Insuring Your High Value Collections Properly

Insurance for your high value collections is crucial. As high value items are defined as something that exceeds £1,000 in cost, normal contents cover won’t be able to insure it. Because of this, normal insurers won’t be the right fit and you’ll need to look elsewhere to cover your bespoke collections and assets.

Luckily, there are many insurers out there that can help cover your high value collections. Choosing the correct one is crucial, however, as the type of cover you’re paying for needs to cover the entirety of your collection and needs to be reasonable in terms of risks.

If, for example, your assets are moved from site to site or exhibition to exhibition it is crucial that your cover includes items in transit. If your assets have any chance of moving or if they are on display or out on loan, your cover should reflect this as this is where most of the risk is.

As well as this, your cover should take into account what your high value collection contains. If you are a wine collector, it’s most helpful to seek out specialists in wine cover. This way you’ll be able to include cover for both individual bottles or an overall cover limit.

Your high value collection may contain artwork, musical instruments, jewellery or gems. It can be photographs or collectors items such as stamps or coins, or it can even be fine furs.

No matter what your collection contains it will always be important or valuable to you, whether you’re working with a museum or if you have your own, personal collections. This is why choosing a comprehensive insurance policy is a must.

What will you need to insure your high value collections?

Since it’s not the same as insuring your contents, you will need a lot more supplementary information to ensure you’re not liable for loss or damage. Of course, this makes sense because the assets you’re insuring are much more valuable both in terms of cost and rarity.

With contents insurance cover, if something is stolen, goes missing or is damaged and it isn’t your fault, it will be much easier to replace. If you have something either extremely rare, like a vintage wine collection, or even unique, like a piece of artwork or a famous artist’s guitar, it’s not a simple matter of getting an insurance company to pay out and to find a replacement.

Of course, there are a lot of details you’ll want to track anyway when it comes to owning and managing high value collections. This will invariably be helpful should the worst happen, as the more transparent you can be with an insurance company that you have been meticulous, the chances of a dispute minimise greatly.

If it’s a collection that is exhibited to the public, there are more likely to be records of details anyway. If it’s a personal, bespoke collection, you may not have transparent written records. For example, if your wine collection is shown to business partners and investors, you may have knowledge of each bottle in your mind and the information may be printed onto the bottle’s label. If the bottle smashes and the label itself is damaged you may find yourself in a situation where you’re discussing the supplementary information with an insurance company as the full amount hasn’t been translated onto an asset register.

Either way, to ensure transparency with your insurance company, you will need to have records of supplementary information, should the worst happen.

