Stay updated on the latest trends and innovations in modern construction, building methods, and advanced technologies transforming the industry today and beyond.

The world of asset management is poised for radical change driven by advances in artificial intelligence. As industries move forward and data becomes the lifeblood of decision-making, AI promises easier processes, better performance, and improved outcomes. This article looks at how AI asset management sets the future, what the emerging trends are, and what technologies are leading the industry forward.

Revolution of Intelligence: The Role of AI in Asset Management

Asset management really lies at the core of many businesses: managing the assets of the company, financial investments, equipment, or real estate, for example, to grow their value and support the overall business strategy. Traditionally, asset management has relied on human expertise, meticulous market analysis, and manual processes. But let's face it: with data exploding and markets moving faster than ever, the old ways are struggling to keep up.

Welcome AI. Artificial Intelligence is reconsidering the way we manage assets. How so? Because AI can do all of the heavy lifting: it analyses large volumes of data, detects patterns, and forecasts events in ways that humans simply cannot. Think about this: instead of having a team of analysts go through data for days, AI applications in asset management will be processing that data in minutes. It delivers insights in real time, so you're not just reacting; you're anticipating the market changes. It gives a complete game shift within an industry where everything survives on timely yet precise decisions.

How does that have to do with today? The fact of the matter is efficiency and accuracy have never been more important.

Firms have to process much more information and very complicated markets; neither of these can afford to rely on a manual process. This is why companies turn to AI asset management: because it is faster and smarter. AI algorithms can predict market fluctuations, optimise portfolios, and also raise red flags over impending risks much before they become big problems.

In short, AI transforms asset management from a slow and manually operated process to a dynamic, technology-driven strategy. It's not mere maintenance; it's value creation at levels never thought possible. And here is where AI steps in to become the backbone of modern asset management. And you wouldn't want anything less from technology than to keep you ahead?

Vision of Tomorrow: Integrating AI into Business

What is AI, and where does it fit into asset management? Simply put, artificial intelligence (AI) refers to the ability of machines to perform tasks that typically require human intelligence. These are things like learning from data, recognising patterns, making predictions, and even problem-solving. AI isn't just about robots or science fiction; it's a powerful tool being used by businesses today to deliver big-time, real-world results-especially in asset management.

In simple terms, AI for asset management means a set of intelligent algorithms and machine learning to enhance decision-making, efficiency in operations, and effectiveness. Whether financial portfolios or physical assets like machinery or real estate, AI transforms corporate operations by automating repetitive tasks and bringing insights previously unreachable.

Benefits such as the following can be realised upon the integration of AI into a particular process. First is the advantage relating to speed. AI analyses large volumes of information in real time to provide insights to humans, who would have otherwise taken days or even weeks to realise. This saves time and ensures that asset managers make decisions based on current information. Second is the advantage of accuracy. A single human error is expensive, especially on large portfolios and complex systems. AI, therefore, applied in asset inspection, cuts down the likelihood of a mistake, given that the algorithms are indeed set to identify anomalies, flag potential risks, and suggest corrective measures before problems escalate.

Now, let’s talk about some key areas where AI is making a significant impact:

- Predictive Analytics: One of the most powerful applications of AI is in forecasting. AI can predict market trends, equipment failures, or shifts in asset value with remarkable accuracy. This allows asset managers to be proactive rather than reactive, making adjustments before a situation becomes critical.

- Portfolio Optimization: In financial asset management, AI helps create and adjust portfolios based on real-time data. AI can continuously analyse performance, balance risk and return, and even suggest adjustments to ensure optimal outcomes.

- Risk Management: Managing risk is a top priority for any asset manager. AI algorithms can analyse market data, news, and even social media to identify potential risks that may affect an asset's value. This real-time analysis helps managers mitigate risks before they affect the bottom line.

- Automation of Routine Tasks: Many day-to-day asset management tasks are time-consuming and tedious. AI can automate these tasks – whether it’s monitoring asset performance, processing transactions, or tracking compliance – freeing up human talent for more strategic decision-making.

- Enhanced Client Reporting: AI can also improve transparency by generating clear, data-driven reports that help clients understand how their assets are performing. This strengthens trust and fosters better communication between asset managers and their clients.

