A well-maintained fixed asset register is essential for businesses across all industries. It provides a clear, organised record of assets, improving financial reporting, compliance and operational efficiency. In this guide, we’ll delve into what fixed assets are, the importance of a fixed asset register, best practices to maintain accuracy and the step-by-step guide of preparing a fixed asset register.

Why is a fixed asset register important?

A fixed asset register:

✔️ Ensures accurate tracking of assets to prevent loss.

✔️ Helps with tax compliance (e.g. IFRS, GAAP).

✔️ Simplifies depreciation calculations for audits.

✔️ Improves budgeting and financial planning.

Understanding What Fixed Assets Are

Fixed assets are otherwise known as non-current assets. They are stable assets which are necessary for the business to generate revenue. Such assets usually have a lifespan of more than 12 months and are not intended to be sold within standard business processes. Buildings, different types of machinery, vehicles, furniture, and equipment are examples of fixed assets. Correct management of these assets ensures effective utilisation, proactive maintenance, and simplified depreciation.

Ideally, business owners would add any assets that they don’t plan to sell in the next 12 months to their fixed asset register so that they can be tracked and monitored with ease.

Types of Fixed Assets

- Property, Plant, and Equipment (PP&E): This includes land, buildings, machinery, and equipment. These assets are crucial for a business’ day to day operational activities.

- Vehicles: Company cars, trucks, and other vehicles used for business operations.

- Furniture and Fixtures: Office furniture, fittings, and other fixtures that are part of the business infrastructure.

- IT Equipment: Computers, laptops, servers, and other IT equipment necessary for daily operations.

- Intangible Assets: Although not physical, these assets, such as patents and trademarks, are considered fixed assets due to their long-term value to the business.

Preparing a Fixed Asset Register

The purpose of an asset register is to provide a comprehensive record of a business’s fixed assets, facilitating accurate financial reporting, improved asset management, and enhanced accountability. It aids in audits, compliance, budgeting, risk management, and strategic decision-making.

You can use the step-by-step guide on how to prepare a fixed asset register format below:

Step 1: Gather Necessary Information

Before you begin, collect all relevant information about your fixed assets. This includes:

- Purchase invoices and receipts

- Asset descriptions and specifications

- Serial numbers and unique identifiers

- Location of each asset

- Maintenance records

- Depreciation schedules

Step 2: Choose the Right Tool

Step 3: Categorise Your Assets

Organise your assets into categories to make the register more manageable. Common categories include:

- Buildings

- Machinery

- Vehicles

- Furniture

- IT Equipment

- Intangible Assets

Step 4: Create Unique Identifiers

Assign each fixed asset a unique identifier or asset tag. This could be a serial number, barcode, or RFID tag. Unique identifiers help track and manage assets more effectively, reducing the risk of loss or misplacement.

Step 5: Record Detailed Information

For each asset, record the following details:

- Asset Description: A brief description of the asset, including make, model, and specifications.

- Purchase Date: The date the asset was acquired.

- Purchase Cost: The cost of the asset at the time of purchase.

- Location: The current location of the asset within your premises.

- Depreciation Method: The method used to depreciate the asset (e.g., straight-line, declining balance).

- Useful Life: The estimated useful life of the asset.

- Current Value: The current book value of the asset after accounting for depreciation.

- Maintenance Records: Any maintenance or repair work done on the asset.

Step 6: Update Regularly

Maintain and update your fixed asset register regularly to ensure accuracy. This includes recording new asset purchases, disposals, and any changes in asset details. Regular audits and physical verifications are also essential to confirm the existence and condition of assets.

Choosing Which Assets to Record

Multiple factors need to be taken into account when determining what should be in an asset register. Begin by evaluating the worth of each asset. Assets that have considerable worth and usefulness in your business operations should be documented. These resources are significant investments and help your company generate revenue in the long run. By recording these valuable items, you can effectively oversee their utilisation and guarantee they are cared for correctly.

The lifespan of the asset is another important factor to consider. Typically, fixed assets have a lifespan of over one year. If you plan to use an asset for several years in your business, make sure to list it in your register. This aids in monitoring depreciation and comprehending the asset’s impact on your operations throughout its existence.

