Every asset has its life that it goes through, right from its acquisition to eventual disposal. This is what is referred to as the asset lifecycle, and an integral part of this cycle is what is called asset disposition. Asset disposition involves a process by which businesses undertake a decision on how to dispose of assets when they become beyond their useful life. It concerns deliberate planning and management in terms of the minimum loss and value addition, especially in the case of IT equipment or inventory that is of immense value.

Effective asset disposition involves not only the safe removal of out-of-date items but also managing risks, complying with laws and regulations, and ensuring the highest return on investment. Most firms use specialised strategies for various asset types, such as inventory and IT equipment, to achieve financial and operational efficiency.

This article will cover everything that one needs to know about asset disposition, from the importance of asset lifecycle across various industries to how well proper disposal can make a difference in business to specialised areas such as IT asset disposition, the disposition of inventory and more. By the end, you will have a thorough overview of how effective asset disposition can help your business stay efficient and compliant.

What is Asset Disposition?

Asset disposition simply refers to a disciplined process of managing the final stages of an asset, including its sale, reuse, recycling, or disposal. Simplistically put, it is that moment or juncture when an asset becomes useless and/or not economically viable for a business, and a decision must be reached on what to do with it.

The process of asset disposition forms part and parcel of asset lifecycle management. Every asset is created with a predictable life, during which it becomes outmoded, ineffective, or even completely deprecated. An asset disposition should strive to realise the most feasible outcome in either the sale, reuse, or responsible disposal of the asset.

The major part of asset disposition management is the determination of value prior to the actual asset disposition. In this scenario comes asset valuation. A proper asset audit gives a business a realistic picture of the value that rests on every asset. It works out the most efficient method of disposal for the asset. The various asset valuation methods a business can utilise include:

- Fair Market Value: Estimating the price that an asset would sell for on the open market.

- Net Book Value: Calculating the value of an asset based on its original cost minus depreciation.

- Liquidation Value: Determining the likely value if the asset were sold in a quick sale scenario.

Understanding these valuation methods helps businesses choose the right approach for disposing of assets, ensuring they recover as much value as possible. Valuation also plays a role in accounting, ensuring that the disposition of depreciable assets is reflected appropriately in financial statements.

Effective asset disposition not only helps reduce waste but also contributes to minimizing costs associated with maintaining outdated or unused assets. By planning for asset disposition, businesses can optimise their asset inventory and reinvest funds into newer, more efficient equipment.

Transitioning from understanding asset disposition as a concept, let's dive into how businesses handle specific types of assets, starting with inventory.

All You Need to Know About Disposition of Inventory

By disposition of inventory, we mean the disposal of items in inventory that no longer create value for the business, such as overstock or obsolete products. Inventory disposition efficiently represents a very important activity that will ensure financial performance as well as operational efficiency.

One of the major problems facing companies is a potential loss on the disposition of assets in terms of obsolete or excess inventory. If not handled appropriately, this could ultimately result in financial distress. Effective inventory disposition requires a determination of the best way to dispose of excess stock through discounting, donating, or inventory liquidation. Example:

- Excess Inventory Discounting: This recoups partial value while simultaneously freeing up the stock for new ones.

- Dead Inventory Donation: Companies that donate dead inventory can obtain tax benefits and enhance their corporate social responsibility for unsalable items.

- Liquidation of Inventory: This refers to the process of inventory liquidation, where companies can get some cash back from excess stock by selling it quickly at lower costs.

Each of these methods has its pros, and the best method should be chosen depending on needs and goals.

For instance, discounting excess inventory can help recover some value while freeing up space for new products. Donating obsolete inventory can provide tax benefits and improve corporate social responsibility. Engaging in inventory liquidation allows businesses to sell excess stock quickly, often at a reduced price, to recoup some of the investment.

Sometimes, a partial asset disposition might be necessary, where only part of an inventory or an asset is disposed of while retaining other parts for future use. This approach helps maximise the value that can be salvaged from excess inventory. Moreover, businesses need to conduct regular financial audits to understand the impact of their inventory disposition decisions and make more informed financial plans.

Managing the disposition of inventory effectively means understanding market trends, anticipating shifts in demand, and reducing carrying costs. The key is to avoid losses from unsold or depreciating inventory by finding alternative ways to dispose of it that benefit the business. By adopting proactive inventory management strategies, companies can minimise losses and create opportunities for cost savings.

Now that we have covered inventory let's explore how IT assets are handled at the end of their lifecycle.

Uncovering IT Asset Disposition (ITAD)

It involves value management and disposal of useless IT equipment, such as computers, servers, and other electronic devices. In the wake of data breaches and environmental concerns, ITAD is perhaps more critical than ever to any company.

