Integrating Your Asset Register into the Contingency Planning Process

Your fixed asset register is there to help you have full control over all of your assets. This can be easier said than done if your asset register is a spreadsheet.

Imagine a scenario where a fire, cyberattack, or supply chain breakdown impacts your operations. Without a clear plan backed by precise asset data, recovery efforts can become chaotic and costly. A well-maintained fixed asset register doesn’t just catalogue assets; it helps businesses anticipate risks, allocate resources efficiently, and execute contingency plans seamlessly.

With the latest software, you can have reliable data that allows you to do more. You could, for example, allow the data to offer you better contingency planning and risk management. Let’s take a look at what contingency planning is and just how your asset register allows this.

What Exactly Is Contingency Planning?

A contingency plan is a special type of plan that involves keeping your business running. It does this by ensuring there’s a backup for your teams, and/or your entire business. A result of this plan means that you’ll know exactly what to do in the event of an emergency. As such, a contingency plan is very important.

If you didn’t have a contingency plan and your system went down for 6 hours, what would you do? If a very important client chose to pull out of a project at the last minute, what would your next move be?

Contingency Planning and Your Asset Register

Your contingency plan can be kept safe thanks to the use of a fixed asset register. This is simply because the register would give you easy access to the plan. In addition to this, it will make sure your plan is always available.

Key Data Fields in an Asset Register for Contingency Planning

To enhance contingency planning, a fixed asset register should include essential details that provide real-time insights into asset availability and condition. These key data points include:

- Asset Type & Category – Classify assets based on function (e.g., IT hardware, machinery, vehicles) to streamline recovery planning.

- Location & Accessibility – Knowing exactly where assets are stored ensures rapid deployment in emergencies.

- Condition & Maintenance History – Tracking asset conditions helps anticipate failures and schedule preventive maintenance.

- Backup & Redundancy – Identify spare assets or alternative suppliers to avoid prolonged disruptions.

- Operational Dependencies – Document which assets are critical to specific processes, ensuring contingency actions align with business priorities.

5 Steps of Contingency Planning

Every effective contingency planning process follows a structured approach to ensure businesses can respond swiftly and effectively to unexpected disruptions. Below are the five key steps, along with how a fixed asset register enhances each stage.

1. Programme Management: Establishing Clear Roles and Responsibilities

Contingency planning starts with assigning responsibility to key personnel across departments. Each team should have a representative who understands their specific operational risks and asset dependencies.

- Your asset register can document who is responsible for which assets, ensuring accountability during emergency response.

