciation guarantees more reasonable financial planning by helping to distribute the expense across time, smoothing out profit projections. Depreciation also influences your future asset replacement budget so as to guarantee no financial surprises. Including depreciation helps companies more precisely estimate their continuous costs and make necessary changes.

Among the several kinds of fixed assets are physical objects, including offices, machinery, buildings, and cars. Every one of these has a certain lifetime and undergoes depreciation throughout that period, therefore balancing the company’s books. These physical resources help the business achieve its strategic goals by formulating effective delivery of goods and services.

What Is a Current Asset?

Unlike fixed assets, current assets are transient by nature. They are items anticipated to be consumed or turned in for money within a year. Because they offer liquidity – that is, the capacity to pay off current liabilities (wages, supplier invoices, and other short-term debts) – current assets are absolutely essential for daily business operations.

Cash, inventory, accounts receivable, and marketable securities are typical examples of current assets. These easily convertible assets enable the organisation to satisfy its immediate financial needs and maintain commercial operations free from disruptions. They directly help a company be operationally efficient and liquid.

Cash, for example, is the most liquid asset a business may use immediately for various needs. Money owed by customers for goods or services delivered is shown in accounts receivable, and it is expected to be recovered quickly. Marketable securities are short-term investments that can rapidly be transformed into cash, and inventory is raw materials or completed goods ready for sale.

“Is equipment a current asset?” you might wonder. Often, the response is no. Long-term operations need for equipment designated as a fixed asset. But if the equipment is meant for sale in line with business operations, it could be seen as part of the inventory and, hence, as a current asset.

Current assets vs. fixed assets differ mostly in their liquidity and application inside the company. While permanent assets enable long-term output and stability, current assets maintain active cash flow and provide quick funds to cover running costs.

Examples of Current Assets

To make things a bit clearer, some common current assets and their roles in business operations would include:

- Cash: The most liquid type of asset, ready for immediate use in business activities.

- Accounts Receivable: Money owed to the company by clients, usually within a very short period of time. It ensures continuity of cash inflow.

- Inventory: Goods or materials that a company owns for sale. Inventory facilitates sales and revenue generation.

- Marketable Securities: Short-term investment that is readily convertible into cash and thus may serve as a flexible supplemental source of liquidity when required.

In turn, the very existence of current assets ensures that the enterprise will, at any moment in time, be capable of satisfying its current liabilities without interruptions, a buffer shielding the normal process of running a business from any disturbances.

Current vs Non-current Assets

Current assets are those that exist and can be turned into cash or used within one year. These represent the essential requirements that meet the short-term financing, liquidity assurance, and the maintenance of operational flow. The non-current assets, by contrast, are held longer and include items such as software, property and equipment, buildings, furniture, and vehicles. The non-current assets should provide lasting value to the company and help it grow and sustain its business activities in the long term. Knowing the difference enables companies to balance short-term needs with the strategies of long-term growth.

Examples of Fixed Assets

Fixed assets comprise the backbone of any business; they provide the infrastructural platform on which the operations are found to run smoothly. Some common examples of fixed assets and their impact could be elaborated upon by:

- Buildings: These are fixed assets employed for office purposes, manufacturing, or storage. Depreciation spreads the cost of the building over its useful life so that an accurate and true financial picture is reflected. Buildings provide a stable location for business activities; therefore, they relate to both operational stability and the presence of a brand.

- Machinery: It is integral to the manufacturing process and, therefore, forms one of the biggest asset bases for production-oriented businesses. With time, machinery depreciates, affecting production costs, which in turn affects financial planning. Proper machinery depreciation enables us to verify the cost of production and create a replacement prospectus for the future.

- Vehicles: These are seen as fixed assets, whether for deliveries or transportation of employees. They lose their value over time, but logistics and operations cannot be performed without them. They help a company continue its supply chain and customer service.

- Furniture: Office desks, chairs, and other fixtures are fixed assets that provide service over a pretty long period. Though depreciable, they are indispensable to establishing a work environment conducive to increasing employees’ productivity.

These are depreciable assets over time since their book value is gradually used to help a company arrive at its level of profitability. Types of fixed assets include machinery and vehicles that are well managed to ensure better financial management and compliance and long-term operational efficiency.

Let’s Break Up the Difference Between Fixed and Current Assets

In other words, let’s directly contrast the fixed assets vs. current assets position based on several key parameters below:

- Liquidity: The current assets are highly fluid and can be turned into cash within one year. The fixed assets are long-term and are not easily liquidated.

- Usage: Current assets refer to short-term, daily uses and working capital needs, while fixed assets are used for long-term production and operations support.

- Depreciation: Fixed assets are prone to wear and tear due to usage or consumption over a certain period, diminishing their economic value. As opposed to current assets, which may include cash or inventories, these fixed assets are never depleted in value.

- Accounting: Fixed assets appear as long-term assets on the balance sheet, whereas liquid or current assets are combined under the short-term asset category.

