At their most basic level, fixed assets are assets that are purchased for long-term use, such as equipment and machinery, land and buildings. They can’t be quickly sold or converted into money, and so their usefulness is dictated by their long-term conversion of use to profit.

Your fixed assets, for example, won’t include your inventory, as you can sell that to make an immediate profit. It will, however, be a card reader as this will be used over a more extended time and assists you in selling inventory, therefore helping to generate revenue for the business.

The longevity of an asset is what dictates whether or not it can be classified as a fixed asset. If an asset is rented or sold or only used for a quick conversion into money, it won’t be a fixed asset. If an asset is consistently converting its use into monetary value throughout its useful life, it can be classified as a fixed asset.

The lifetime of an asset will, of course, depend on the asset itself, which is why tracking a fixed asset’s life cycle is crucial. A pneumatic drill will have a much shorter useful life than a plot of land, for example. They will both be used in businesses for an extended period and still affect profit and loss (as they affect the efficiency a business can run at). Still, they will require different types of maintenance and will need to be decommissioned or replaced at different times.

What types of fixed asset are there?

There are a lot of different types of fixed assets. There are tangible assets, intangible assets, physical assets. They can be land, buildings, office equipment, construction equipment. They might live in your office or in the field.

When it comes to fixed assets, it’s simplest to break them down into categories before breaking them down further.

There are two main categories of fixed assets: tangible fixed assets, and intangible fixed assets.

- Intangible fixed assets: These are the assets your business will use, but that you can’t touch. For example, an intangible asset you may use every day is your CRM software system you access via your computer.

- Tangible fixed assets: These will be used in the field or in your office. If you can pick it up, use it, and if the business purchased it to fulfill a need, and if the asset is intended to have a long life in your business, it’s a tangible fixed asset.

Tracking asset depreciation is possible for both of these categories, but a lot simpler when it comes to tangible fixed assets. For a start, you can see damages on tangible assets. You can see when a laptop starts to slow down, for example. It’s much easier to see when a drill becomes uneconomical than it is to see when software is uneconomical.

It is possible to track the depreciation of intangible assets, however. Software does and will eventually become uneconomical. Nobody uses Myspace anymore for a similar reason. The way you should track intangible assets is, therefore, simply different from how tangible assets should be managed.

When it comes to tracking the lifecycle of software, it’s not as if you can inspect it for scratches. Instead, you can track whether or not the software slows when it has less storage; if it becomes monetised, you can track whether or not a new subscription is worth it. You can use statistical analysis to see if the software is creating or helping to close leads.

These categories can then be broken down further, into groups such as physical assets or IT assets.

Physical assets are pieces of kit or equipment that you can physically use. Physical assets can also be vehicles. So long as it’s making you money and you can touch it, it’s a physical asset.

IT assets can be software or hardware. IT asset management is required for things like GDPR compliance and accountability, but when it comes to making you money, IT assets help with sales, CRM, fieldwork, and morale (whether it’s cat pictures or shopping).

Managing Your Assets

Successful companies will track and manage their fixed assets. Managing an asset’s lifecycle and how its monetary value and usage depreciates can keep you ahead of the curve when it comes to maintenance and replacements.