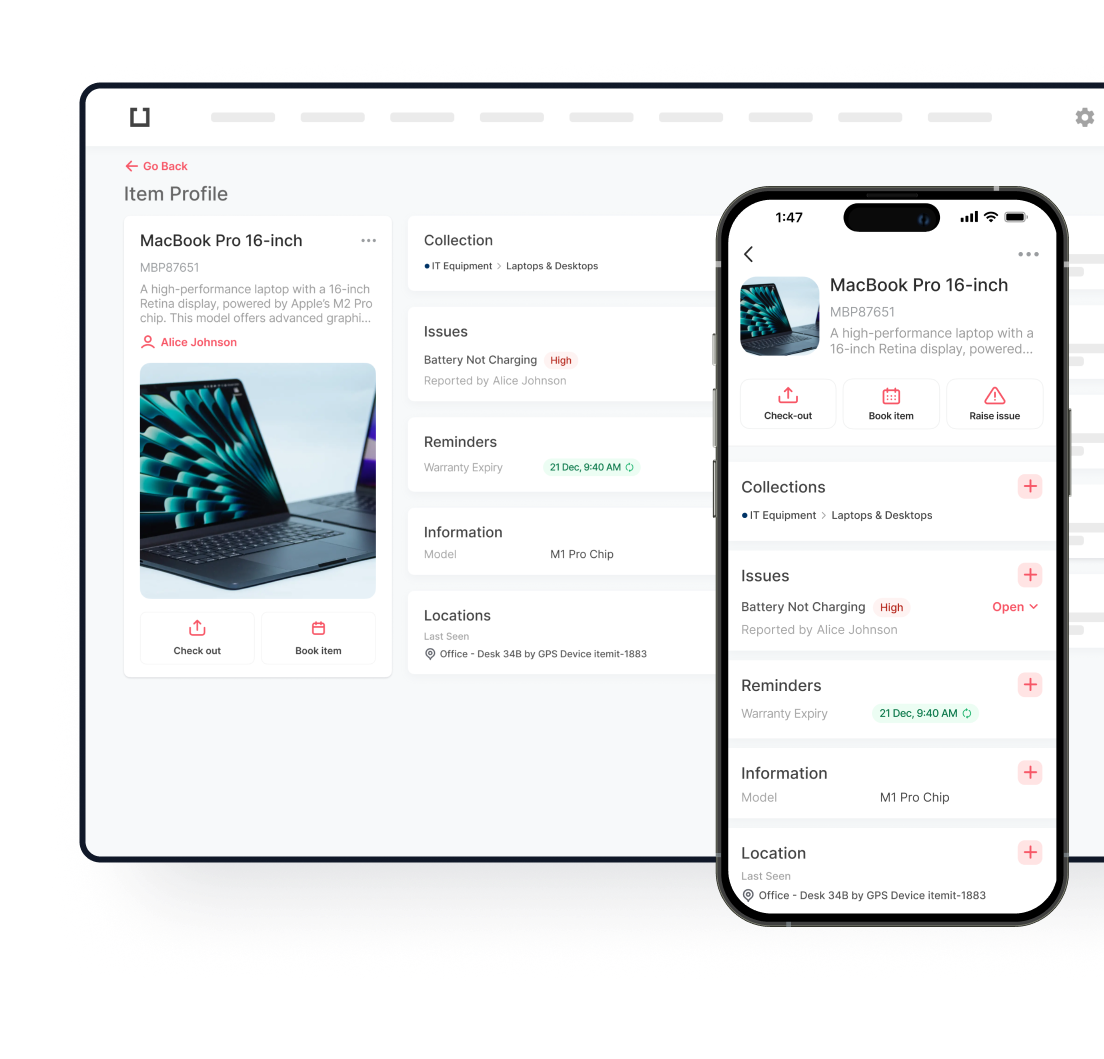

- Digital asset management platforms allow authorised personnel to access contingency data remotely, ensuring quick decision-making even offsite.

2. Planning: Identifying Risks and Business Impact

A thorough risk assessment is crucial to identifying potential threats and their impact. These risks could include IT failures, supply chain disruptions, or natural disasters.

- Businesses should conduct asset-based risk assessments, identifying critical equipment and infrastructure at risk.

- A well-maintained asset register provides real-time insights into asset conditions, allowing companies to predict failures before they occur.

By integrating risk contingency measures—such as asset redundancies and backup plans—organisations can mitigate the impact of major disruptions.

3. Implementation: Documenting and Structuring the Plan

Once risks are identified, the next step is to create a detailed action plan outlining who does what, when, and how.

- Your fixed asset register can store critical contingency documentation, ensuring employees can quickly access emergency procedures.

- Businesses can log backup equipment details, emergency suppliers, and alternative work arrangements within the system.

4. Testing and Exercises: Ensuring Practical Readiness

A contingency plan is only effective if it works under real-world conditions. Regular testing helps identify gaps and improve response strategies.

- Simulated crisis scenarios allow teams to verify whether asset recovery procedures are effective.

- Digital asset tracking enables businesses to monitor equipment deployment in real-time, ensuring smooth execution during drills.

For example, if a warehouse experiences a power outage, an exercise could confirm whether backup generators are accessible and functional.

5. Programme Improvement: Refining and Updating the Plan

Continuous improvement ensures that contingency plans remain relevant and effective. Lessons learned from tests should be applied to strengthen response strategies.

- Asset tracking software provides historical data on past incidents, helping businesses refine contingency responses.

- Businesses should update asset registers regularly to reflect new acquisitions, replacements, or disposal of outdated equipment.

Industry-Specific Contingency Planning: How Different Sectors Prepare for Disruptions

Every industry faces unique risks, meaning a contingency plan must be tailored to specific challenges. Below, we explore how different sectors integrate contingency planning with asset management to safeguard operations.

IT and Technology: Managing System Failures and Cyber Threats

For IT-driven businesses, system outages, security breaches, and data loss are among the biggest threats. Unplanned downtime can result in lost revenue, legal consequences, and reputational damage. A strong IT contingency plan ensures that businesses can quickly recover critical infrastructure.

- Maintaining an updated IT inventory helps companies track hardware, software licenses, and cloud services, ensuring that replacement systems or failover solutions are readily available.

- Identifying IT asset management risks, such as outdated software, hardware vulnerabilities, or insufficient data backups, allows companies to implement preventive measures before issues arise.

- Cloud-based asset tracking ensures that contingency plans remain accessible even if internal systems fail.

By proactively addressing IT-related risks, organisations can avoid prolonged disruptions and maintain seamless service delivery.

Project Management: Ensuring Smooth Execution Amid Uncertainties

Projects rarely go exactly as planned—budget overruns, supplier delays, or sudden resource shortages can derail progress. A well-structured contingency plan in project management helps teams stay on track despite unexpected obstacles.

- Identifying high-risk areas in the project timeline allows managers to allocate buffer time and backup resources.

- Integrating asset tracking into project planning ensures that tools, equipment, and personnel are available when needed, reducing delays.

- Maintaining alternative suppliers or subcontractors in the asset register provides a fallback option when key vendors fail to deliver.

With a proactive contingency strategy, project managers can prevent small disruptions from escalating into major setbacks.

Manufacturing: Minimising Downtime and Equipment Failures

Manufacturing plants depend on continuous production, making equipment failures or supply chain disruptions costly. A risk management contingency plan ensures that operations can quickly resume after unexpected breakdowns.