Here’s a simple breakdown to better understand their roles:

| Aspect | Fixed Assets | Current Assets |

| Liquidity | Low | High |

| Usage | Long-term Operational Support | Short-term, Daily Operations |

| Depreciation | Yes | No |

| Reporting | Non-current assets on the balance sheet | Current assets on the balance sheet |

For instance, inventory is an example of a current asset, while machinery is a fixed asset – each serving a different yet complementary role in the business. Together, they ensure that the company can both sustain long-term operations and cover short-term obligations, creating a balanced financial structure.

How Fixed and Current Assets Work Together

The following are a few detailed use cases that further explain how fixed and current assets work within different industries.

- Manufacturing Industry: A Manufacturing company utilises machinery (fixed asset) to manufacture goods, and its inventory-current asset represents raw materials and finished goods ready to be sold. Together, these assets ensure that production runs smoothly and provide liquidity for other operational requirements. Efficient management of these assets ensures the company can continue large-scale production and continuously meet customer demand without interruptions.

- Retail industry: Fixed assets are the buildings that house the stores, and inventory is comprised of products for sale. Of course, in every such industry, there will be a certain equilibrium between fixed and current assets, such that the retailer can keep merchandise in stock without overspending. Fixed assets, such as store shelving and furniture, enhance the customer experience, while current assets, in the form of cash, provide flexibility to respond to changing market conditions.

- Logistics and Transportation: Vehicles are fixed assets used by logistic companies for transportation and delivery purposes, while fuel and spare parts are current assets that become essential requirements on a day-to-day basis. Without a healthy fleet of vehicles, no logistics company can ever deliver on schedule. The interrelationship between current and fixed assets ensures that the group can provide efficient service at controlled costs. Asset tracking software helps business organisations trace their logistical setup with much efficiency and sees to it that fixed assets and current assets serve the purpose intended.

- Technology Industry: Technology companies use servers and equipment (fixed assets) in their operations to provide a digital service. Software licenses, on the other hand, can be current or non-current assets, depending on the time period used. Good asset management in this line enables these firms to minimise infrastructure costs as they offer quality service to their clients.

The Impact of Fixed and Current Assets on Financial Statements

Both fixed and current assets have significant implications on a company’s financial statements, particularly the balance sheet and income statement. To better understand how to prepare a fixed asset register and its relevance, companies need to maintain proper records of all fixed assets, including their purchase price, depreciation, and location. This often leads to questions like what is fixed asset register, which is essentially a systematic log of all fixed assets owned by a business.

- Balance Sheet: Fixed and current assets are listed separately on the balance sheet under non-current and current assets, respectively. Current assets like cash and accounts receivable are presented first due to their liquidity. Fixed assets, which include buildings, machinery, and vehicles, are listed under non-current assets and are reported at their book value (historical cost minus accumulated depreciation).

- Income Statement: Depreciation of fixed assets appears as an expense on the income statement, reducing net income. This affects profitability but also provides tax benefits by reducing taxable income. Current assets, such as inventory, directly impact the cost of goods sold (COGS), which influences gross profit margins.

- Cash Flow Statement: The purchase or sale of fixed assets impacts investing activities on the cash flow statement, while changes in current assets affect operating activities. Efficiently managing both types of assets helps maintain a positive cash flow, which is vital for business sustainability.

