Published on January 7, 2025 •

5 min read

A fixed asset register plays a vital role in keeping your finances accurate and up-to-date. It serves as a comprehensive record of what your business owns, how each asset is performing, where it’s located, and any other key details you need to know.

By tracking your fixed assets effectively, you gain greater visibility, control, and accountability. This, in turn, helps you avoid unnecessary purchases, reduce asset losses, and keep your tax and insurance details accurate.

However, these benefits only come if your fixed asset register is both accurate and kept up-to-date. Without that, you could be missing opportunities to optimise your asset usage and streamline your business processes.

Why Asset Records Matter

Maintaining correct asset records is about making wise commercial judgements rather than solely focusing on compliance. A well-kept fixed asset register facilitates effective resource allocation, tracking of depreciation, and understanding of asset value. Knowing the actual state and location of every asset helps you decide when to replace outdated machinery or make calculated improvements.

Properly kept asset records also help avoid theft, reduce misplacement, and ensure assets are neither over- nor underinsured. These records aid in good budgeting by indicating exactly when assets require replacement and the associated costs. In the long term, accurate records reduce the risks linked to erroneous financial reporting.

Additionally, by providing a reliable audit trail, asset records demonstrate transparency to stakeholders and show that assets are being utilised responsibly. For external audits, an up-to-date fixed asset register streamlines the process by offering clear, organised data, thereby reducing the risk of discrepancies and compliance issues.

Should You Use A Spreadsheet As A Fixed Asset Register?

While spreadsheets can serve as a starting point for asset tracking, they often fall short in providing the real-time accuracy and control needed for effective asset management.

If your fixed asset register is in the form of a spreadsheet, every row will pertain to an asset and very column will contain a specific type of information. However, any time an asset changes, a single cell out of potentially thousands instantly becomes out of date. This can become quickly unmanageable. and lead to errors.

Moreover, there may be separate tabs or sheets for depreciation data, fixed asset information, lifecycles, and so on, creating an overwhelming workload. The risks of ghost and zombie assets are too high to rely solely on spreadsheets.

