Picture running a small or medium company; you do everything yourself—including asset tracking. Many owners, like you could have in the early days, rely on Excel. Excel looked fantastic—quick to build lists, inventory control, and organisation of data. Excel begins to expose its limits, though, as your company expands.

It was not built for sophisticated asset tracking. Manually updating data gets difficult, and mistakes like deleting a row or entering the incorrect number could compromise your records. There is no real-time data. Hence, retaining maintenance schedules is quite a task.

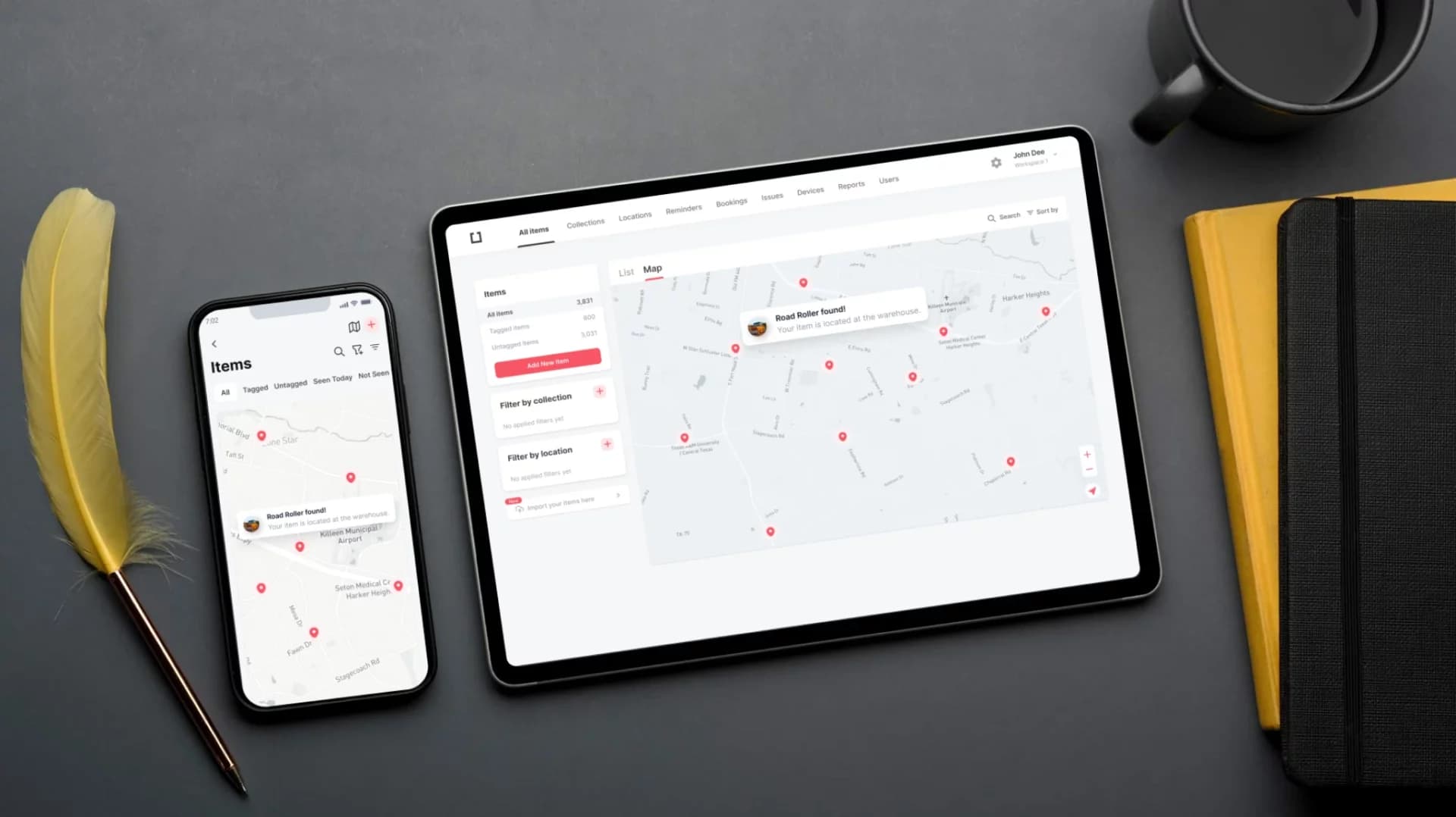

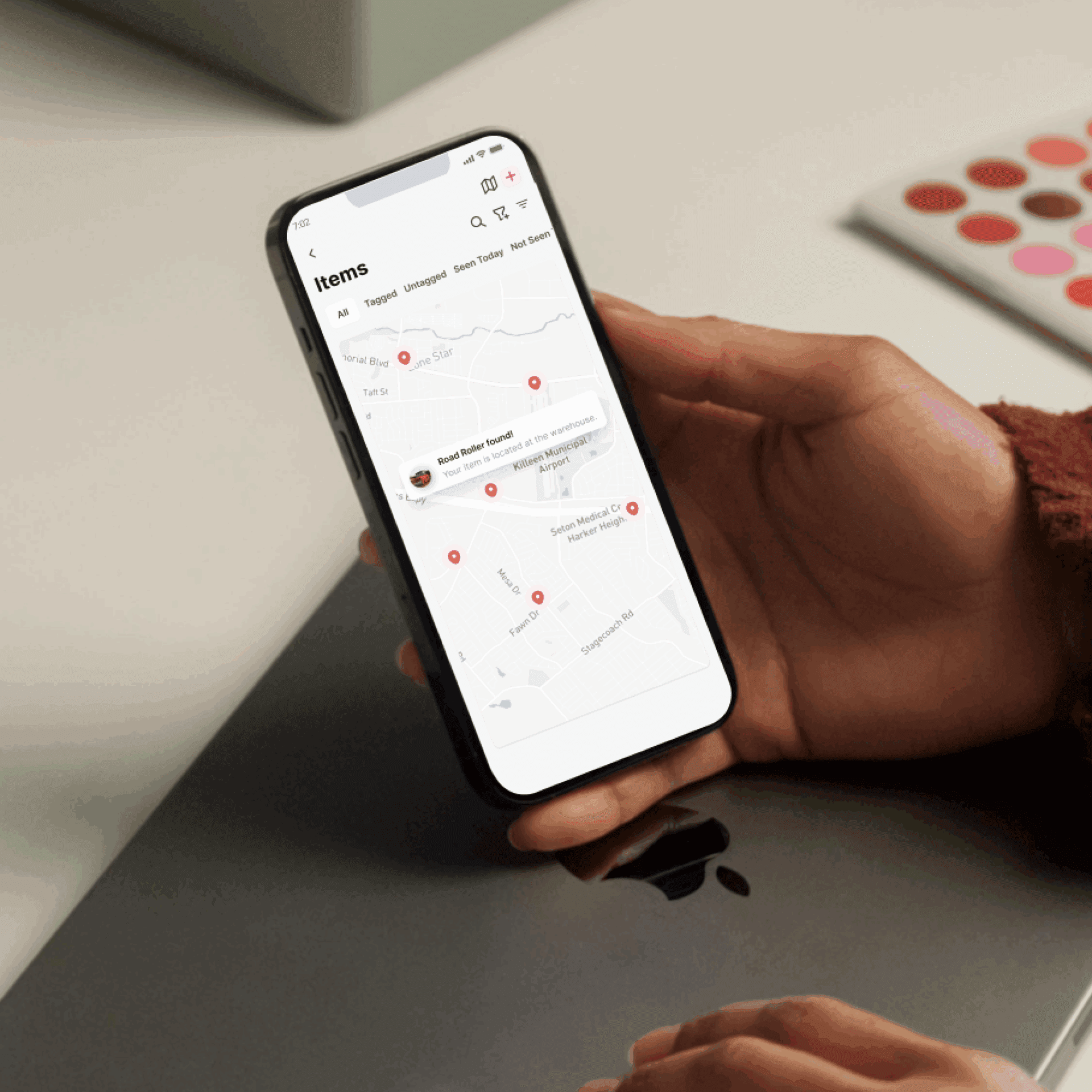

Imagine now using asset management software instead. It tracks everything automatically, changes in real time, and expands with your company. No more hours wasted adjusting spreadsheets or obsessing over human mistakes. Excel was useful in the past, but today's companies demand more—software that secures and streamlines your assets so you can keep on top of everything effortlessly. Itemit can provide you with such asset register templates, helping you run your everyday tasks with ease.

The purpose of an asset register is to be a highly detailed list of all of a business’s assets. The list includes details such as the owner of the assets, the condition and location. An asset register helps businesses understand the asset’s price, depreciation, status, and procurement date. In addition to this, the asset register also lets the user know the asset’s current value and insurance status.

What Types of an Asset Register Exist?

Businesses cannot effectively track and control their resources without asset registers. These registers guarantee correct monitoring and maintenance by giving a methodical approach to document details on the assets a corporation holds. Depending on the kind of assets being recorded, different asset registers—each with a particular use—exist. Knowing these different kinds can help companies decide which one best fits their situation.

Fixed Asset Register

A fixed asset register is designed to record long-term physical assets like buildings, machinery, cars, and furnishings. Usually designed to be employed over an extended period, these assets are not readily convertible into cash.

Crucially important information in this kind of registration includes:

- Purchase date

- Purchase price

- Depreciations

- Place of the asset's location

- Plans for maintenance

Maintaining a fixed asset register helps companies control depreciation and guarantee the scheduled completion of all required repairs and maintenance. A firm might use it, for instance, to monitor fleet vehicles or office equipment to guarantee that these precious assets remain in excellent condition and that their value is fairly reported in its financial accounts.

IT Asset Register

Many businesses operate their operations in the digital age of today mostly depending on technology. Specifically meant to track hardware and software assets like computers, servers, software licenses, and other tech-related resources is an IT asset register.

