Managing assets effectively has never been more critical, especially with the growing complexity of business operations. Whether you’re dealing with machinery, technology, or property, knowing exactly what you have, where it is, and its current state is fundamental to running a smooth and efficient operation. This is where asset verification becomes a cornerstone of effective asset management. It's not just about having a list - it's about ensuring the list mirrors reality.

Asset verification involves validating the existence, location, and condition of your assets, helping to keep records precise, minimise discrepancies, and build operational trustworthiness. Let’s explore why proof of assets is vital for every business, and how a comprehensive verification strategy can make all the difference.

Understanding Asset Verification and Its Importance

Asset verification is the process of checking physical or digital assets against inventory records for their existence and condition. Think of this as giving your portfolio of assets a health check to make sure everything is as and where it should be.

Ensuring Regulatory Compliance

This need for regulatory compliance is a driver for asset verification. Stringent regulations in industries that include health care, finance, and logistics require proper asset records to be maintained at all times. Proof of assets is not only a question of ticking boxes in the direction of regulations but also an exercise in transparency to stakeholders, shareholders, and customers alike. Asset verification stands as testimony to your accountability and reliability in operation - the very basic qualities expected of every business.

Penalties against fines, sanctions, and even the revocation of licenses come when laws require an organisation to keep records, some of which are accurate. Frequent verification makes your records correct; thus, your business can squarely prove that compliance may be proved beyond reasonable doubt. Assuring others, building trust relationships with partners and customers, and with regulatory bodies, is easy because your good reputation and credibility allow you to do so.

Boosting Operational Efficiency

Verification also enhances operational efficiency. Knowing exactly where your assets are and their condition at any moment in time means that fewer resources are wasted through misplaced items or redundant purchases. This clear visibility allows enterprises to make good use of maintenance schedules, equipment usage, and avoid unnecessary costs and downtime.

For instance, a construction company depends on having the right heavy machinery in the right place at the right time. Losing sight of equipment or its unavailability, simply because it was never checked, makes projects fall behind schedule, inflating costs and impairing relationships with clients. Asset verification makes sure each piece of equipment is tracked and accounted for, smoothing the workflow and boosting productivity.

Enhancing Data Accuracy

Accuracy is key to asset management. Verification eliminates discrepancies between what's recorded and what actually exists, ensuring that your asset accuracy is spot-on. This accuracy feeds into everything from effective resource allocation to financial auditing, making sure your records are always reliable.

Incorporating asset verification into your management processes not only ensures compliance but also supports smarter decisions, effective resource management, and enhanced loss prevention by protecting against theft or misplacement. Accurate data helps businesses make informed choices on asset allocation, replacement, and maintenance, ensuring optimal resource use and improving overall efficiency.

What Is Asset Verification?

So, what is asset verification? Simply put, it’s a structured process that involves verifying each item in your asset register to ensure it is present, functional, and accurately recorded. By systematically verifying your assets, you can ensure that your records reflect reality, ultimately supporting better decision-making.

Preventing Fraud and Unnecessary Expenditure

Regular verification is critical to maintaining asset accuracy and preventing fraud or loss. Imagine spending money on new equipment, only to discover later that the original assets were misplaced or recorded incorrectly. Effective verification eliminates these costly errors, ensuring that your investments are genuinely needed.

Fraud prevention is also a significant benefit of asset verification. In industries where high-value assets are commonplace, discrepancies can be a sign of internal theft or fraud. By regularly verifying assets, you create an environment of accountability, discouraging any potential misuse or misappropriation of company property. This not only safeguards your investments but also creates a culture of trust and integrity within the organisation.

What Is an Asset Check?

An asset check is a part of the verification process where each asset is physically confirmed to ensure the details in the records match reality. This process adds an extra layer of transparency and minimises the risk of inaccuracies creeping into your asset management.

For example, an asset check might involve inspecting office equipment such as laptops, projectors, and printers to confirm their location and condition. If an asset is no longer operational or missing, the asset check process ensures that these discrepancies are updated in the records immediately. This practice keeps your asset register current and ensures you aren’t allocating resources based on outdated information.

Maintaining the Asset Lifecycle

Regular checks also help in maintaining the asset lifecycle. By knowing the condition of your assets, you can predict when maintenance or replacements are needed, reducing unexpected costs and ensuring productivity remains high.