In short, integrating AI into asset management isn’t just part of the digital transformation trend – it’s a strategic move that brings real benefits. Whether it's through improving efficiency, reducing risk, or delivering better client outcomes, AI is revolutionising how assets are managed in today’s fast-paced world.

Benefits of AI in Asset Management

Among the strongest capabilities of AI in asset and wealth management is handling enormous amounts of data. With the continuous flooding of information coming in from stock price changes, market reports, global news events, and even social media trends, human analysts can't process these inputs effectively. AI will do this easily: analyse and make sense of the big streams of data in real time, thus providing actionable insights to asset managers at the point of their need.

Machine Learning Models: Detecting Market Patterns

The core of AI's data processing power is machine learning models. These models learn from past data by picking up on patterns and trends that often go unnoticed by humans. For example, AI can find correlations between the movement of stock prices and global economic indicators, or it can identify early signals of market fluctuations.

In the financial asset management market, these machine learning models are very important for anticipating what may happen in the market in the future. In developing the forecasts of possible outcomes, the AI tools draw upon patterns learned from an analysis of historical data. This gives a great advantage to the asset manager, who is able to spot the trends and take proper action ahead of other competitors.

Real-Time Risk Identification and Mitigation

Perhaps the most exciting application of AI in asset risk management is its real-time risk detection capability. Markets are always on a roller coaster, and managing risks never becomes an easy task. AI systems, therefore, are made to track real-time data feeds in search of potential risks to assets, whether in the form of market volatility, political instability, or economies suddenly plummeting downward.

The bottom line is that whatever risk AI detects, it does not just stop at detection. It offers solutions either through recommending portfolio adjustments or adjusting the asset allocations accordingly. For example, if an asset is growing risky, AI provides the best recommendation to sell off or hedge that position, thus ensuring instantaneous action to prevent further losses.

24/7 Monitoring: AI’s Round-the-Clock Capability

One of the unique features of AI in enterprise asset management is that it can provide constant monitoring 24/7. AI, unlike humans, does not need any breaks. Data processing and risk monitoring are performed with the ticking of the clock to ensure that the asset managers are always covered. This level of monitoring is needed in today's fast financial world, where risks can emerge overnight.

Meanwhile, AI-enabled asset tracking tools do the same for corporate asset tracking of both physical and financial resources. This tool will track the location and status of important assets and employ predictive analytics to forecast asset devaluation or failure. This will provide companies with the ability to optimise the time required for maintenance without experiencing costly downtime or fiscal losses.

AI also allows asset management to be much quicker, more precise, and, above all, much safer. AI's constant learning involves constant refinement of its models and predictions, which improves risk management capabilities.

Feel the Difference: AI-based Assets Management System

AI is transforming asset management practices while concurrently setting new trends in the future. In full force, asset management digital transformation is driving a number of key AI-driven trends-changing traditional asset management practices and pushing the boundaries.

AI-Based Investment Platforms: The Rise of Automation

The most prominent among these is the arrival of AI-based asset management systems and investment platforms. These are platforms on which AI algorithms are used to automate investments, so it becomes more efficient and accessible. Instead of having human financial advisors or brokers, users can simply type in their preferences, such as risk tolerance and investment goals, and the AI system takes care of the rest.

Companies such as Wealthfront and Betterment have industrialised this AI-powered platform. These platforms allow users to create and manage portfolios with little or no human touch. These platforms use AI in analysing market trends, providing asset allocation, and even rebalancing portfolios in real time, thus offering a seamless experience for investors. The benefits of such services are visible: a decrease in management fees, increased precision, and personalisation that hardly anyone can match up to.

Emerging AI Technologies: What’s New?

New AI technologies are coming up beyond investment platforms, each pushing that concept of asset transformation just a little bit further. One area under development will cover NLP, or Natural Language Processing, which covers those aspects whereby AI systems can handle and make sense of human language. Asset management makes use of NLP in processing financial news, earnings calls, and even social media sentiment as an indicator of market movements. Through natural language understanding, AI can gain valuable insights from unstructured data sources, which is an advantage in anticipating market behaviours.