Usually, the "IT asset register" consists of:

- Serial numbers and guarantees

- Version control and licenses for software

- Configurations of networks

- End-of-life dates for tools and programs.

- Updates and security standards

A company with a lot of laptops and PCs, for instance, would use this register to record which staff members use which devices, the state of software upgrades, and any possible security concerns related with obsolete software.

Financial Asset Register

Tracking assets regarded as financial in nature—that is, investments, stocks, bonds, and other financial instruments—a financial asset register. This kind of register is geared at assets that are readily liquidated or turned into cash. Companies that handle significant portfolios of financial assets or participate in investing activities must pay great attention.

Important components of this kind of registry consist in:

- Purchase price

- Market value

- Ownership data

- Maturity dates for bonds or other investments

A corporation having investments in several stocks and bonds, for instance, would utilise a "financial asset register" to monitor these assets and effectively manage their portfolio thereby guaranteeing regulatory compliance and maximising earnings.

Consumable Asset Register

Consumable assets are those used up during routine business operations—that is, office supplies, raw materials, and other expendables. Monitoring the stock levels of these products enables companies to avoid shortages and guarantee seamless operations by use of a consumable asset register.

Usually speaking, the consumable asset register comprises:

- Level of inventory

- Information on suppliers

- Replenishment plans

- Cost per unit

A restaurant might track its food inventory using a consumable asset register, for instance, making sure that ingredients are reordered before they run out and to avoid overstock and waste.

What About the Asset List Format?

The particular format or structure applied in an asset register is referred to as the asset list format. The type of assets under management and the sector the business runs in will determine this as well. For example, a construction company could concentrate more on maintenance plans and depreciation values for machines whereas an IT company might employ a thorough list approach stressing serial numbers, software versions, and network configurations.

Businesses choosing an asset list format should weigh what data tracking is most important. Important elements could include:

- Asset IDs

- Date of purchase and installation

- Current status or condition

- Responsible department or individual

A well-organised asset list format guarantees nothing slips through the gaps and streamlines asset management. It also facilitates managers' wise judgements about asset use and replacement as well as auditor evaluation of asset records.

Understanding What is the Purpose of an Asset Register

Having viewed the several types of asset registers now, you can ask the most important question – so, what is the purpose of an asset register? Simply said, asset registers enable companies to retain a correct record of their assets, therefore guaranteeing proper management, maintenance, and financial reporting. They help to lower asset loss risk, enhance maintenance plans, and offer vital data for audits and decision-making. Businesses would find it difficult to track their priceless resources without them, which would cause inefficiency and maybe financial loss.

Every one of these—a fixed asset register for long-term assets, an IT asset register for technology resources, or a consumable register for daily needs—helps companies remain orderly and effective.

The Benefits of an Asset Register

There are many benefits of having an asset register, including:

- Assets can be tracked and easily identified

- Assets can stay compliant in accordance with the industry’s regulatory standards

- Helping to prevent assets from getting lost or being stolen thanks to itemit’s accurate location data services

- Estimating repair and maintenance costs

- It helps to provide complete transparency of all assets and associated data

- Providing users with a highly accurate audit trail

- The calculation of depreciation

As your business grows, you’ll naturally gain more assets. It can become increasingly difficult to track all of your assets over time. Keeping a close eye on your assets is much easier when you have an asset register. While setting up the register can take time, once it is complete, it will benefit your business right away.

Another benefit of this type of register is that it can help to eliminate ghost assets. When an asset is damaged beyond repair or has gone missing, they are no longer of any use. By tracking every asset and its state of repair, ghost assets can be eliminated. Finally, the register can be accessed via a computer or mobile app.

What Should I Include in My Asset Register?

You can include any business assets you wish in your register. Assets can include:

- Computers, printers, servers, and laptops

- Vans and cars

- Furniture such as chairs, desks, and filing cabinets

- Photocopiers, telephones, and scanners

- Stationery and tools

- Machinery and associated equipment

Add any assets that have value to your business. The above list is just an example, however, your business may have other types of assets. Adding these assets to the register can help you to track them. Using itemit allows you to track both high and low-value assets 24 hours a day.

What Data Should I Include in My Asset Register?

There is a real possibility for you to include a whole host of different data in your register. Including as much detail about each asset can be very useful. Some of the data that itemits users include is the:

- Asset’s Depreciation

- Asset’s remaining life

- Asset’s serial number or barcode

- Current and previous users of the asset

- Current value of the asset

- Date and frequency of maintenance

- Estimated resale value

- Insurance coverage and what it includes (repairs, maintenance, etc)

- Licence start date

- Location of all assets

- Manufacturer’s warranty information

- Operating licence

- Owner of the asset

- Purchase date and price

When every asset in the register contains detailed information, they are easier to keep track of. Users will know where the assets are and what condition they are in. Notes can be left for the next user, and management can see how effectively each asset is being used.