A well-managed asset lifecycle means extending the useful life of equipment, reducing downtime, and optimising maintenance schedules. Asset verification provides valuable data that helps in determining the best times for servicing or upgrading assets, ultimately leading to reduced costs and enhanced operational efficiency.

Defining Verification in Auditing and Its Role in Asset Management

Verification is an essential aspect of auditing that goes beyond counting items. In an audit, proof of assets refers to showing evidence that assets listed on your records actually exist and are in good working order. This process supports financial transparency and adds credibility to your operations.

Role During Financial Audits

Asset verification is vital during a financial audit. Auditors need concrete proof that assets exist as listed. This isn’t just for compliance - it provides stakeholders with confidence that the company’s financial statements are accurate and reflect true asset value.

When auditors verify assets, they are essentially confirming that your organisation’s reported financial health matches reality. Discrepancies can raise red flags for investors and regulatory bodies, leading to a loss of trust. By integrating asset verification into your routine, you ensure that audits are smoother and that your financial statements are always credible and reliable.

Ensuring Accountability

The phrase “proof of assets” means presenting undeniable evidence during an audit that all items on your books are real and functional. For instance, if your records show a fleet of vehicles, you need to physically verify that these vehicles exist and are operational. Such thorough verification ensures accountability and minimises the risk of fraud or errors in financial reporting.

An example of proof of assets might be locating a piece of machinery on the factory floor and confirming its presence with supporting documents like purchase invoices or maintenance records. This kind of hands-on verification provides reassurance to auditors and stakeholders that the business is accurately reporting its resources and assets.

Fixed Asset Verification: Why It Matters for Businesses

Fixed asset verification is about keeping a check on assets like machinery, vehicles, and property - elements that are foundational to your operations. Particularly in sectors like manufacturing, construction, or logistics, these assets require careful monitoring to prevent losses or inefficiencies.

Crucial for High-Value Sectors

For sectors such as oil and gas, fixed asset verification is indispensable. The value of equipment in this field is enormous, and any discrepancies can lead to severe financial repercussions. Regular verification ensures assets are where they should be, properly maintained, and accurately recorded in financial documents. By preventing discrepancies, businesses can avoid costly write-offs and unexpected downtime.

Optimising Asset Use and Preventing Losses

Verification doesn’t just stop at protecting assets from theft - it’s also about using them efficiently. Identifying underused or idle equipment allows for better resource reallocation and prevents unnecessary capital expenditure. Verification schedules also help prevent downtime by ensuring assets are maintained before problems arise, extending their useful life and boosting productivity.

For example, a construction company might discover through asset verification that certain machinery is sitting idle at one site while desperately needed at another. By reallocating these assets, the company avoids unnecessary rental costs and maximises the value of its existing investments.

Accurate Assessment of Fixed Assets

Fixed asset verification is also a fundamental part of asset assessment. Understanding the value and condition of your assets helps with budget planning and decision-making, especially when deciding whether to repair, replace, or upgrade an asset.

For instance, a company planning to open a new branch needs to understand which existing assets can be moved and which ones need to be purchased. Verification provides the data necessary to make these decisions confidently, ensuring both financial and operational efficiency.

