Published on December 10, 2021 • 4 min read

But handing over a business asset to someone else, even if just for a short period of time, has its risks. You never know if the borrower will use your tools or equipment carefully, keep it safe or even return it all. What’s more, when you’re loaning out multiple pieces of equipment, it becomes difficult to keep track of the loaned out items.

While loaning out equipment has its benefits, you should always minimise the risk it involves. There are a few steps you can take for this. The first is to always sign an equipment loan agreement with the borrower so the lending process is protected by law.

Secondly, you should use equipment loan software to help you keep track of all your loaned assets. It enables you to loan out your stuff with peace of mind.

Equipment Loan Software — An Introduction

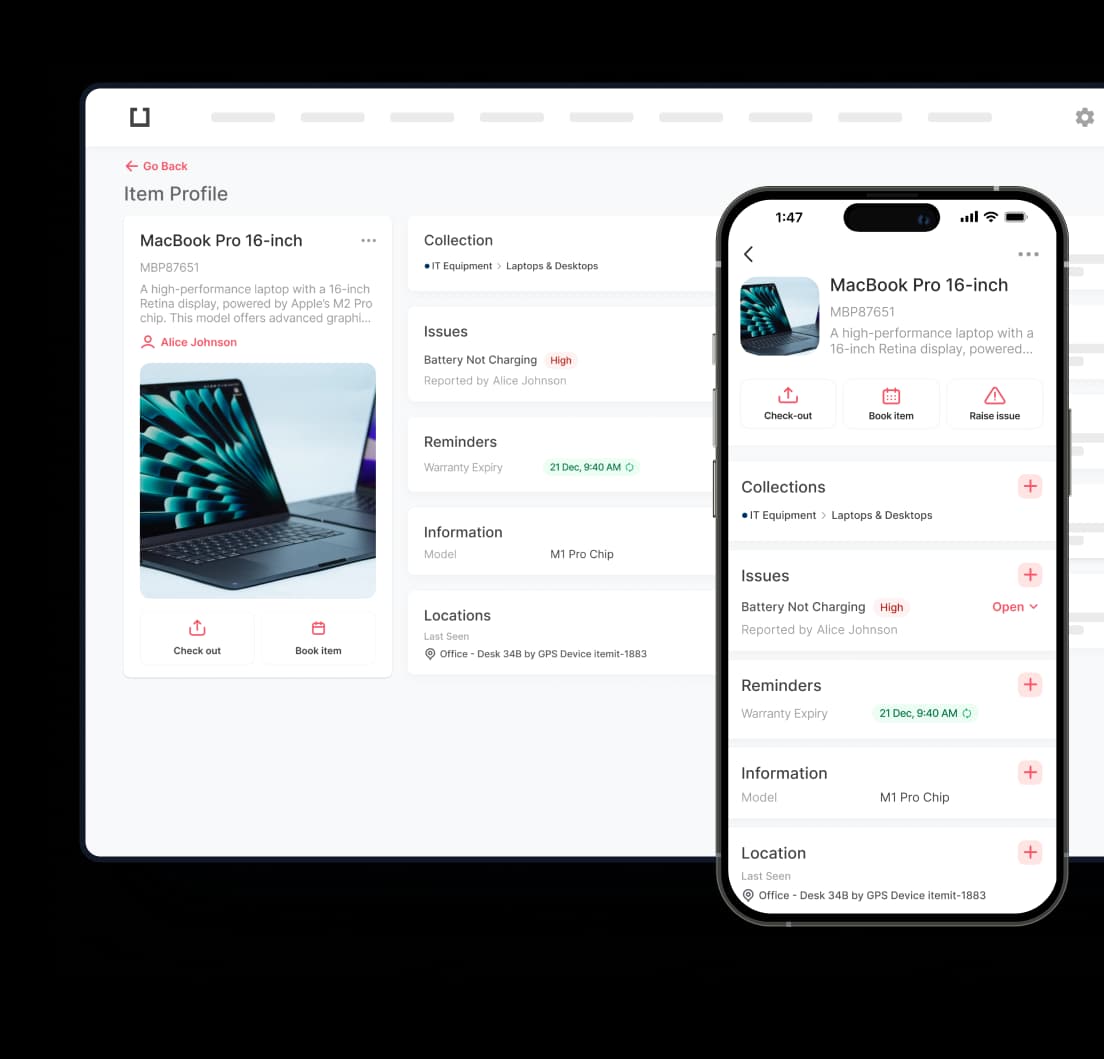

When you let another business borrow a piece of equipment from you, there are quite a few details that you need to record at the time of loaning out. These include but are not limited to the name of the asset being loaned, the borrower’s details, the duration of the loan, rent for the equipment.Equipment loan software lets you record and track all of these details digitally. Moreover, it enables you to keep track of an asset’s location after it has been checked out by the borrower. This software solution gives you a clear overview of all your lent out assets on one centralised platform.

But these are only the most basic functions this software offers. You’ll read about its different features and find out more about how it streamlines the equipment lending process in the sections below.

Smooth Lender Management

Equipment loan software allows you to create, update and track equipment loans and manage lenders swiftly. The easy-to-use equipment tracking software is based on an online database and can be accessed from multiple devices by multiple users. This means managers and employees can collaborate on the equipment loaning out process and it’s not dependent on one person only.Invoicing Made easy

The software allows you to record the rent or charges for loaning out a piece of equipment easily. It also records the date it was checked out by the borrower and when it was brought back in. This means calculating loan charges and creating invoices is as easy as it gets. On top of that, all members of your team can see which items are loaned out at any point in time.Booking

If someone wants to book some of your assets to borrow them at some point in the future, the booking feature in equipment loan software can prove to be a great solution. Booking an asset is pretty straightforward, and you can easily reserve a piece of equipment for a particular borrower.Benefits of Using Equipment Loan Software

At the start of this blog post, you would’ve read that using equipment loan software minimises the risk of loaning out your assets. But how exactly?No Equipment Goes Untracked

Suppose you run a theatre and you’ve lent a few of your props to another business for a week. These props include several different items. If you did not track the individual assets that you’ve let them borrow, there’s a solid chance that one or two of those props might never come back.After the borrower has returned the equipment, you might not realise that a few pieces of equipment are missing until the moment you need them. This could be easily avoided if you were tracking the props with equipment loan software.

But that is not the only risk. Sometimes when you lend an asset, you never know you’re going to get the same one back. This is pretty common when you’re dealing with multiple identical-looking assets. This issue can easily be solved with asset tags.

Using asset tags can supercharge the benefits of using equipment loan software. Tagging gives each of your assets a unique identity so you never mistake your equipment with someone else’s.

itemit's Equipment Loan Software

itemit gives you a centralised platform to track all your loaned and available equipment. Our state-of-the-art equipment tracking solution is an automated, transparent and effective tracking system that reduces the gaps in your asset management to zero and lets you lend your equipment without a worry. Moreover, with its scalability, you can use it for other asset management purposes like fixed asset management and IT asset management too!To find out more about itemit’s equipment loan software and how it will help you, you can contact our team at team@itemit.com that’s always happy to answer your queries. You can also fill in the form below to start your 14-day free trial.