Another exciting development is AI-driven predictive analytics. Through machine learning, AI can now forecast the future performance of assets with uncanny accuracy. These predictive models take into account the historical data and market conditions to forecast trends of particular assets, hence enabling asset managers to make better-informed decisions. The trend is revolutionising the ways in which companies plan their asset allocation by reducing the element of risk in generally uncertain markets.

Impact on the Future of Asset Management

These technologies stand to impact asset management at a deep level. As AI systems become more matured, they can take up more complex responsibilities currently required by human managers. In the future, multi-asset portfolios could be taken up by AI, building a completely automated system in managing everything from bonds to commodities. What this would entail is that asset managers could devote more time to strategy and innovation rather than day-to-day operations.

Also, personalisation and adaptability in financial strategies will keep being enhanced due to the increasing adoption of AI-based asset management systems. With its access to real-time market trends and individual risk profiles, AI can build investment solutions that are fully aligned with the needs of every client. This level of personalisation indeed connotes the massive leap that is possible in the asset management industry, offering efficiency in addition to precision unmatched by conventional manual processes.

In a nutshell, continuous development in AI accelerates the process of asset transformation at a pace that has never been achieved. As these technologies continue to evolve, they will redefine asset management; effective, data-driven, and innovative ways will highlight new ways forward. In any case, the future of asset management is indeed bright with AI at the helm, whereby smarter, quicker, and more accurate systems will be at the forefront.