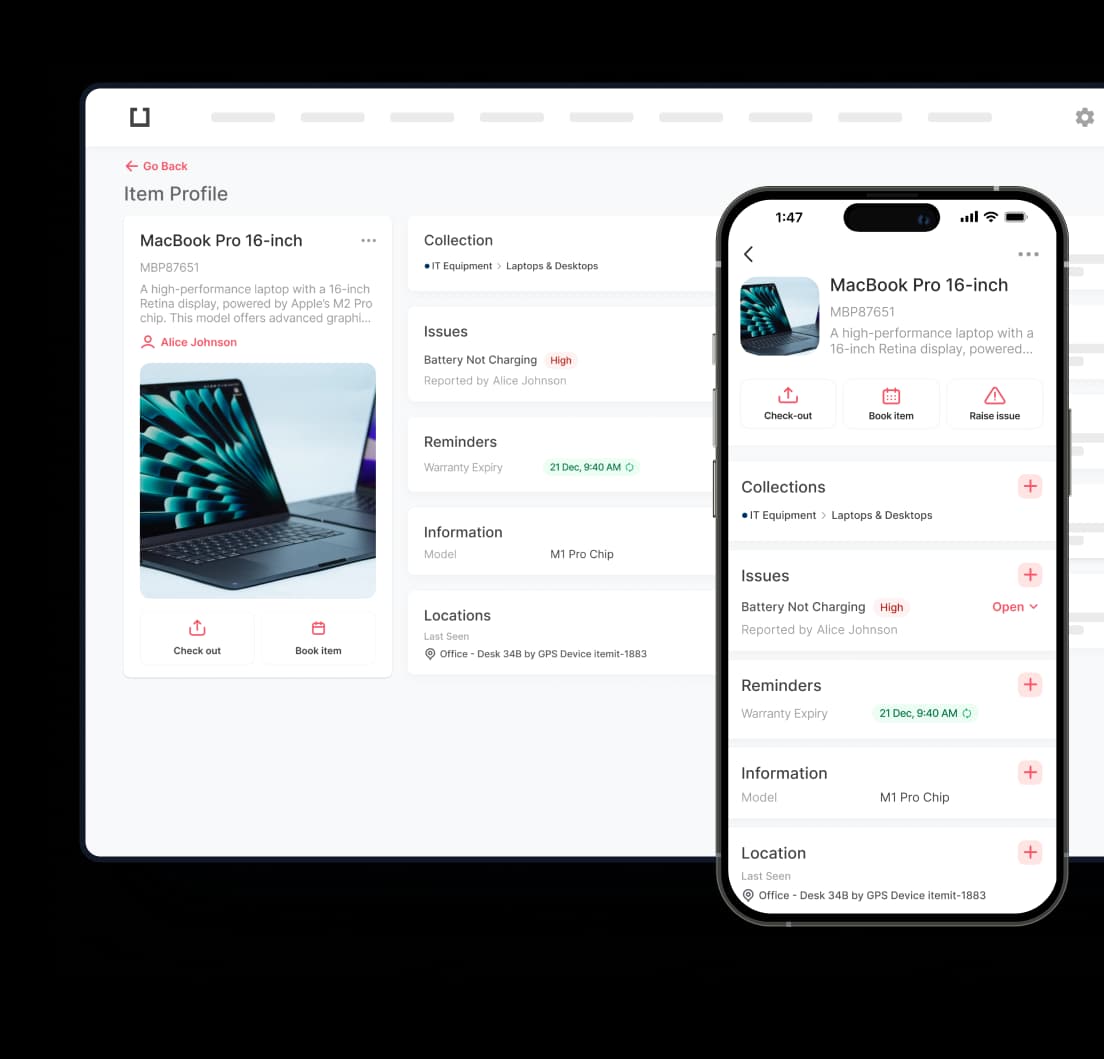

You can also track your fixed assets to manage them. This way, you can create an audit trail, as well as see exactly where your assets have been and who has been using them.

Using a Fixed Asset Register

The main way fixed assets are tracked and managed is with a fixed asset register. A fixed asset register is a list of your fixed assets, as well as information about them.

The information can be related to location if your assets like to travel, or it can be financial information such as warranty prices or dates. It can even be asset lifecycle management information to make sure your company is running smoothly.

A fixed asset register also minimises the chance of ghost and zombie assets. As much as you might daydream about hunting ghosts or zombies on the lot, unfortunately, these terms just mean assets that aren’t entirely accounted for, whether it’s in terms of ownership or use.

With itemit, you can track and manage your assets, as well as generating a fixed asset register with the touch of a button. Find out more by emailing us at team@itemit.com or filling in the form below.