Using Fixed Asset Management Software

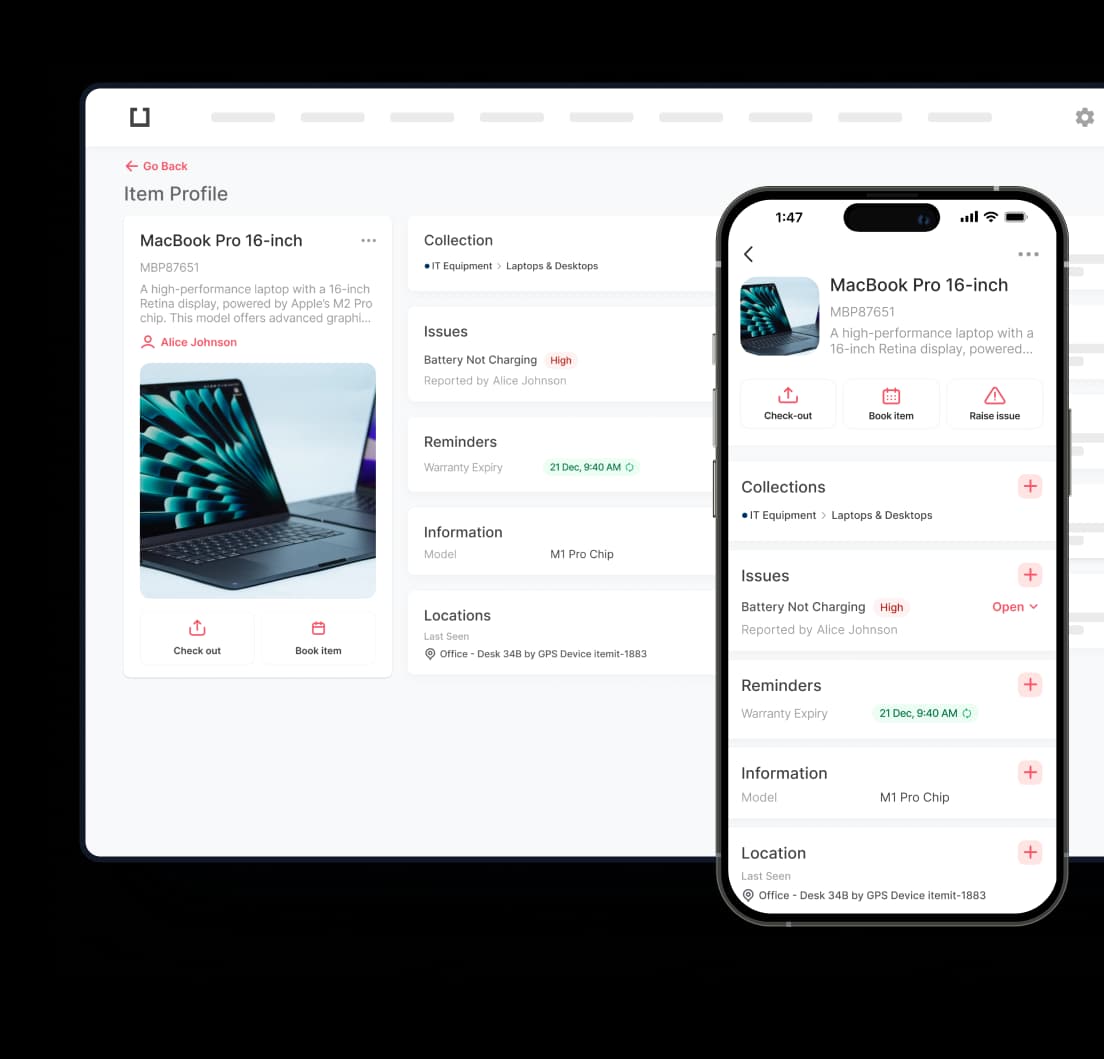

Fixed asset management software is a more effective way to keep your asset records up-to-date. With features, functionality, and a user-friendly interface, this software eliminates the inefficiencies of spreadsheets.

You can create unique asset profiles, adding relevant information in an organised manner. This makes it easier to update asset data without the risk of missing critical details. Additionally, asset management software streamlines processes, such as equipment booking software and issues management, reducing manual input and improving accuracy.

Whether you need an asset tracking system for construction assets or an IT asset management system, fixed asset management software can be customised to meet your needs.

Fixed asset tags reduce administrative tasks and automate fixed asset operations. Asset tags simplify audits by enabling you to scan assets in a location and rely on a digital system instead of a manual checklist.

Asset tags are physical labels affixed to your assets and linked to their profiles within your software. Each time you scan an asset’s tag, the system updates its last seen location, providing a clear audit trail.

Fixed asset tracking software also simplifies bulk actions. For instance, you can filter assets and update their locations in one go, a task that would be cumbersome in a spreadsheet.

With this approach, you have the flexibility to manage your asset register remotely or interact with assets on-site using a smartphone.

Benefits of Maintaining Detailed Asset Records

Maintaining detailed asset records is about more than just tracking physical items. It enables better financial planning, maintenance scheduling, and compliance. For more detailed guidance, you can refer to our simple guide on maintaining a fixed asset register.

Accurate records help you understand the true value of your business assets, facilitating precise financial reports and asset depreciation assessments. A well-maintained fixed asset register ensures that you know what assets you have, where they are, and their condition, which is essential for insurance purposes.

Moreover, tracking the complete history of your assets, including maintenance and service records, helps optimise usage and prolong asset lifespan. Regular maintenance reduces unexpected breakdowns, enhancing productivity and reducing downtime.

Asset Records and Regulatory Compliance

Another critical reason to maintain accurate asset records is regulatory compliance. Many industries require precise tracking and reporting of assets to meet legal obligations. Failure to comply can result in fines, legal issues, and reputational damage.

Accurate records ensure smoother audits by providing comprehensive documentation. Auditors can verify the existence and value of assets, avoiding potential delays or discrepancies. Inaccurate records may lead to penalties and damaged credibility.

How to Record Fixed Assets Correctly

Recording fixed assets accurately involves more than simply listing them in a spreadsheet. Assign unique IDs, classify assets by type, and track purchase dates, costs, and depreciation to gain a full picture of your assets' lifecycles.

Knowing the exact location of every asset is vital for effective management. Using barcodes or RFID tags simplifies this process. Real-time tracking ensures your records remain current and prevents unnecessary replacements.

Consequences of Not Maintaining a Fixed Asset Register

Failing to maintain a fixed asset register can have serious consequences. Inaccurate insurance coverage, lost assets, and financial discrepancies are just a few risks.

A disorganised register can cause inflated budgets, unnecessary asset purchases, and increased running costs. Operational efficiency suffers when assets are misallocated or unavailable when needed.

Inaccurate records can also affect your ability to claim tax benefits. Many countries allow depreciation claims on assets. Without accurate records, your business may miss out on valuable tax deductions, impacting your bottom line.

Leveraging Technology for Better Asset Record Management

Modern asset tracking software integrates with mobile devices, allowing real-time updates. This reduces discrepancies and ensures your records are always accurate.

Using technologies like RFID tags and GPS trackers enhances asset location accuracy, making record maintenance more manageable. Automation also reduces manual errors, ensuring data reliability.

Asset Auditing: Ensuring Accuracy

Regular audits verify the physical existence of assets and ensure that recorded details are correct. Audits help identify discrepancies, such as missing or outdated information.

Audits also reveal underutilised assets, which can be sold to free up capital. By ensuring every asset contributes effectively to your operations, audits add value to your business.

itemit’s Fixed Asset Register Software

itemit’s software lets you prepare a fixed asset register. By creating asset profiles and applying filters, you can manage your assets efficiently and export data as needed.

By adopting itemit’s fixed asset management software and leveraging technology like asset tags, you gain greater control over your assets, reducing the risks associated with outdated records.

With a web interface and integrated mobile Asset Tracking App, itemit makes it simple to manage your assets both remotely and on-site.

Discover how itemit's asset tracking solutions can streamline your operations and improve accuracy. Start your free trial today by contacting the team at team@itemit.com or filling in the form below.