The IT asset disposition market involves secure methods for the disposal of IT assets, such as the erasure of data and equipment recycling or repurposing, in a manner that conforms to regulations. This would imply that one has to follow environmental compliance standards in order to protect data. Data security has become one of the most important issues with regard to IT asset disposals since the threat of unauthorised dispositions leads to illegal access to highly sensitive information of any given company.

By effectively dealing with ITAD using best practices, tracking all IT assets using IT asset management software throughout their lifecycle is enabled. This helps companies monitor IT assets closely and find the best moment to dispose of them to avoid data breaches and comply with environmental regulations.

Best practices for ITAD include:

- Partner with Certified ITAD Vendors: Work with vendors who follow strict data erasure protocols to ensure data security.

- Maintain Detailed Records: Keep comprehensive records of all disposed assets to maintain compliance and tracking.

- Meet Industry Standards: Ensure that all processes align with industry standards for environmental compliance.

- Implement Secure Chain-of-Custody Procedures: Track assets from the point of decommissioning to final disposal to prevent any breaches or mismanagement.

Many companies choose inventory liquidation for IT assets that are still valuable but no longer needed, allowing them to recover some value and reinvest in newer technologies. An effective ITAD strategy not only protects data and the environment but also ensures businesses maintain a smooth asset management process.

Different industries have unique challenges when it comes to asset disposition, which we'll explore in the next section.

Common Challenges in Asset Disposition

Managing asset disposition effectively requires addressing various problems, but the nature of these problems varies a lot from one industry to another. A few of the most widely seen are:

- Risk of Data Security Breach: Incorrect disposals of IT-based assets lead to data leakage. A business should make sure that all data is properly erased prior to their disposal.

- Regulatory Issues: Most industries have specific regulations for asset disposal. Non-compliance with such regulations can result in fines and other legal consequences.

- Financial Losses: When obsolete or depreciated company assets are disposed of without proper planning, financial losses may occur. However, this may be reduced through regular auditing and valuation.

The strategic approach involves addressing these various challenges by inculcating best practices that minimise risks and ensure compliance.

Asset Disposition in Different Industries

The term asset disposition is not only related to IT equipment or inventories; it also plays a vital role in any industry. Different industries have varied needs for handling assets at the end-of-life phase.

- Manufacturing Industry: This requires extensive procedures for disposing of capital assets, such as heavy machinery and equipment. Retiring these assets typically involves determining the least costly method of removing outdated machinery within the legal confines of safety and environmental laws. Companies may sell or recycle machinery to salvage value or donate it to educational facilities for training purposes. Parts and components of the machinery can be reused to minimise waste and decrease costs on new equipment.

- Healthcare Industry: The healthcare industry is customised with assets like medical equipment, which have special disposition protocols. Financial disposition involves accounting for depreciation and realising the most economical way to recover value, either by recycling or selling the asset. Proper asset disposition in healthcare also minimises exposure to health and safety risks and maintains regulatory compliance. For example, certain medical equipment needs to be discarded with the utmost care for safety and to avoid contamination.

- Real Estate: In real estate asset disposition, the properties that are no longer needed are concerned. In real estate, it can be any office building or land. Most of the time, property selling, leasing, and repurposing are included depending on the needs of the business. For example, the company can sell a building that is no longer used to raise funds or transform assets for new business activities. Real estate asset disposition also encompasses knowledge of market conditions that define the right time to dispose of or repurpose the property for maximum returns on investment.

- Retail Industry: Problems of inventory disposition are often faced by retail concerns who have to design strategies for product liquidation, which has either become outdated or is no longer in demand. Inventory liquidation will enable them to accommodate fresh inventories with minimal loss. They could also offer promotional schemes or package offers to clear off obsolete items so that cash flow is maintained with a reduction in storage costs. Besides that, retail businesses have to perform seasonal inventory disposition, clearing merchandise that is no longer in season, in order to make room for future stocks.

- Technology Industry: IT asset disposition is fairly relevant in the technology world for data security and compliance. In fact, most technology companies use asset tracking software to keep an updated inventory of all their hardware in order to make sure nothing goes unmanaged. This helps optimise asset utilisation and make more profound decisions on the timing of asset dispositions. Moreover, these technology companies can refurbish the IT equipment for resale, extending the life of these assets and helping to attain goals on sustainability. Proper ITAD also includes adhering to environmental standards for responsible e-waste recycling that reduces ecological damage.

Whichever the industry may be, proper asset disposition is important because it enables companies to reduce costs, limit risks, and reinvest in the newest technologies and equipment to keep them competitive. In light of the needs of each industry, businesses can develop their asset disposition strategies in such a manner as to maximise value recovery, ensure compliance, and provide sustainability. Companies can provide the needs of a particular industry by positioning their strategies to optimise value recovery in asset disposition while remaining compliant.

