A well-maintained fixed asset register is essential for businesses across all industries. It provides a clear, organised record of assets, improving financial reporting, compliance and operational efficiency. In this guide, we’ll delve into what fixed assets are, the importance of a fixed asset register, best practices to maintain accuracy and the step-by-step guide of preparing a fixed asset register.

Why is a fixed asset register important?

A fixed asset register:

✔️ Ensures accurate tracking of assets to prevent loss.

✔️ Helps with tax compliance (e.g. IFRS, GAAP).

✔️ Simplifies depreciation calculations for audits.

✔️ Improves budgeting and financial planning.

Understanding What Fixed Assets Are

Fixed assets are otherwise known as non-current assets. They are stable assets which are necessary for the business to generate revenue. Such assets usually have a lifespan of more than 12 months and are not intended to be sold within standard business processes. Buildings, different types of machinery, vehicles, furniture, and equipment are examples of fixed assets. Correct management of these assets ensures effective utilisation, proactive maintenance, and simplified depreciation.

Ideally, business owners would add any assets that they don’t plan to sell in the next 12 months to their fixed asset register so that they can be tracked and monitored with ease.

Types of Fixed Assets

- Property, Plant, and Equipment (PP&E): This includes land, buildings, machinery, and equipment. These assets are crucial for a business' day to day operational activities.

- Vehicles: Company cars, trucks, and other vehicles used for business operations.

- Furniture and Fixtures: Office furniture, fittings, and other fixtures that are part of the business infrastructure.

- IT Equipment: Computers, laptops, servers, and other IT equipment necessary for daily operations.

- Intangible Assets: Although not physical, these assets, such as patents and trademarks, are considered fixed assets due to their long-term value to the business.

Preparing a Fixed Asset Register

The purpose of an asset register is to provide a comprehensive record of a business’s fixed assets, facilitating accurate financial reporting, improved asset management, and enhanced accountability. It aids in audits, compliance, budgeting, risk management, and strategic decision-making.

You can use the step-by-step guide on how to prepare a fixed asset register format below:

Step 1: Gather Necessary Information

Before you begin, collect all relevant information about your fixed assets. This includes:

- Purchase invoices and receipts

- Asset descriptions and specifications

- Serial numbers and unique identifiers

- Location of each asset

- Maintenance records

- Depreciation schedules

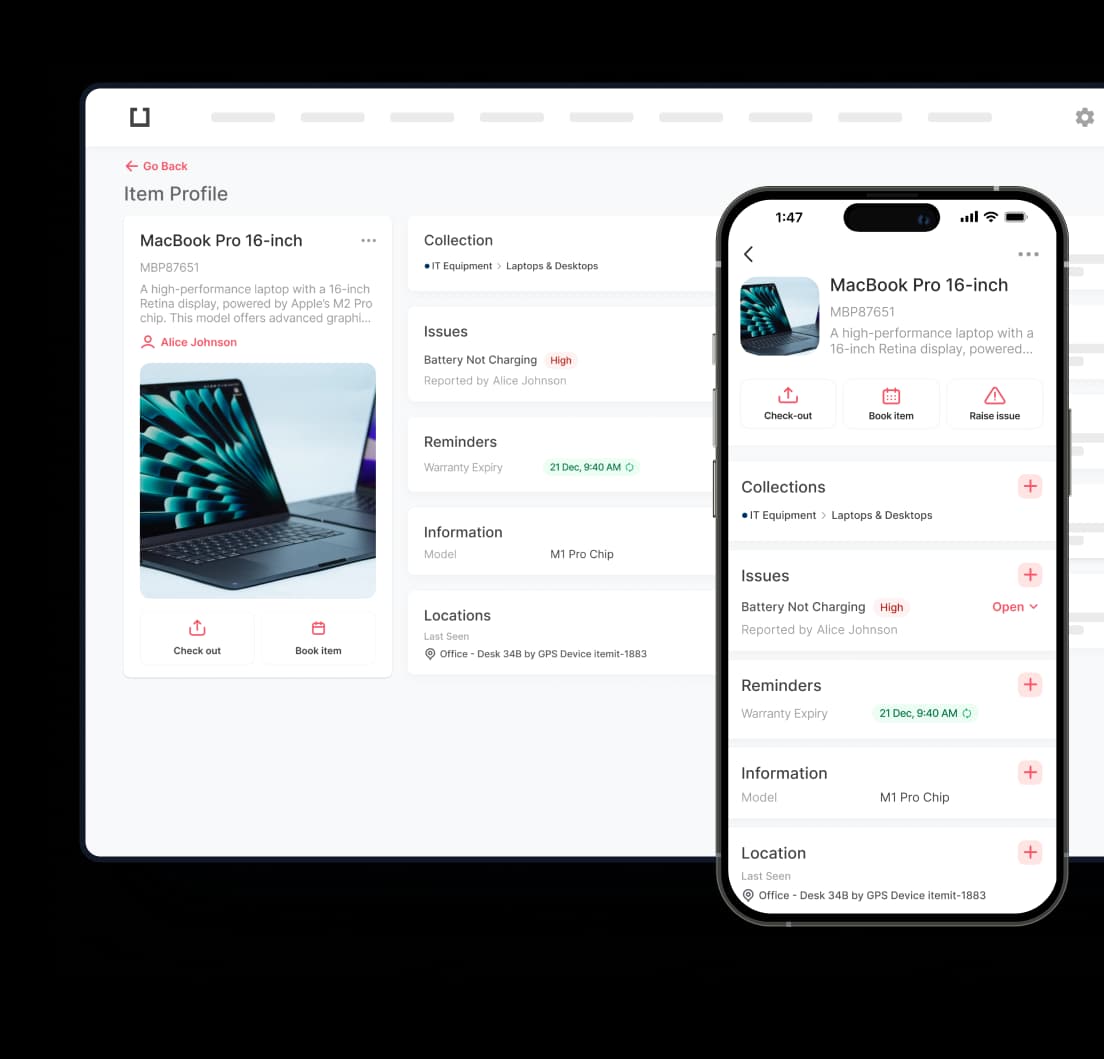

Step 2: Choose the Right Tool

Using reliable software like itemit’s asset register can significantly simplify the process. itemit’s software offers an intuitive interface and advanced features to help you create and manage your fixed asset register efficiently. With itemit’s asset register format, you can easily customise fields and generate comprehensive reports.Step 3: Categorise Your Assets

Organise your assets into categories to make the register more manageable. Common categories include:

- Buildings

- Machinery

- Vehicles

- Furniture

- IT Equipment

- Intangible Assets

Step 4: Create Unique Identifiers

Assign each fixed asset a unique identifier or asset tag. This could be a serial number, barcode, or RFID tag. Unique identifiers help track and manage assets more effectively, reducing the risk of loss or misplacement.

Step 5: Record Detailed Information

For each asset, record the following details:

- Asset Description: A brief description of the asset, including make, model, and specifications.

- Purchase Date: The date the asset was acquired.

- Purchase Cost: The cost of the asset at the time of purchase.

- Location: The current location of the asset within your premises.

- Depreciation Method: The method used to depreciate the asset (e.g., straight-line, declining balance).

- Useful Life: The estimated useful life of the asset.

- Current Value: The current book value of the asset after accounting for depreciation.

- Maintenance Records: Any maintenance or repair work done on the asset.

Step 6: Update Regularly

Maintain and update your fixed asset register regularly to ensure accuracy. This includes recording new asset purchases, disposals, and any changes in asset details. Regular audits and physical verifications are also essential to confirm the existence and condition of assets.