The utilisation of something is also an important factor. Record assets that are vital for business operations and that contribute to generating revenue. This consists of machinery, equipment, and other necessary tools. Keeping thorough records of these assets helps ensure efficient utilisation and proper maintenance, ultimately optimising performance and prolonging useful life.

Documenting all non-current assets, regardless of their worth, can offer a holistic perspective of your firm’s asset portfolio. Although it may seem logical to include high-value assets, there are benefits to documenting lower-value items as well. This comprehensive method helps in making more informed decisions, increasing asset efficiency, and improving financial reporting precision. For example, having a precise count of office chairs or computers can assist in budgeting for replacements and guaranteeing that all resources are included in audits.

By using itemit’s asset register, you can simplify the process of recording and managing all these assets. itemit’s software allows for easy categorisation and detailed recording, ensuring that every asset, whether large or small, is documented accurately. This comprehensive recording practice not only enhances operational efficiency but also provides valuable insights into asset management, helping businesses make informed decisions about asset purchases, maintenance, and disposal.

How to Record Your Fixed Assets

Recording fixed assets can be quite a task. Depending on the type of business someone owns, they could have multiple assets in multiple locations. However, the more locations there are the greater the need for a fixed asset register.

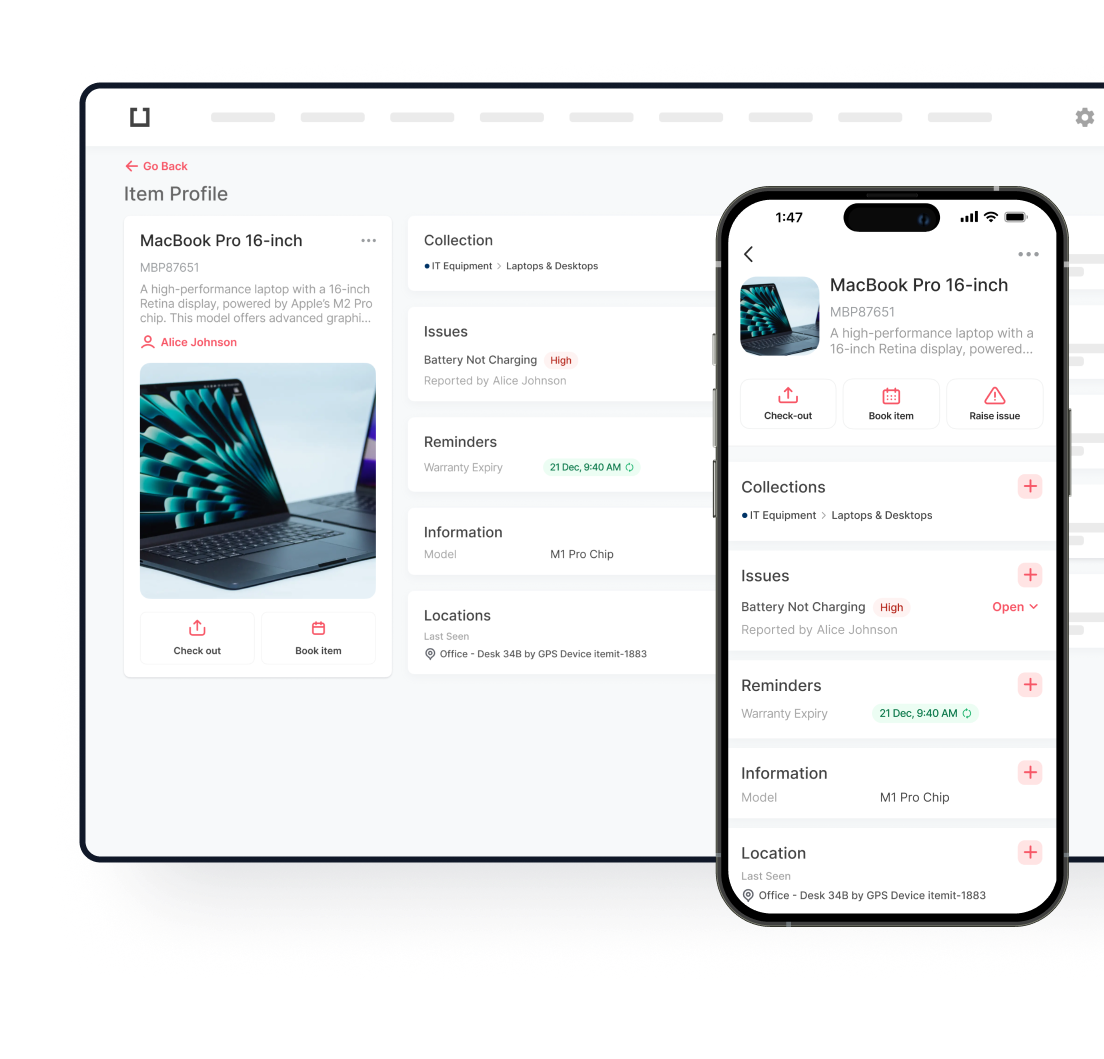

One effective solution is to use itemit’s fixed asset tracking software. Our asset tracking software uses combined technologies to help users everywhere track their fixed assets.

Users simply need to log into itemit’s platform and add a new asset. The menu allows users to add as many details of each asset as they please. This allows users to have as much information about each asset as required. Having access to insurance information, for example, can help save time. Users will be able to find the insurance information with ease and, therefore, make the appropriate claim much quicker.

It is possible to upload pictures and other files to itemit’s system. This allows users to have access to the information they need at all times.