The Future of Asset Management

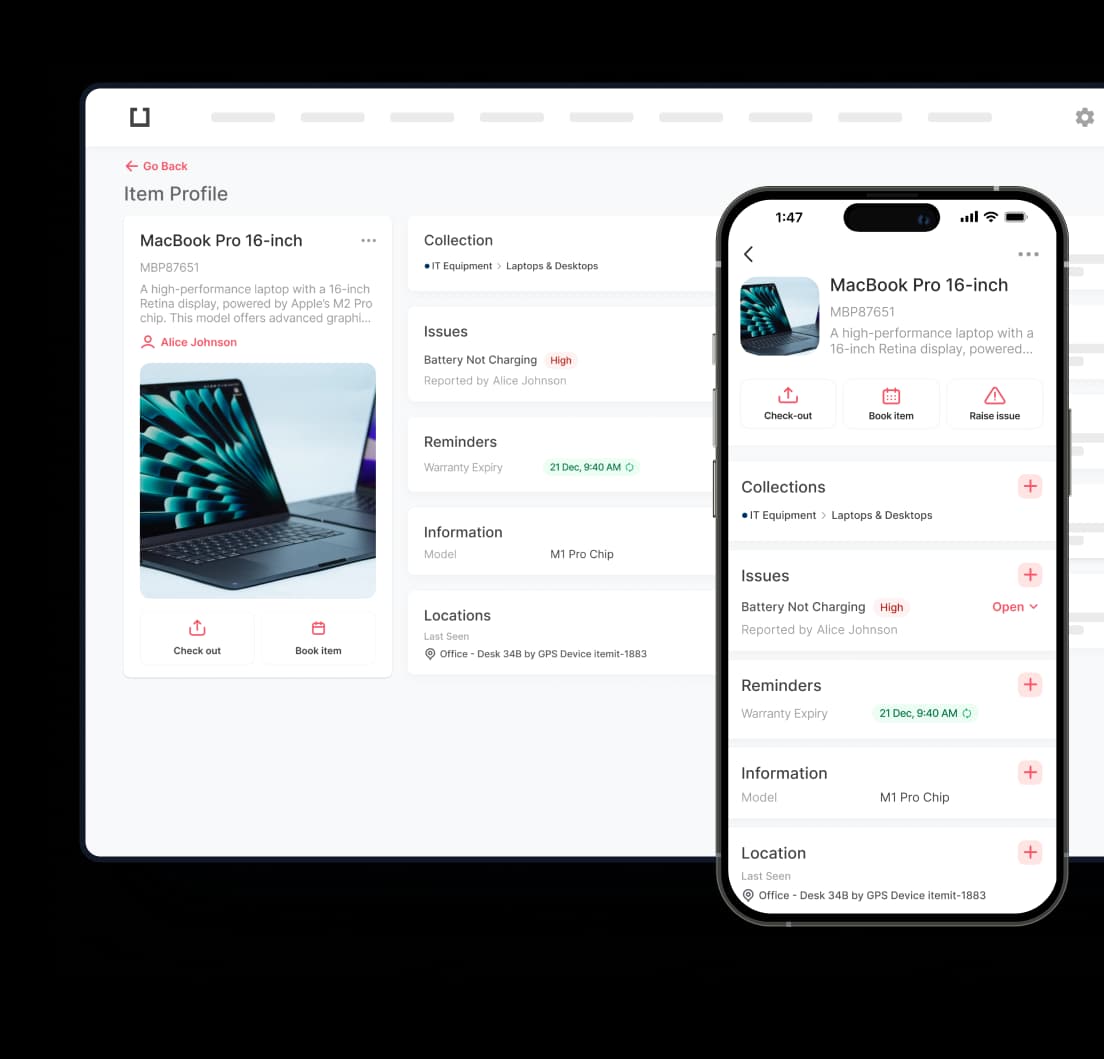

However powerful AI may be, it's only as good as the data with which it works. Artificial Intelligence Asset Management relies on high-quality data to act as the backbone of any system. Whether you're tracking assets, predicting markets, or managing risk, the accuracy of AI-driven insight wholly depends on the quality of input. Asset management for businesses will be able to claim accuracy regarding real-time data of their physical and digital assets, thanks to assistance from asset tracking apps. Since accurate data forms a very strong backbone, AI systems will analyse trends and make decisions based on these to enhance overall efficiency in asset management processes.

However, it is not replacing human advisors; it changes their role. Whereas AI does a great job of processing large volumes of information and turning it into actionable insights, human input continues to be highly valued, especially in areas that touch on the wider business context or navigate a complex client relationship. Human advisors add intuition, experience, and emotional intelligence to the table that AI, for all recent advancements, simply cannot.

Strategies for Combining AI and Human Expertise

The future of asset management lies in blending human insights with AI-driven data. Here are some strategies for combining the two:

- Use AI to Enhance Decision-Making: Rather than viewing AI as a replacement for human advisors, see it as a tool that enhances decision-making. AI can process data faster and more accurately, but humans are needed to interpret those insights within a broader strategic framework.

- Collaboration Between AI and Advisors: Human advisors can work with AI systems to offer personalised solutions to clients. For example, while an AI-based system might recommend a portfolio change based on market conditions, a human advisor can explain the rationale behind that recommendation and adjust it based on the client’s long-term goals.

- Adopt AI for Repetitive Tasks: Let AI handle repetitive and time-consuming tasks, such as asset tracking, reporting, and data analysis. This frees up human advisors to focus on relationship-building, strategy development, and offering more complex advice that requires human intuition.

Expert Predictions and Future Applications

While already a significant factor, gen AI in asset management will, if all goes well, push the boundary even further. More concretely, generative AI will revolutionise asset management by developing new strategies, reports, and even forecasts about the future with minimal input from humans. As these systems continue to evolve, it is not a stretch to suggest we will begin to see them applied to both the advisory process and the execution of an asset management strategy.

In the future, AI in industry applications could very well extend to real-time client interaction, wherein AI-driven chatbots could provide responses to client queries right on the spot with data backing. Other applications could involve predictive maintenance within physical asset management, whereby AI systems predict exactly when an asset will require repairs or replacement using data gleaned via asset tracking apps. This can save businesses much money and time by preventing sudden downtimes.

Whereas AI is currently reinventing asset management, the future will yet retain a collaboration between advanced technologies and human expertise. This blend will not only enhance efficiency but also create a somewhat more customised and strategic approach to asset management.

Modern Methods of Building Construction. Trends and Innovations to Watch

How to Create an Effective Construction Management Plan for Your Project

Create an effective construction management plan that improves safety, minimises delays and keeps your project organised and on track from planning to completion.

A Complete Guide to Construction Cost Management and Planning

Effective construction cost management and planning improve profitability, enhance financial stability, and strengthen resource allocation across every project.