Features of itemit Fixed Asset Register Software

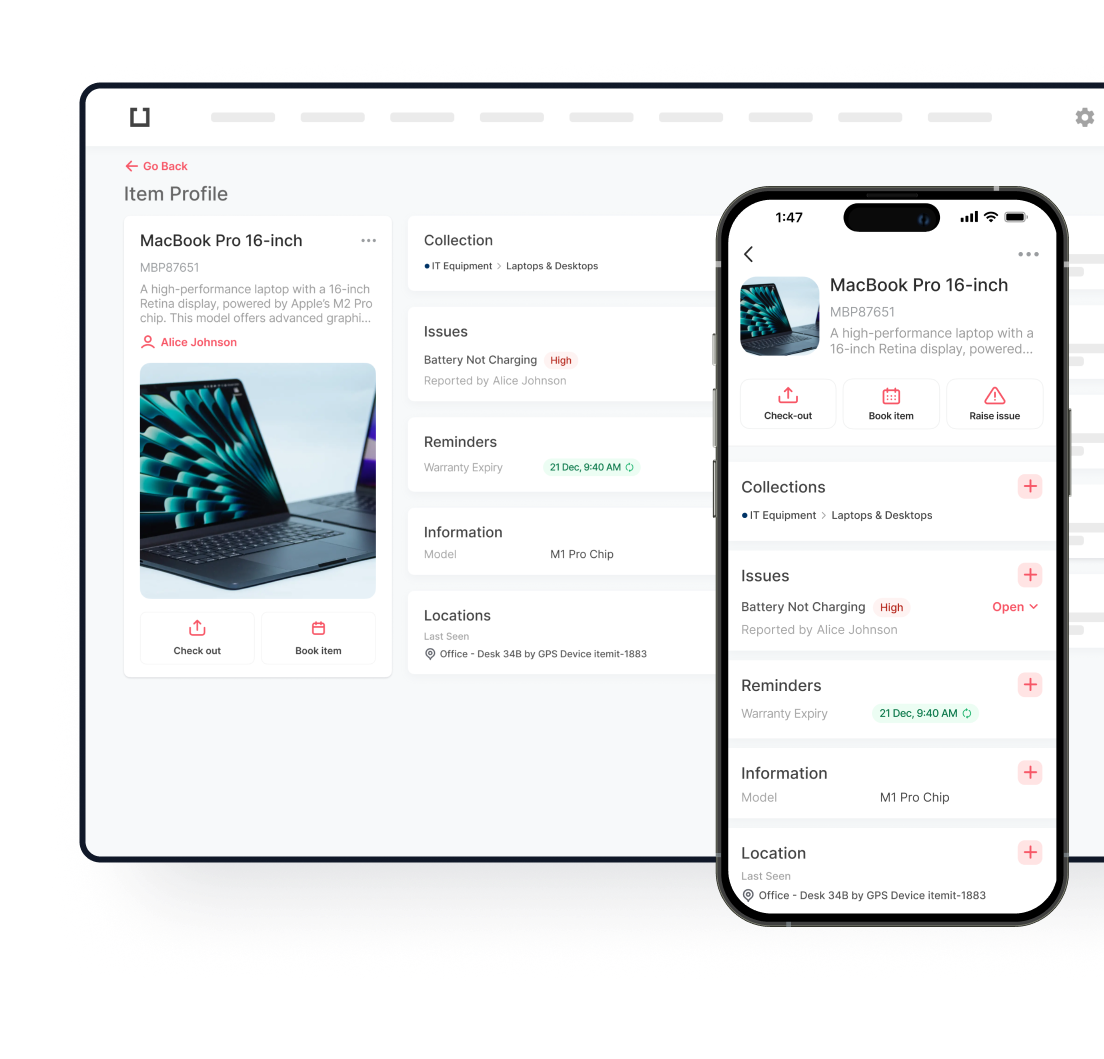

Managing fixed assets can be challenging, and that’s where itemit’s fixed asset register software comes into play. Asset management is often a time-consuming and complex process, but itemit offers a solution that streamlines every aspect of it.

With itemit, you can effortlessly keep track of your fixed assets, ensuring you always know their location, value, and depreciation status. The software not only helps maintain an organised asset register but also enhances transparency within the business.

Real-Time Monitoring and Tracking

itemit’s software features real-time monitoring, which means you get instant updates whenever assets move or change status. This is especially useful for businesses with multiple locations or those managing a large volume of assets. Knowing the real-time status of your assets can help you make better operational decisions and reduce downtime.

Detailed Reporting and Asset Valuation

The system also offers detailed reporting and asset valuation, providing insights that simplify fixed asset accounting and asset lifecycle management. By maintaining a record of asset history, itemit makes it easy to plan future investments, understand depreciation impacts, and comply with regulatory requirements. Accurate asset valuation helps in making better strategic decisions regarding asset replacement and upgrades.

Advanced Asset Tracking Technology

With advanced asset tracking technology, itemit ensures that you’re always on top of your asset management needs. The system uses barcodes, QR codes, and RFID tags to provide detailed tracking of assets, offering a seamless way to locate and manage resources. This kind of tracking minimises the risk of asset loss and theft, especially in industries like construction or healthcare, where assets are frequently moved.

Integration with Inventory Tracking

itemit’s software also integrates with inventory tracking, making it a comprehensive solution for managing both current and fixed assets. This integration means you can manage stock levels, asset availability, and asset conditions all in one place. For industries such as retail or logistics, this feature is crucial for ensuring that both inventory and fixed assets are optimised for operational efficiency.

Customisable Asset Management Solutions

Every business is unique, and itemit understands that. The software offers customisable asset management solutions that cater to specific industry needs. Whether you need to track depreciation schedules, monitor asset conditions, or generate compliance reports, itemit’s customisable features ensure that you have everything you need to manage assets effectively.

Whether you’re dealing with inventory tracking, asset depreciation, or just need an efficient asset management system, itemit has you covered. Accurate tracking reduces the risk of asset loss, improves operational efficiency, and helps you make informed decisions.

Ready to streamline your asset register software? Email us at team@itemit.com to learn more and get started today!

Try itemit

Choose a better way to track your assets. Start your free 14-day trial now!

Keep Learning

itemit Blog

Tips, guides, industry best practices, and news.

The Key to Asset Reliability: Preventive Maintenance and Real-Time Tracking

Enhance asset reliability with preventive maintenance and real-time tracking. Reduce downtime, improve efficiency, and extend asset lifespan with smart strategies.

Optimise Asset Performance: Essential Efficiency Strategies & Tools

Explore practical strategies to optimise asset performance management, maximise efficiency, and enhance productivity with predictive and real-time monitoring tools.

Asset Integrity Management: Strategies for Reliable Operations

Discover how asset integrity management ensures safety, efficiency, and longevity of your assets. Learn effective strategies to protect your investments.