For those seeking a starting point, here is a sample fixed asset register format:

| Asset ID | Description | Purchase Date | Purchase Cost | Location | Depreciation Method | Useful Life | Current Value | Maintenance Records |

|---|---|---|---|---|---|---|---|---|

| 001 | Dell Laptop | 01/01/2022 | $1,200 | Office 1 | Straight-line | 5 years | $960 | 01/01/2023 - Replaced battery |

| 002 | Office Chair | 01/03/2022 | $150 | Office 2 | Straight-line | 7 years | $140 | 01/04/2023 - Tightened bolts |

| 003 | HP Printer | 01/02/2023 | $500 | Office 3 | Declining Balance | 3 years | $450 | 01/03/2024 - Replaced toner |

| 004 | Conference Table | 01/05/2022 | $800 | Meeting Room | Straight-line | 10 years | $720 | 01/06/2023 - Polished |

| 005 | MacBook Pro | 01/07/2021 | $1,500 | Office 4 | Straight-line | 5 years | $1,000 | 01/08/2023 - Updated software |

Maintaining Your Fixed Asset Register

Regular maintenance of your fixed asset register is crucial for accuracy and efficiency. Conduct periodic audits to verify the existence and condition of your assets, ensuring that your register reflects reality. Promptly update records whenever there are changes, such as new acquisitions, disposals, or relocations, to keep your register current.

Review depreciation methods and useful lives periodically to ensure they reflect the actual usage and condition of your assets. This helps in accurate financial reporting and better asset management.

Leverage technology, like itemit’s software, to streamline updates, automate maintenance schedules, and reduce human error. Real-time monitoring and reporting features provided by itemit ensure your register remains up-to-date, enhancing overall asset management and decision-making for your business.

Adding a QR Code Asset Tag

In order to make full use of itemit’s tracking features, users can add a QR tag to each of their assets. Once the tag is attached to the asset and scanned into the system, tracking is possible. Upon opening up the asset’s profile, users can see the asset’s last-known location.

A QR code can be affixed to every single asset, even those which do not move. The tag, when scanned, will reveal a lot of information about the asset. Users can then decide which pieces of information they would like to access.

Use itemit’s Fixed Asset Register

Business owners everywhere can use itemit’s fixed asset register to keep track of all of their assets. Thanks to the way that the software works, business owners can now create and effectively monitor all of their assets.

