Published on July 10, 2023 •

3 min read

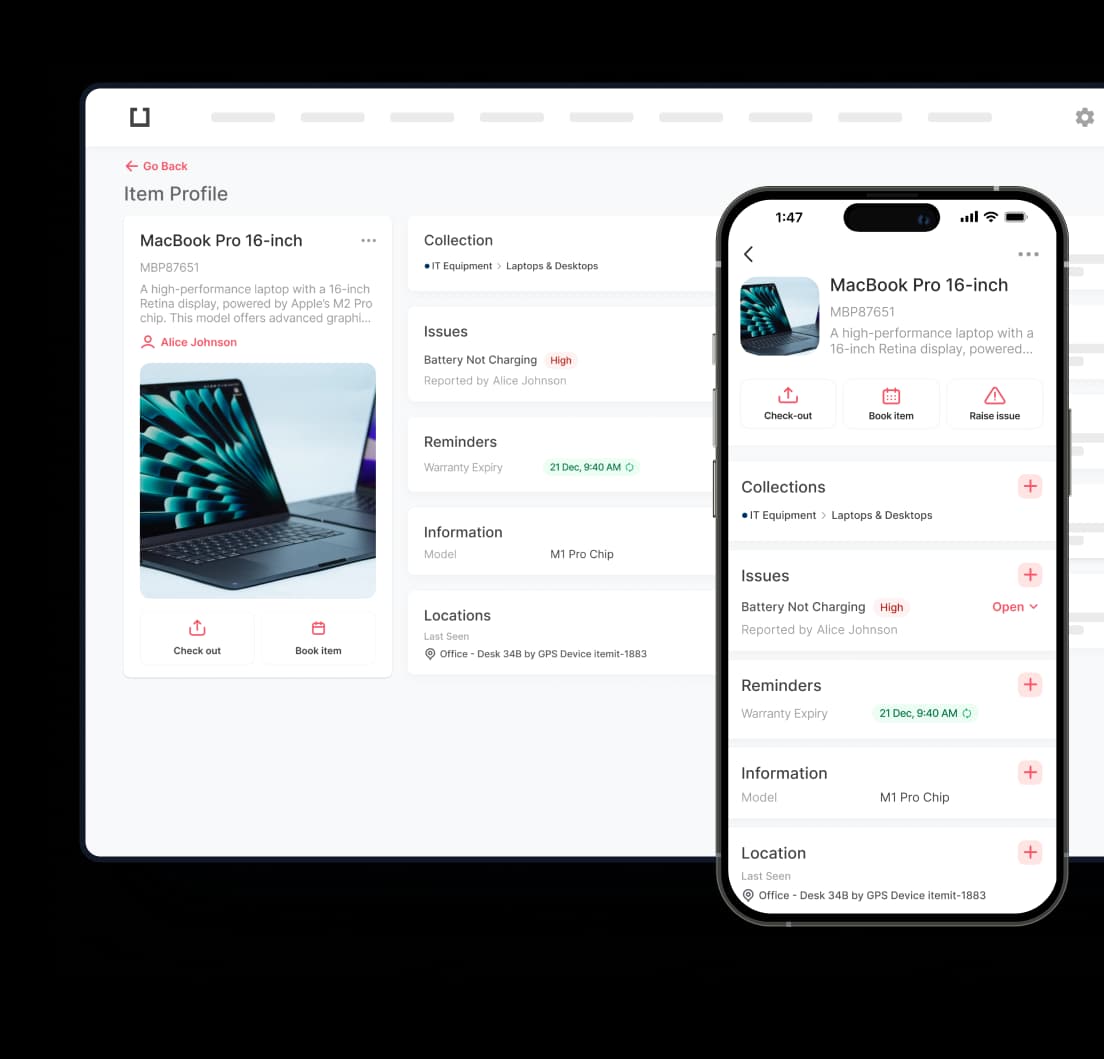

Many people use an asset register to help them to keep track of their assets. For example, they may wish to know who is using what asset or even where the asset is located. Alternatively, a business owner may use a hardware asset register to help them schedule important reminders.

Add Financial Information To Your Assets

If you already have an asset register up and running, now’s the time to add financial information to it. If you have not yet created a software or hardware asset register, now’s the time to do so. In fact, you can create an asset register for all of your assets such as machinery, computers, tools, equipment, and anything in between.

Once you have your asset register you will need to add financial information to it. Don’t worry, this is usually very easy. Simply select an asset and click on a menu that allows you to add text. You may, for example, use software that has a “currency” menu. Opening this menu will allow you to enter the currency and the cost of the asset. Please bear in mind that not all software has the same menus. Therefore, you may have to look for the relevant one.

Double Check The Information You’ve Added

Once you have added your assets to your hardware asset register, it makes sense to double-check everything. It’s very easy to make mistakes when entering information. However, if you want to create financial reports the information needs to be correct.

Double-check everything carefully so you’re satisfied that all is well.

Verify Your Assets

Part of the accounting process includes the verification of your assets. When you verify your assets you walk around your office, yard, factory, etc., looking for each asset. If the asset has been recorded on the asset register but it is nowhere to be seen, it may be a ghost asset. In other words, they may appear to be working and present and correct but the opposite might be true.

Should you come across a ghost asset, it’s worth your while sending it to maintenance. As soon as the printer, photocopier, tool, or machine is repaired, it will no longer be a ghost asset.

Furthermore, if you find anything that is not listed on your hardware asset register, it’s what we call a zombie asset. Adding it to the register will ameliorate this.

Calculate Depreciation

Over time, all of your assets are going to lose value. This is known as “asset depreciation”. If you want your financial reports to be accurate you need to account for depreciation. There are a few different ways to calculate asset depreciation. However, this is not something we’re going to explore here. For now, we’re just going to consider your hardware asset register and how you can create financial reports.

As soon as your asset depreciation has been calculated, it will need to be recorded in your asset register. Additionally, you’ll need to record any updated tax and insurance values.

Ensure Your Asset Register Is Always Up To Date

Now that you have added all of the required information, you need to keep it up to date. The good news is that this is usually fairly easy. Simply add any changes to your hardware asset register. For example, you may find that the value of one of your assets increases from time to time. While it may not increase by a huge amount, it’s still worth noting this in your register.

When you choose to purchase more assets, they need to be added to your register. Don’t forget to add the depreciation values too.

When your asset register is up to date it allows you to have a better idea about your assets. You can also have a clearer idea about the value of your assets combined. Additionally, you can have more control over your assets, who uses them, where they are, and the maintenance status. Having more control over every aspect ensures that you can make the most out of them.

Export Reports

There are many types of asset register software available. However, using this software for financial reporting only makes sense if you can export reports. When you have the ability to do this, you have the ability to understand your business more.

Using an asset register for financial reporting means you can understand your business on a whole new level. You can see, for example, how many times particular assets are used. You will know the maintenance status of your assets and which ones need to be repaired or replaced. All of this information will help you to have a new, more accurate view of your business. It’s this view that can help your business to succeed.

Wish to speak with an expert about using a hardware asset register for financial reporting? Talk to us now at team@itemit.com.