Maximising Business Efficiency Through Asset Disposition

The journey of an asset does not end at the end of its useful life but sets forth when asset disposition takes place. Good asset disposition practices contribute towards sustainability by reducing waste, making sure materials are recycled, and minimally affecting the carbon footprint of businesses. Understanding how to handle asset disposition, from IT equipment to inventory, helps organisations to recover value, reduce risk, and contribute to sustainability goals. Whether it’s a disposition of Inventory, IT asset disposition, or disposition of capital assets, an effective strategy drives the optimisation of asset management.

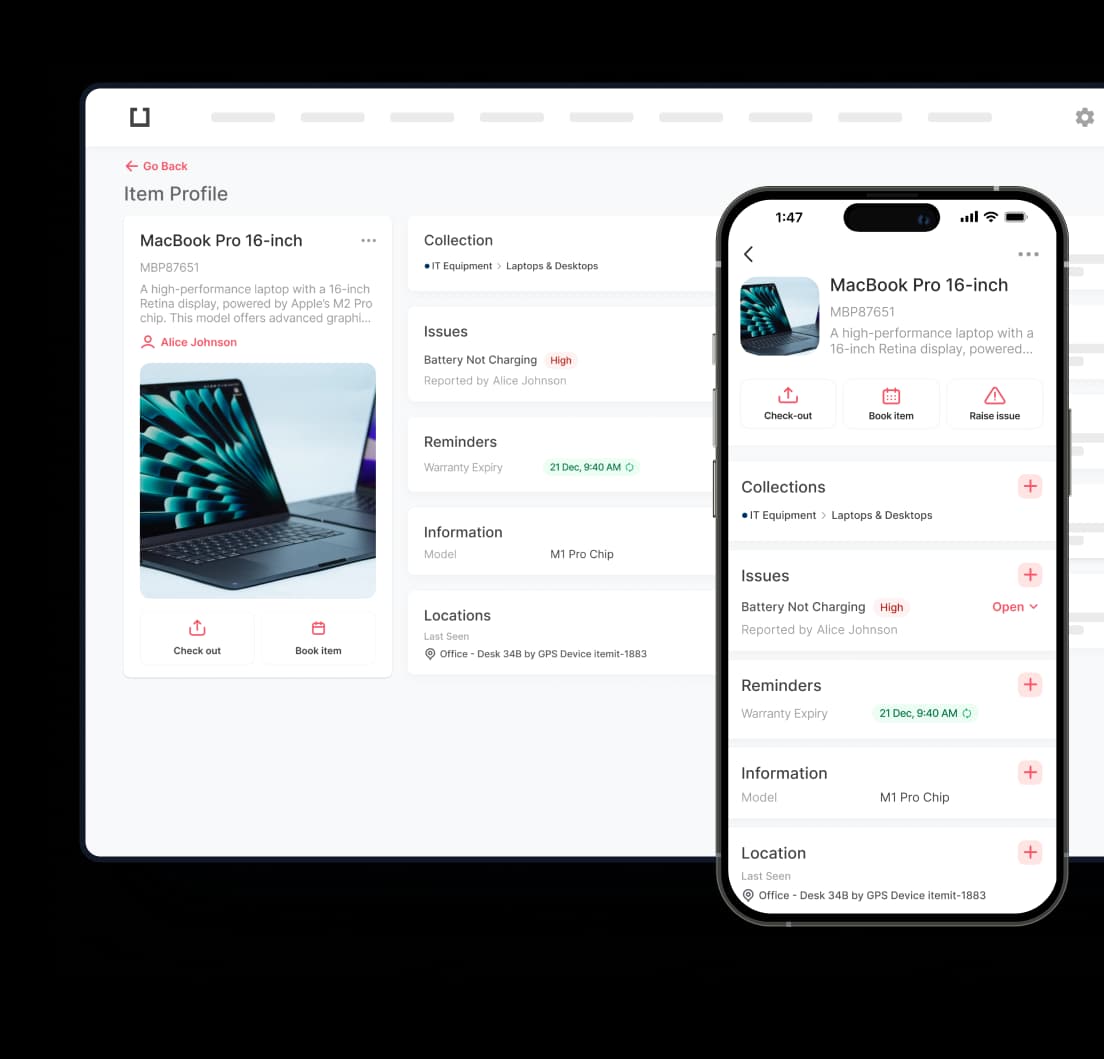

That would, in the end, drive operational efficiency by enabling businesses to reduce costs, stay compliant, and reinvest in newer technologies. Integrating asset disposition into the overall asset management strategy can create a more sustainable operation while improving profitability in the long run. With our fixed asset tracking app, you'll have a smooth way to handle your assets and ensure they're working at top performance. itemit can facilitate the entire life cycle for your assets, starting from acquisition to retirement. If you wish to understand more about how we can streamline processes, bring in more environmentally sustainable asset management, and assure optimum results for your business, just contact us at team@itemit.com.