Benefits of Using Asset Verification Software for Efficient Tracking

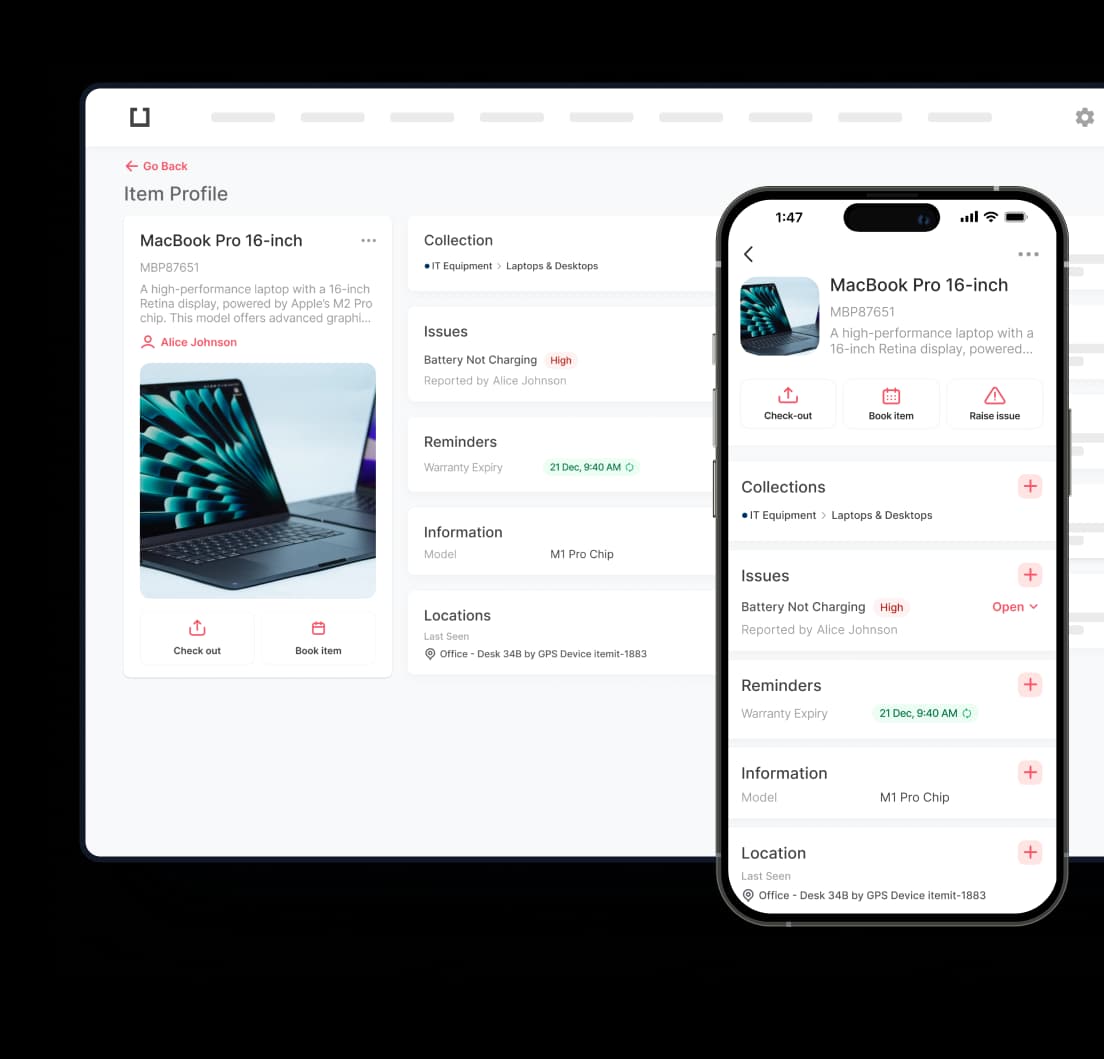

Streamlining asset verification is best done using specialised software like itemit. This solution is designed to simplify asset tracking with features such as real-time monitoring and automated asset verification - removing the burden of manual tracking.

Automation and Real-Time Data

Gone are the days of spending hours cross-checking spreadsheets. With itemit, you can generate verification of asset reports with just a few clicks, providing an instant overview of your assets. Automation not only saves time but also significantly reduces human error, ensuring accurate data collection.

Real-time monitoring means you can track assets as they move, providing visibility that was previously impossible with manual methods. Whether assets are being transferred between departments or used at a different location, real-time updates ensure everyone is always informed. This level of insight allows for immediate corrective action if something goes wrong, minimising disruptions to your operations.

Supporting Audits and Regulatory Compliance

Whether it’s an IT inventory audit or a financial audit, itemit’s verification software ensures you are ready. Accurate and up-to-date asset records are crucial for compliance, and itemit allows you to conduct an asset audit efficiently, making it easier to demonstrate the value and existence of your assets.

For IT companies, ensuring every piece of hardware is accounted for is vital - not just for financial reasons but also for data security. Missing equipment can lead to data breaches or compliance violations. Asset verification software ensures that every server, laptop, or piece of networking equipment is precisely tracked and verified, reducing risks and streamlining the audit process.