- Asset registers help track machinery maintenance schedules, reducing the risk of unexpected failures.

- Emergency response plans include predefined steps for equipment replacement or production line reconfiguration.

- Supplier diversification strategies, documented within the asset register, help mitigate risks associated with raw material shortages.

By planning ahead, manufacturers can minimise financial losses and maintain production efficiency even in crisis situations.

Healthcare: Protecting Patient Care During Emergencies

In healthcare, contingency planning is critical for maintaining life-saving operations. Power outages, IT failures, or medical supply shortages can put patients at risk.

- A risk management contingency plan ensures that hospitals and clinics have backup power, alternative supply chains, and emergency staffing protocols in place.

- Managing an accurate IT inventory ensures that critical medical devices and patient record systems remain functional during system failures.

- Asset tracking software helps healthcare facilities monitor stock levels of essential medicines and equipment to prevent shortages.

The Financial Impact of Not Having a Contingency Plan

Failing a contingency planning process can lead to severe financial and reputational consequences. Consider these risks:

- Revenue Loss: Downtime caused by unexpected system failures can halt sales and production, directly impacting profitability.

- Legal & Compliance Issues: Many industries have strict regulations that require businesses to have backup plans for data protection, worker safety, and operational continuity. Non-compliance can lead to legal penalties.

- Reputational Damage: Customers and stakeholders expect businesses to be resilient. Failing to manage disruptions effectively can erode trust and damage long-term brand credibility.

What Is Risk Management?

Asset risk management is all about searching for risks and identifying and treating them. These risks could include security issues, loss of machinery, theft, floods, and so on. Ideally, you will be prepared for any of the above and more. Your fixed asset register could be useful here as it can show you exactly when you need to use your contingency plan. All that you have to do is carry out a risk assessment and work out the details. These details can then be uploaded to your asset register so they can be accessed easily.

Risk Management and Your Asset Register

Risk management is about identifying threats and taking action to reduce their impact. A fixed asset register plays a critical role by ensuring businesses have up-to-date information on their assets, enabling quick responses to potential risks. Below are five key risk management techniques and how an asset register helps implement them effectively.

Avoidance: Preventing Risks Before They Happen

Some risks can be entirely avoided by adjusting business operations or putting preventive measures in place.

- A company might avoid IT asset management risks by replacing outdated servers before they fail, rather than waiting for a system crash.

- In logistics, rerouting vehicles to avoid flood-prone roads prevents delays and damage.

- Keeping a record of high-risk assets in the fixed asset register ensures businesses can track vulnerable equipment and schedule preventive actions.

Retention: Accepting Risks When Necessary

Certain risks are manageable, and sometimes, it’s more cost-effective to accept them rather than eliminate them.

- A business may choose to self-insure low-value assets instead of paying high premiums.

- Some companies tolerate minor IT downtimes instead of investing in expensive redundant systems.

- Logging past incidents in the asset register allows businesses to track patterns and decide when retaining a risk is a reasonable choice.

Spreading: Distributing Risk to Minimise Impact

Rather than relying on a single resource, businesses can distribute risk by diversifying suppliers, data storage, or operational sites.

- A retailer avoids supply chain disruptions by sourcing products from multiple vendors.

- Storing IT inventory across multiple locations ensures that a single system failure doesn’t halt operations.

- Documenting these asset allocations in a fixed asset register helps businesses maintain oversight and react quickly if an issue arises.

Loss Prevention and Reduction: Securing Assets to Minimise Damage

Proactive measures can help businesses reduce the likelihood of asset loss or damage.

- Security cameras and access control systems protect valuable equipment from theft.

- Installing fire suppression systems prevents costly damage to critical assets.

- Tracking maintenance schedules in an asset register ensures equipment stays in good condition, reducing the risk of sudden failures.

Transfer: Shifting Risk to Third Parties

In some cases, businesses can transfer financial liability to another party, such as an insurer or a contractor.

- A company hosting an event in its venue may require the organiser to provide insurance.

- Businesses outsourcing critical services ensure contracts clearly define risk contingency responsibilities.

- Keeping a record of insured assets in the fixed asset register simplifies claims processing and ensures coverage details are easily accessible.

Using a fixed asset register alongside your contingency plan and risk assessment strategy can give you peace of mind. It’s no wonder then, that more and more people are using an asset register in this way.

Would you like to chat with a fixed asset register expert about contingency planning and risk management? Contact us today at team@itemit.com.

Try itemit

Choose a better way to track your assets. Start your free 14-day trial now!

Keep Learning

itemit Blog

Tips, guides, industry best practices, and news.

Why Having An Accurate Asset Register Is Important

Why is having an accurate asset register so important and how can it help with equipment tracking? Read this post now to find out!

What To Include In Your Fixed Asset Register

What should you include in your fixed asset register and how can you make it work for you? Read this post now to find out!

What Exactly Is An Asset register?

What exactly is an asset register and will your chosen asset register format offer you everything you need? Read this post to find out!