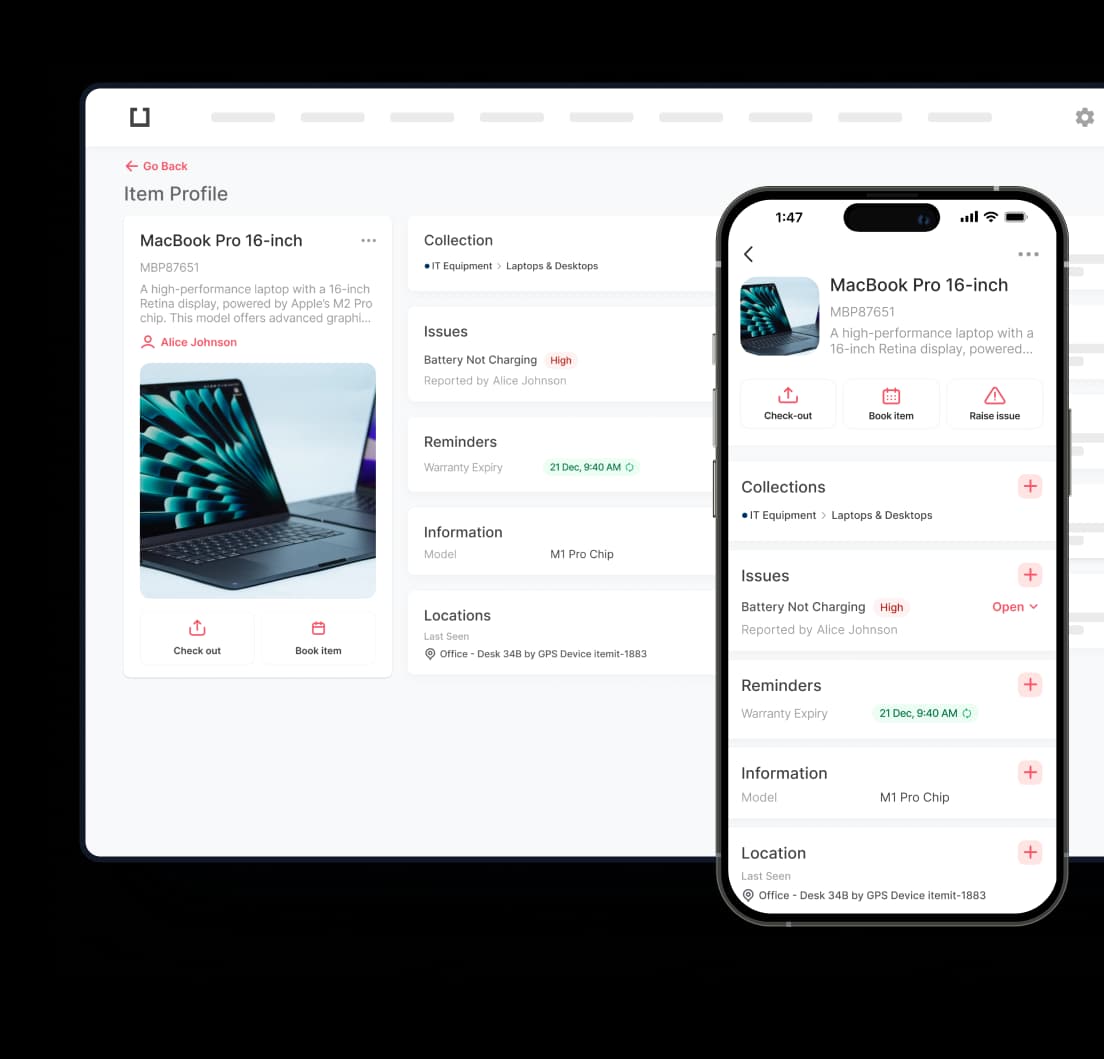

How Can itemit Help?

itemit works to help complement insurance.

As mentioned before, it’s important for your high value collection insurance to cover items in transit, but you still want to minimise the possibility that you’ll be liable for losses in transit. As itemit is an asset tracking software, you will be able to use RFID or QR tags to increase accountability when high value items are in transit, minimising the chances you’ll be blamed for asset loss. You’ll be able to track who has been handling the assets and where they’ve been.

You may not want to use QR codes and it may not be feasible to add them to packaging. In this case, if the QR code cannot be placed and used anywhere else other than on the asset itself, you’ll be able to use RFID tags, instead. If you have a collection where tagging would need to be as discreet as possible, you’ll be able to hide RFID tags. If it’s a painting, for example, you will be able to place it on its back so that it will only need to be taken off the wall once and nobody will need to touch it again.

RFID tags require a third party reader that you can hook up to your smartphone with bluetooth to read. They don’t require line of sight to be read, however, meaning you can turn your high value assets into smart objects without affecting the quality or value of the asset. As well as this, itemit’s QR and RFID tags have an advanced adhesive that won’t leave marks if they have to be peeled off.

itemit can also help with all of the other supplementary information you may require to show your insurance company at some point. You can add purchase price, value, purchase date, date of creation, anything. You can also set reminders for appraisals and then add this information subsequently.

Should the worst happen, itemit’s reporting feature helps you get all the information you need to your insurance company in order to show total, complete transparency and meticulous accountability. You will be able to download a pdf. of your entire asset register as well as add filters to create and export reports that show all the information you need to show. As well as this, you’ll have all the information you need in your pocket for any time you should need it. If something needs to be stored safely, therefore, all you’ll need to do is get out your smartphone.

Find out more by filling in the form below, or by emailing the team at team@itemit.com

Need to buy some QR or RFID tags?

Find out more here!

Start your free 14-day trial now

Instant access. No credit card details required.