Making Informed Business Decisions

Real-time insights are a game changer. If an asset is moved or misplaced, you’ll be immediately aware, allowing for quick action. Such insights enable better decision-making, like deciding when it’s time to buy new assets or reallocate existing ones based on usage patterns.

For example, an IT company may discover through verification data that certain workstations are underutilised, indicating they could be reassigned to other teams in need. This allows the business to maximise resource use without incurring additional costs. These kinds of data-driven decisions not only save money but also enhance overall productivity.

Ready to revolutionise your asset management? Let us streamline your verification process, cut costs, and increase precision. Contact our specialist today at team@itemit.com to learn more about how we can meet your needs.

Industries That Rely on Asset Verification for Success

Asset verification is essential across many industries, each facing unique challenges that require precise tracking and accountability.

Healthcare

In healthcare, maintaining asset accuracy is crucial for patient safety. Medical devices must be available, calibrated, and accounted for to ensure efficient care. Regular verification avoids equipment shortages or failures, directly impacting patient outcomes.

Manufacturing

Manufacturers rely on fixed asset verification to maintain production efficiency. Regular verification of machinery ensures it is functional, minimising unexpected downtime and production interruptions.

Retail

Retail asset verification helps track inventory, fixtures, and digital systems. Maintaining accurate records prevents losses and ensures stock availability, contributing to better customer satisfaction and efficient store operations.

IT and Logistics

The IT sector uses digital asset verification to keep servers, computers, and other digital equipment functional, preventing losses and ensuring data security. Logistics companies, on the other hand, rely on asset verification to track vehicles, scanning devices, and other essential equipment, ensuring smooth operations across the supply chain.

Oil and Gas

For the oil and gas industry, oil and gas fixed asset verification is critical due to the high value of equipment spread across remote locations. Regular checks ensure assets are maintained, reducing failures and operational risks.

Effective asset verification helps these industries stay compliant, efficient, and competitive while minimising losses.

Best Practices for Asset Verification Across Various Sectors

To make asset verification effective, follow these best practices tailored to your specific industry needs:

- Create a Detailed Asset Register: List all assets, including their type, location, condition, and acquisition date. A well-maintained asset register ensures you have a solid foundation for asset verification. Using tagging systems like barcodes or RFID tags helps make tracking easier and more accurate.

- Conduct Regular Checks: Schedule asset checks based on the type of asset and its usage frequency. This helps identify issues early and keep records up-to-date.

- Leverage Technology: Use asset verification software to automate the process. Automation helps eliminate human error, speeds up verification, and ensures real-time tracking of assets.

- Adapt to Industry Needs:

- Healthcare: Verify medical equipment frequently to ensure patient safety.

- Manufacturing: Regular checks of machinery help prevent unexpected breakdowns.

- IT: Verify digital assets to keep systems secure and up-to-date.

- Retail: Verify inventory to minimise shrinkage and keep stock levels optimised.

- Integrate Verification into Audits: Regular audits help reconcile records with actual conditions, ensuring accountability and transparency.

- Train Your Team: Properly train employees in the use of asset tracking software. The more familiar they are with verification tools, the smoother the process will be.

- Set Clear Policies: Define guidelines for asset verification, including responsibilities and schedules. This ensures consistency across your organisation.

- Use Data Insights: Analyse verification data to make informed decisions about asset maintenance, retirement, or replacement. These insights can reduce costs and improve operational efficiency.

- Refine Your Process: Asset verification is an ongoing process. Regularly review and improve verification practices based on new technology or employee feedback to ensure they stay effective.

By following these best practices, your asset verification process will be efficient, support better decision-making, and minimise losses.

Wrap-Up

Asset verification isn’t just a good practice - it's an absolute necessity for businesses that aim to maintain an accurate inventory, reduce losses, and maximise efficiency. By embedding asset verification into your management processes, you ensure that every asset is accounted for, properly utilised, and optimised to its fullest potential.

Verification supports loss prevention, minimises operational inefficiencies, and ensures that your organisation complies with industry regulations. Additionally, it provides a foundation for superior resource management, helping you make well-informed decisions on maintenance, replacements, and investments.

With reliable data, you can also better understand the asset lifecycle of everything in your register, ensuring you derive maximum value while minimising downtime and unexpected costs.