Business owners and their employees can have much more control over the business. An asset register can be a highly useful tool. It can help businesses to understand how well the business is performing. It can also be used to help prevent assets from being lost or stolen.

There are multiple ways that itemit’s asset register can help. Feel free to contact our helpful team to ask them how itemit’s fixed asset register can help you. Reach out to our team at team@itemit.com. Alternatively, you could sign up for our 14-day Free Trial and find out just how well itemit’s asset register software works for you.

Try itemit

Choose a better way to track your assets. Start your free 14-day trial now!

Frequently Asked Questions

What is the frequency of updating a fixed asset register?

Regular updates of a fixed asset register are necessary for maintaining accuracy. Ideally, updates should occur whenever there are changes, such as new acquisitions, disposals, or relocations of assets. Furthermore, performing a comprehensive evaluation every quarter is important in ensuring the register remains accurate and dependable.

What expenses come with installing asset-tracking technologies?

The expenses for setting up asset-tracking technologies can differ greatly based on the company’s size and the intricacy of the tracking system. Potential expenses at the beginning may consist of buying asset labels (like barcodes or RFID tags), acquiring scanning equipment, and enrolling in asset management software similar to itemit’s. Continuing expenses could encompass charges for software subscriptions, upkeep, and possible enhancements. Enterprises should perform a cost-benefit evaluation to identify the most appropriate and economically efficient option for their requirements.

What is the process for businesses to manage asset depreciation in the ledger?

Businesses have the option to manage asset depreciation in the register by selecting a suitable depreciation technique, like straight-line or declining balance. Each asset category should be treated consistently using the chosen method. Consistently keeping the register up to date with current depreciation values helps to ensure precise financial reporting. itemit’s software is capable of streamlining this process by automatically computing and documenting depreciation to increase efficiency and minimise mistakes.

What are the typical obstacles encountered when managing a fixed asset register?

Managing a permanent asset register can be difficult due to the need to update records, maintain data accuracy, and monitor the whereabouts of assets. Additional typical problems involve overseeing the selling and purchasing of assets, managing depreciation calculations, and linking the registry with other financial platforms. Using advanced asset management software such as itemit can assist in addressing these difficulties by automating various tasks, enabling quick and easy updates and integrating with other platforms via the itemit REST API.

Are there particular best practices for keeping a fixed asset register in specific industries?

Indeed, the guidelines for creating a fixed asset register can differ depending on the industry. In manufacturing, it is essential to monitor machinery maintenance schedules carefully, for instance. Regularly maintaining software and hardware inventories is crucial in the IT industry. Healthcare entities must guarantee adherence to regulatory guidelines for medical devices. In every sector, effective methods involve conducting routine audits, providing timely updates, and monitoring depreciation precisely, as well as using advanced asset management software such as itemit’s to simplify the procedure.

What frequency is recommended for updating a fixed asset register to guarantee precision?

It is essential to update the fixed asset register regularly whenever there are alterations to maintain precision. Furthermore, performing a thorough examination and alignment every quarter helps identify any inconsistencies and maintains the register’s precision and dependability.

What are the steps to audit a fixed asset register effectively?

Auditing a fixed asset register effectively involves several steps:

- Planning: Define the scope and objectives of the audit, including which assets will be reviewed and the audit timeframe.

- Preparation: Gather all necessary documentation, including purchase records, maintenance logs, and previous audit reports.

- Physical Verification: Conduct a physical count of the assets to verify their existence and condition. Compare this with the register’s records.

- Reconciliation: Identify and resolve any discrepancies between the physical count and the register. Update the register with any changes.

- Review Depreciation: Check the accuracy of depreciation calculations and ensure they align with the chosen depreciation method.

- Reporting: Prepare an audit report detailing the findings, including any discrepancies and recommendations for improvement.

- Follow-Up: Implement corrective actions based on the audit findings and schedule regular follow-ups to ensure ongoing accuracy and compliance.

Using a reliable asset management tool like itemit’s can simplify the audit process by providing accurate and up-to-date asset information, making physical verification and reconciliation more efficient.

Keep Learning

itemit Blog

Tips, guides, industry best practices, and news.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.